Written by: Brandon Hall

At its May meeting, the Federal Open Market Committee (FOMC) voted to leave the Federal funds rate unchanged at a target range of 4.25% to 4.50% for a third consecutive meeting. Despite some signs of policy-induced weakness emerging, the Fed remains committed to its “wait-and-see” approach and is in no hurry to make meaningful adjustments to policy until the ultimate form and impact of tariff policies become clearer.

While the decision to hold rates steady came as no surprise, changes to the statement language leaned hawkish.

- With a spike in imports weighing on economic activity during the first quarter, the statement “economic activity has continued to expand at a solid pace” is now preceded by “Although swings in net exports have affected the data.” This suggests that, despite the weak headline figure, the Committee was largely unfazed by the underlying details of the 1Q25 GDP report.

- “Uncertainty about the economic outlook has increased” from the March statement now states that “uncertainty…has increased further” after the April 2nd tariff announcements and subsequent policy decisions added to the policy fog.

- Acknowledging the stagflationary impacts of tariffs, the Committee explicitly added that it “judges that the risks of higher unemployment and higher inflation have risen.”

During the press conference, Powell noted that tariffs, if implemented as communicated, could limit further progress towards inflation goals. Moreover, when asked which side of the dual mandate the Committee would prioritize should the risks of higher inflation and higher unemployment materialize concurrently, Powell avoided giving a straight answer. Instead, he noted that decisions would not be made preemptively and would depend on how far each variable is from its goal, and how much time it could take to return each to target. In response, rate cut expectations turned modestly more hawkish. The probability of a June cut fell from 32% to 20%, while just two full cuts are priced in by year-end with a third likely but not certain.

In summary, the Committee feels well-positioned to wait for more clarity before making any policy adjustments. As such, with the 90-day pause on reciprocal tariffs set to end in early July, the Committee could wait until its July meeting (at the earliest) to ease policy, giving it a greater sample of tariff-impacted data to assess. That said, this messaging suggests that financial markets should not anticipate help from the Federal Reserve. As Washington policies remain a headwind to U.S. financial markets, investors should be well-served to remain cautious and broadly diversified across assets and geographies.

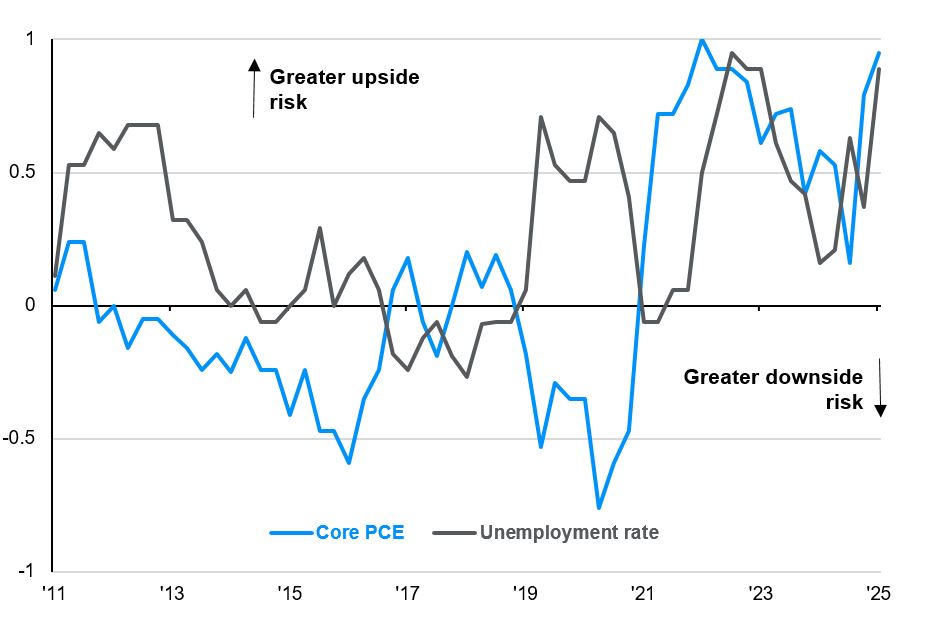

FOMC assessment of risks to core PCE and the unemployment rate

Diffusion index, quarterly

Source: Federal Reserve, J.P. Morgan Asset Management.

For each SEP, participants provided responses to the question “Please indicate your judgment of the risk weighting around your projections.” Each point in the diffusion indexes represents the number of participants who responded “Weighted to the Upside” minus the number who responded “Weighted to the Downside,” divided by the total number of participants.

Data are as of May 7, 2025.

Related: Can Global Stocks Shield Your Portfolio From U.S. Policy Shocks?