There’s no denying that advisors and investors gravitate to low-cost exchange traded funds. Scant annual expense ratios go a long way toward explaining why Vanguard and Charles Schwab are the second- and fifth-largest ETF issuers, respectively.

Recent expense ratio cuts on dozens of Vanguard ETFs confirm that issuer’s commitment to keeping costs low, meaning long-term investors keep more of their hard-earned money over extended holding periods. Plus, that strategy isn’t hurting Vanguard’s top line. As measured by revenue generated by ETFs, the Pennsylvania-based asset manager ranks fourth and in Vanguard’s defense, its ETF roster is significantly smaller than those of the three issuers ahead of it in revenue terms.

Getting back to investor-facing cost conversation, there’s some duality. There’s the annual expense ratio readily found on all issuer websites and the more “stealthy” total cost of ownership (TCO), which factors in trading spreads combined with the annual fee. One way of looking at the spread issue is that it’s possible for an ETF to have a low annual fee and somewhat elevated TCO if the basket of underlying securities is illiquid.

However, that’s more of a consideration for short-term traders. Said another way, the yearly expense ratio takes precedence for long-term investors.

Real World Examples

A skeptic can say that when it comes to low fees, Vanguard is simply “talking its book.” That doesn’t change the reality. Take the case of the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) and the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD).

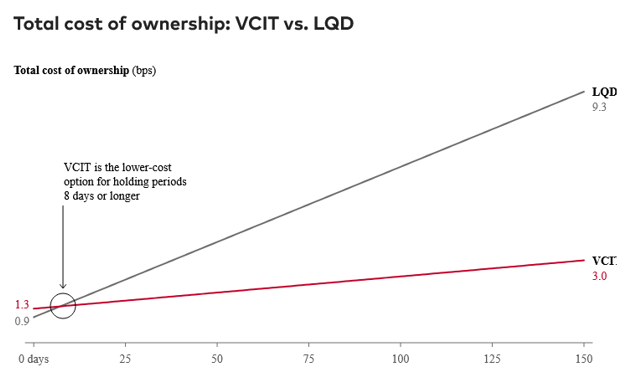

Both are among the largest ETFs in the investment-grade corporate bond ETF category, though LQD is more heavily traded while VCIT is less expensive. LQD’s liquidity (VCIT’s is robust, too) may imply a lower TCO, but the reality is VCIT’s TCO turns in investors’ favor after just eight days, as highlighted by the Vanguard chart below.

“The breakeven in this comparison comes after an eight-day holding period. VCIT’s bid-ask spreads are a tad wider than LQD’s—VCIT’s are 1.26 bps and LQD’s 0.94 bps,” observes Vanguard. “But because of VCIT’s recently lower expense ratio of 0.03%, versus 0.14% for LQD, VCIT’s lower TCO kicks in relatively quickly—this time within only eight trading days.”

In the link above, Vanguard highlights two other comparable examples – one involving long-dated Treasury ETFs and another pertaining to municipal bonds – so the aforementioned advantage isn’t confined to corporate debt.

Have Your Cake and Eat it, Too

Investors that are approaching an ETF, regardless of issuer, with a multi-year holding period in mind need not obsess over daily bid-ask spreads. The long the fund is held, the more important the annual expense ratio becomes.

Of course, some retail market participants simply like to “geek out” on sophisticated investing topics. There’s nothing wrong with that as folks like that often make for engaged clients to advisors. So if you’re in that boat, rest assured various ETF issuers, including Vanguard, check the boxes of tight spreads and paltry yearly fees.

“Combine our average spreads of 2.1 bps with our low average expense ratio of 4.5 bps across our ETF lineup, and the total cost of owning a Vanguard ETF is an industry-leading 6.6 bps. You can truly have your low-cost and liquidity too with Vanguard ETFs,” concludes the issuer.

Related: Breaking up Is Hard to Do…When You Don’t Have Money