We’ve recently noted a change in the market’s patterns. For many of the past few sessions we noticed that when US-based traders wake up in the morning, so do key index futures. Then as the day progresses, so do stocks. This represents a change from recent history, when overnight gains made up the bulk of S&P 500 (SPX) returns.

We had seen some reporting that this could be the case, so we decided to do a little research of our own using SPY, an ETF based on SPX, as a proxy for the index. We chose this product because it has very well-defined opening and closing levels. Indeed, while there are similarly well-defined open and close levels for the index itself, the opening price can get muddied because of the different methodologies for the “official” SPX opening price on AM expirations versus the first print of the index. It was more straightforward to stick with the ETF in this case.

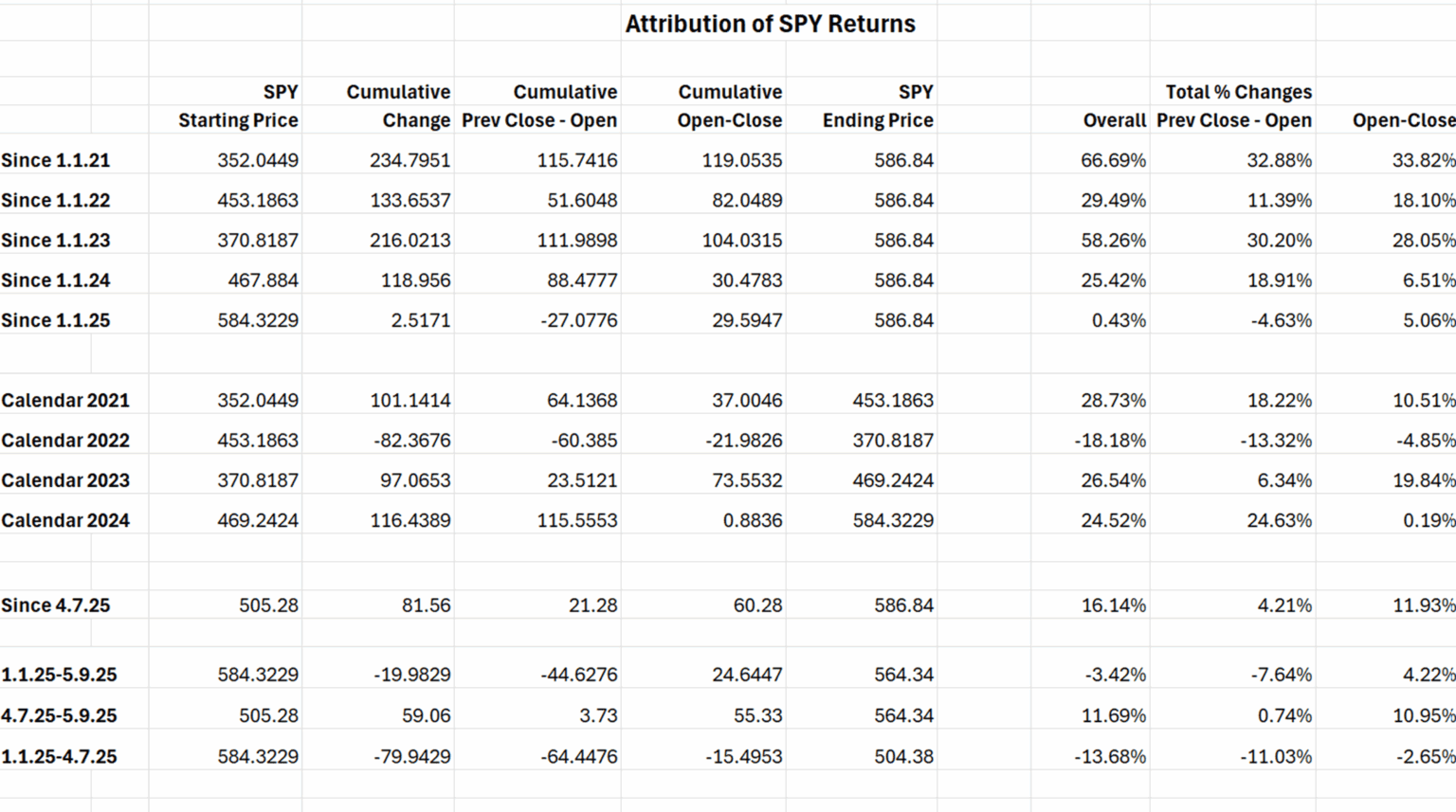

The table below shows the cumulative returns of the index over different time periods, breaking out the moves that occurred from the previous close to the opening print and from the opening to the closing prints. Whether measured by SPY’s point changes or percentages, it is obvious that throughout the past 4+ years, the combination of overnight and pre-market moves tended to outweigh that of the moves during US trading hours.

This tends to be a bull market phenomenon, however. Notice the underperformance of the premarket activity in 2022, when markets fell, and so far this year. On the flipside, notice how almost ALL of the 2024 performance can be explained by overnight and premarket moves. That is what makes the current switch to regular session gains such a dramatic shock.

One could assert, however, that the current rally is more like 2023’s in character. In that year, we rallied off deeply oversold conditions in late 2022 and began an AI-fueled bull market. That appears to have been powered by buying during US hours as well.

It is worth considering the possible causes for these changes. One could reasonably assert that the underperformance during off-market hours represents non-US investors flipping from buyers to sellers. That does fit in with other evidence, particularly from the bond markets. But the insane outperformance of that time frame during 2024 points to a different character of rally. Much of that was also precipitated by futures markets accelerating into the US open, and local traders certainly played a part in those moves. My gut says that those traders are still there, eager to join rallies. But they’re waiting for those pesky foreigners to go to bed before doing so, rather than joining a party that was already in action.

Source: Interactive Brokers