With the help of some progress on the tariff front and last weekend’s trade confab between the U.S. and China, the Nasdaq 100 (NDX) and S&P 500 Growth indexes surged 12.7% for the 20 days ending May 13.

An admittedly narrow timeframe to be sure, but the recent resurgence of growth stocks has helped the S&P 500 and the aforementioned indexes reach positive territory on a year-to-date basis. To their credit, value stocks have spent the bulk of 2025 in the green with the Russell 1000 Value Index nearly doubling the returns of NDX and the S&P 500 Growth Index while beating the S&P 500 by roughly 100 basis points. It remains to be seen just how durable value stocks will be over the remainder of 2025, but it’s clear the asset class provide a modicum of safety during the turbulent January-April stretch.

Some experts are going so far as to say value is being “vindicated,” and that while may sound like an invitation to get involved, it’s a reminder to advisors and investors that the universe of value-based exchange traded funds – a common starting point for many market participants – is littered with products, many of which are not like the next.

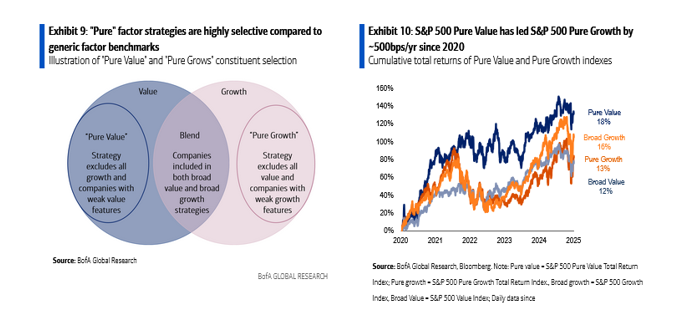

“The goal of value investing is to find companies with intrinsic worth greater than current market prices. Approaches to identifying value vary widely and can significantly affect returns. Index providers use as many as five different metrics to screen for value stocks,” according to Bank of America research. “Some value indexes overlap 33% with growth benchmarks, while others offer targeted ‘pure value’ exposure. ‘Know what you own’ is crucial advice for ETFs, too.”

With Value ETFs, Look Under the Hood

“Look under the hood” is prosaic though still relevant ETF advice and it’s particularly applicable when it comes to value ETFs because, as BofA notes, some stocks rely in both growth and value ETFs. For example, two of the popular ETFs tracking the S&P 500 Growth and Value indexes have 106 holdings in common, good for an overlap by weight of 31%, according to the ETF Research Center.

Point is even advisors need to perform some due diligence with value ETFs to ensure they’re actually providing credible value exposure in client portfolios. That process includes examining sector allocations and index methodologies.

“Most providers will also select from a broad universe of stocks (e.g., the Russell 1000 index) and categorize stocks as 'value' or 'growth' based on their favored criteria,” says BofA. “At the sector level, this process creates some big differences vs. the broad index weights: the average value ETF is overweight health care, financials, and staples, and underweight tech, communication services, and consumer discretionary.”

Value Purity for the Win

One way to ensure a selected value ETF actually represents that style of investors is to focus on purity, also expressed as “pure value.” That’s proven to be a winning concept in 2025.

(Image Courtesy: Bank of America Research)

BofA’s top-rated value ETFs are pure and the quartet has outperformed since 2021, confirming there’s validity in purity – an approach that minimizes exposure to stocks that dance in both growth and value circles.

Those four ETFs are as follows: the Invesco S&P 500 Pure Value ETF (NYSE: RPV), Invesco Large Cap Value ETF (NYSE: PWV), Putnam Focused Large Cap Value (NYSE: PVAL) and the Invesco S&P 500 Enhanced Value ETF (NYSE: SPVU). All four are 1-rated by BofA – the highest grade the research firm applies to ETFs.