Young people often talk about “vibes” and advisors would do well to not be dismissive of such colloquialisms because as it relates to exchange traded funds, clients and self-directed investors are clearly “vibing.”

It’s more than just the simple though impressive statistics of there being more than 4,000 US-listed exchange traded products with a combined $10.3 trillion in assets under management at the end of March. Put simply, investors, both advised and self-directed, like ETFs.

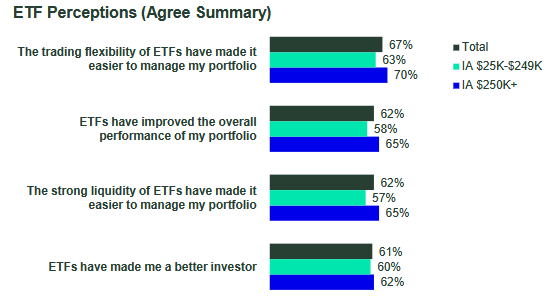

“The majority of those who currently have ETFs in their portfolio have positive perceptions of the investment vehicle. Investable asset level does not significantly impact investors’ perceptions of ETFs, however investor type does,” according to State Street Global Advisors’ 2025 ETFs in Focus Study. “Self-directed and Hybrid investors are more likely to agree than Advised investors that the trading flexibility of ETFs have made it easier to manage my portfolio and ETFs have improved the overall performance of my portfolio.”

Multiple reasons indicate advisors should stay abreast of clients’ ETF enthusiasm and those extend beyond advisors’ own wide embrace of these ETFs. First, affinity for ETFs is often born outside of the advisor relationship as highlighted by high percentages of usage among hybrid and non-advised investors. Second, the predilection toward ETFs is not confined by wealth. According to the SSGA study, motivations for owning ETFs are comparable among market participants with $25,000 to $249,000 in assets to the percentages seen with investors with $250,000+.

Speaking of ETF Motivations…

In the early days of ETF adoption, it was fair to say that low fees relative to mutual funds and the holdings-level diversification benefits of mutual funds were among the primary reasons investors gravitated to ETFs. As investors have become increasingly educated and savvy, their motivations for ETF ownership have evolved as highlighted in the SSGA chart below.

Here’s where things get really interesting for advisors. The SSGA study notes among market participants with at least $250,000 in investable assets, 65% say ETFs improved portfolio performance while 62% believe the products have made them better investors.

“After increasing between the end of 2022 and April 2024, the proportion of investors who agree that ETFs have improved the overall performance of my portfolio is unchanged,” according to the survey. “Conversely, after remaining stable, the percent of investors who agree that ETFs have made me a better investor increased in February 2025.”

Advisors Can Leverage ETF Awareness

For advisors, there are myriad benefits to be enjoyed via clients’ increasing levels of ETF awareness. Those include smoother transitions to model portfolios and introduction of fresh asset classes, such as alternatives. Speaking of alts, 46% of those queried by SSGA said ETFs enhance access to alts and the same percentage said ETFs reduce some of the complexity associated with the asset class. A majority say ETFs are the way to go when it comes to accessing alts due to favorable costs.

“With respect to alternative ETF perceptions, investors aware of ETFs are most likely to agree that ETFs are a cost-effective, more accessible, and less complex way to invest in alternative investments,” observes SSGA. “Generally, investors aware of ETFs with higher investable assets (IA $250K+) and Hybrid investors aware of ETFs have more positive perceptions of alternative ETFs.”

Advisors are responding with more than three-quarters telling SSGA they plan to increase clients’ exposure to alternative ETFs over the next 12 to 18 months.

As for demographic considerations, millennials are the most constructive on ETFs with 72% saying they believe ETFs have made them better investors compared to 58% of Gen Xers and 52% of baby boomers.

Related: Americans May Be Too Cash-Enthusiastic, Too Reserved About Stocks