Written by: Marl Park Durham

Despite low expectations for the U.S.-China meeting in Geneva, both countries agreed to temporarily cut tariffs. The tariff on Chinese imports to the U.S. now stands at 41% (10% “reciprocal” + 20% “fentanyl” + 11% starting point) and 27.5% for U.S. imports to China (10% retaliatory tariff + 17.5% starting point), with sector adjustments and exemptions still in place. China also agreed to remove all export bans. This led to a surge in U.S. and Chinese stocks (MSCI China), which rose by 3.3% and 2.8%, respectively, on Monday.

While this news is positive, further negotiations could be complex and may extend beyond 90 days. Key issues include:

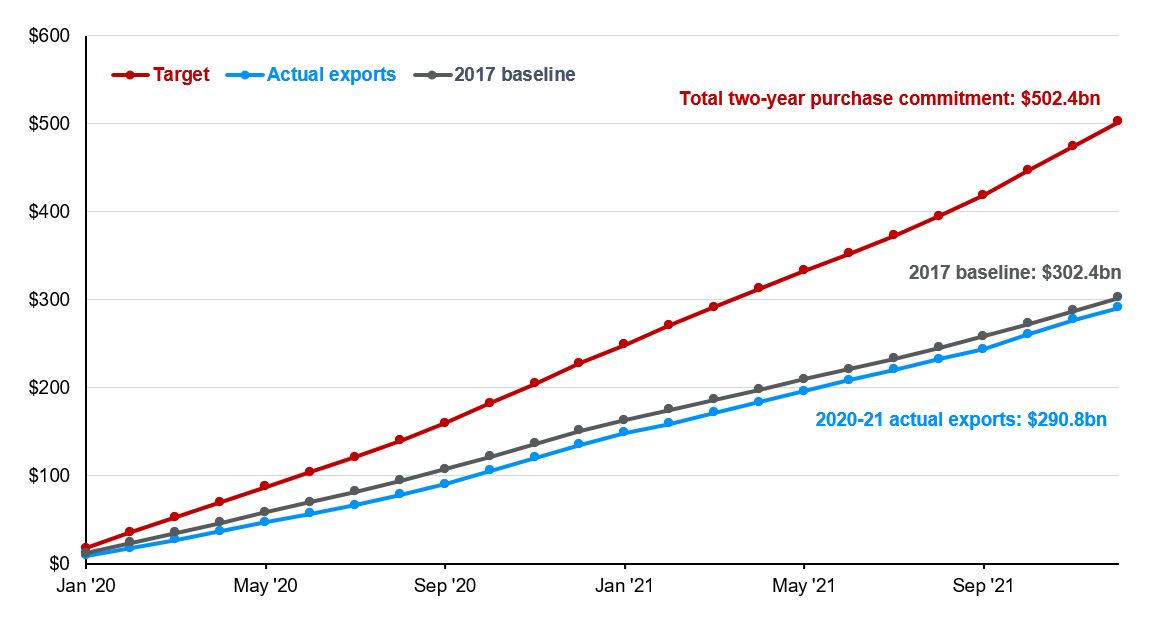

- Trade deficit/reciprocity: The administration is focused on reducing its trade deficit with China, which reached $295 billion in 2024. These efforts began back in 2018-19 when the U.S. and China entered a tit-for-tat trade war, ending in January 2020 with the signing of the Phase One Deal. China agreed to purchase $200 billion more from the U.S. above 2017 levels during 2020-2021 and enhance U.S. IP protections and currency practice transparency, among other items. As shown in the graph below, China didn’t make any of the extra purchases, partly due to COVID-19. Trade Rep Greer noted that full compliance may no longer be the primary focus, but addressing some issues from the Phase One Deal will likely be key for reducing the 10% “reciprocal” tariff. However, shrinking the trade deficit will still be challenging due to import frontloading and other structural issues.

- Fentanyl: Another part of the equation involves the 20% "fentanyl" tariff imposed on Chinese imports earlier this year. The administration has appeared firm on maintaining this tariff, but for the first time, Secretary Bessent indicated that fentanyl tariffs could be lowered, noting China's willingness to collaborate on the issue. Not only is this is promising for negotiations with China but also with Canada and Mexico, where 25% tariffs were imposed partly due to fentanyl and immigration concerns. Consequently, a broader de-escalation could occur, even if certain key sector tariffs remain in place.

- Strategically important products: The administration continues to evaluate tariffs on strategically important goods, such as semiconductors. Although they showed willingness to reduce sectoral tariffs in negotiations with the UK, they stressed in Geneva the U.S.'s intent to 'decouple' from China and other partners for products subject to 'national security' restrictions. However, the high-tech goods China is likely interested in purchasing could become central to the negotiations.

This development with China was a welcome surprise and reduced recession risks, though U.S. import tariffs remain high at 13-15%. Nonetheless, frequent tariff adjustments continue to create uncertainty, affecting business and consumer confidence. Investors are advised to maintain balanced portfolios, avoid market timing and diversify their equity exposure, while adding to defensive assets such as core bonds and liquid alternatives.

China's purchases of U.S. goods and services fell short of Phase One Deal commitments

U.S. exports to China covered by Phase One Deal, USD billions

Source: Peterson Institute for International Economics. The China Phase One Deal refers to a trade agreement signed between the U.S. and China on January 15, 2020. China committed to increasing its purchase of U.S. goods and services by at least $200 billion over two years, above 2017 levels. This included agricultural products, manufactured goods, energy and services.