A friend recently told me that his parents, both of whom are well into their 70s, are thinking about selling their house, moving into something smaller and stashing the profit – likely deep into six figures -- in a high-yield savings account.

There’s nothing wrong with that strategy when considering that my friend’s parents are getting on in age and have other investments, such as stocks and bonds. Selling homes that have appreciated in value and living off the difference is a tactic often employed by retirees and one that makes sense at a time when yields on cash instruments are still relatively generous. Holding large amounts of cash while lowering risk is fine for older folks, but data indicate some investors may be too enamored of cash.

New research from Gallup indicates an arguably staggering 33% of American view cash as the best avenue for strong long-term returns. That ranks second to only real estate, which is understandable because real estate has long been an inflation-fighter and a wealth-creator.

However, the reverence for cash is troublesome and a call to action for advisors because the percentage mentioned by Gallup implies there are plenty of prospective clients that could benefit greatly from working with an advisor. Further highlighting the need for greater financial education and the opportunity set in front of advisors is the point that Americans’ reverence cash as been mostly steady across the recent iterations of the Gallup survey.

What About Stocks?

As advisors know, when it comes to the major asset classes – bonds, real estate and stocks – equities are the primary wealth creator. Yes, there are plenty of billionaires and millionaires that ascended to those rarefied territories by way of real estate, but stocks are the most accessible for wealth-building purposes across a greater percentage of the population.

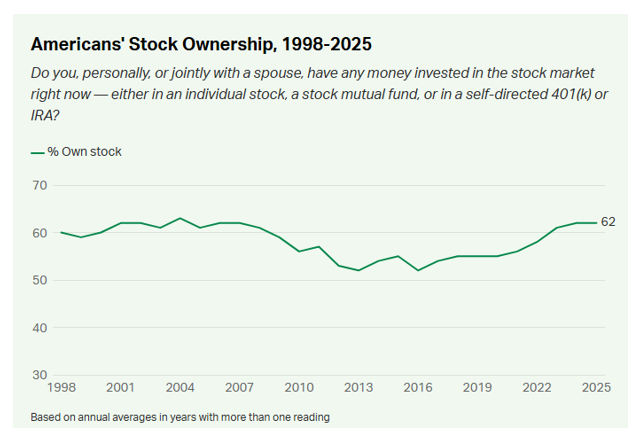

While that’s widely known, the percentage of Americans owning stocks, whether directly, via ETFs, index or mutual funds or in retirement accounts, hasn’t changed much in the past three decades as highlighted in the Gallup chart below.

“A steady 62% of U.S. adults say they, alone or with a spouse, have money invested in the stock market — either in an individual stock, a stock mutual fund, or a self-directed 401(k) or individual retirement account,” according to Gallup. “This is the third consecutive year that stock ownership has been above 60%, which was typically the norm from 1998 until the Great Recession, when ownership fell and stayed below that threshold for more than a decade.”

Demographics Explain Stock Ownership Gaps

Demographics go a long way toward explaining why so many Americans lean into cash and why the percentage of equity owners isn’t higher.

“As has typically been the case, Americans’ investments in the stock market and retirement savings plans are closely affiliated with several socioeconomic characteristics, including income, education, marital status and age,” adds Gallup. “Higher-income, married, college-educated, older U.S. adults are more likely than their counterparts to have stock investments and retirement savings plans.”

However, stocks aren’t reserved for the educated, the rich or married people. Equities are for everyone. Sometimes, it’s merely a matter of the right conversation or education with the right person, such as an advisor, to get more people to see the light.