Written by: Gabriela Santos

This year, investors have found themselves in a policy storm. The speed and magnitude of U.S. policy changes have prompted a rethink of U.S. economic and earnings expectations. Given that tariffs have been front-and-center, it may surprise investors that year-to-date international equities have outperformed the U.S. by the largest margin since 1993 and the dollar has weakened over 8%. As investors reassess the need for multiple diversifiers in portfolios, unhedged allocations to international equities are proving their worth as diversifiers to U.S. policy uncertainty.

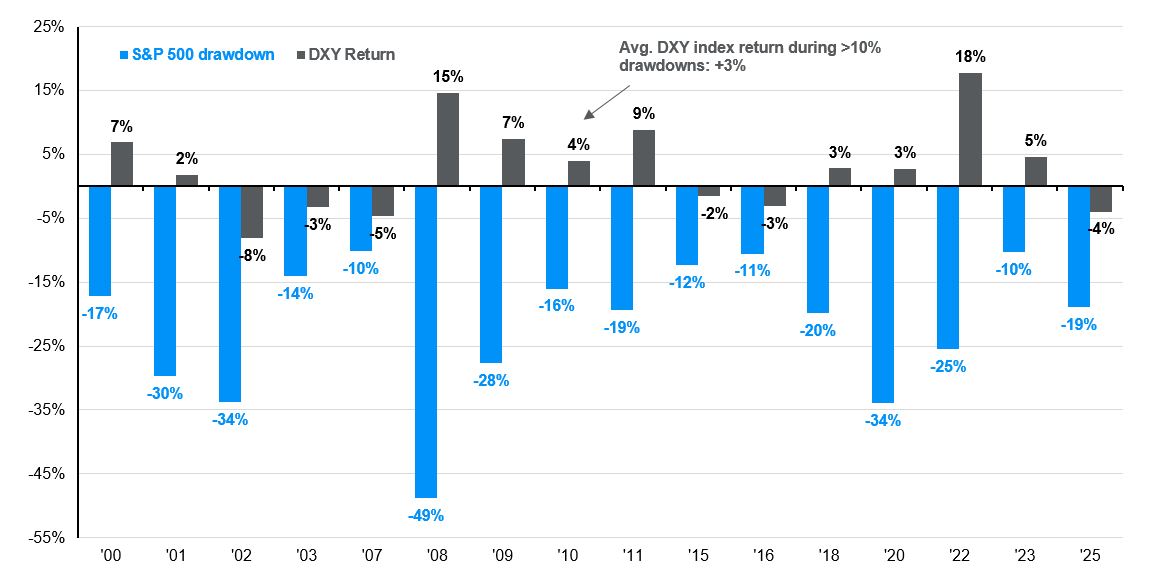

During the 2018 Trade War, global equity returns were negative across the board and international equities underperformed the U.S. by 940bps. That year, U.S. equities had a 20% correction and the U.S. dollar strengthened by 3%. This was normal post-GFC behavior for the dollar: during moments of risk aversion, the dollar strengthened – even if the source of uncertainty was the U.S. itself. This time, the picture looks very different: U.S. equities are down 6% year-to-date while international equities are up 8%, an outperformance of 1,400bps. During this year’s 19% correction, the U.S. dollar weakened 4% - something investors hadn’t seen in this magnitude since 2007.

A combination of “push and pull” factors have led to international’s diversification benefit:

- “Push”: biggest downgrades to U.S. outlook: While export-dependent economies will not be immune, the scale and breadth of U.S. tariffs has implied bigger changes to the U.S. outlook. At face value, the U.S. is a more closed economy, with exports of 7% of GDP versus 38% for the European Union. However, tariffs have increased on all U.S. trading partners. For the EU, only its exports to the U.S. are being directly affected (3% of its GDP not 38%).

- Pull”: Strong returns and earnings elsewhere: The “Magnificent 7”’s 30% correction has opened investors’ eyes to strong international returns for past 2.5 years. The end of deflation and negative interest rates were game changers for Europe and Japan. Even before this year, since late 2022 European and Japanese equities have beaten the U.S. excluding one truly exceptional company (NVIDIA) as the gap between U.S. and international earnings closed. U.S. growth has been bested by European and Japanese banks, European industrials, EM Asia technology, and India’s consumer. Boosting this recent momentum, U.S. policy changes are forcing much overdue policy changes elsewhere, such as fiscal spending in Europe.

- Powerful rebalancing after exceptionally exceptional valuations: Entering 2025, U.S. expectations were high and positioning was concentrated on the U.S.: the premium of U.S. equities versus international was at 40% (double its long-term average) and the U.S. dollar was close to a historical peak after the past decade’s 56% gain. Global equity concentration in the U.S. was at a record 65% of global market capitalization.

A normalization of the exceptionally exceptional U.S. premium has started, but there is further to go to get closer to average. Domestic investors have further to go in closing their international equity underweights and foreign investors do too to close their U.S. overweights. The dollar’s decline helps fuel this as domestic investors use foreign currencies to diversify portfolios and foreign investors hedge their dollar exposure.

U.S. dollar performance during large S&P 500 drawdowns

Max. S&P 500 10% or more drawdowns per year, DXY Index return during those drawdowns

Source: Standard & Poor's, FactSet, J.P. Morgan Asset Management.

Data are as of April 28, 2025.

Related: History of U.S. Tariffs: What Past Trade Wars Reveal About Today’s Risks