Written by: Aaron Mulihill

Private credit has delivered steady, equity-like returns for two decades, propelling its growth to a $1.6 trillion asset class – now rivalling the U.S. high-yield bond market. Yet its track record is relatively short. During the Great Recession, it was a niche strategy and a fraction of its current size. Now, with economic growth showing signs of slowing and tariffs emerging as a threat to some borrowers, investors are asking whether the next true test is approaching.

What is private credit and how has it grown?

Private credit is lending arranged privately between a company and a non-bank lender – most often in the form of direct lending to finance a private equity buyout or a follow-on acquisition. The loans are typically senior-secured and floating rate and they are held to maturity by a private credit fund, rather than being traded on exchanges like bonds.

Post-2008 regulations like Basel III and Dodd-Frank limited the ability of banks to lend to certain borrowers. With traditional lenders constrained, private equity acquirers still needed debt to close deals and private lending filled the gap.

From the perspective of investors, private credit offers a relatively high and regular cash flow yield, and a premium to publicly traded fixed income. When interest rates were very low during the 2010s, this premium made the asset class particularly compelling. With interest rates having risen since 2022, appetite for private credit has not abated as it has continued to offer a premium to high-yield bonds of 200-300bps.

What are some risks to private credit today?

Like any kind of lending, returns from private credit ultimately depend on borrowers repaying their loans.

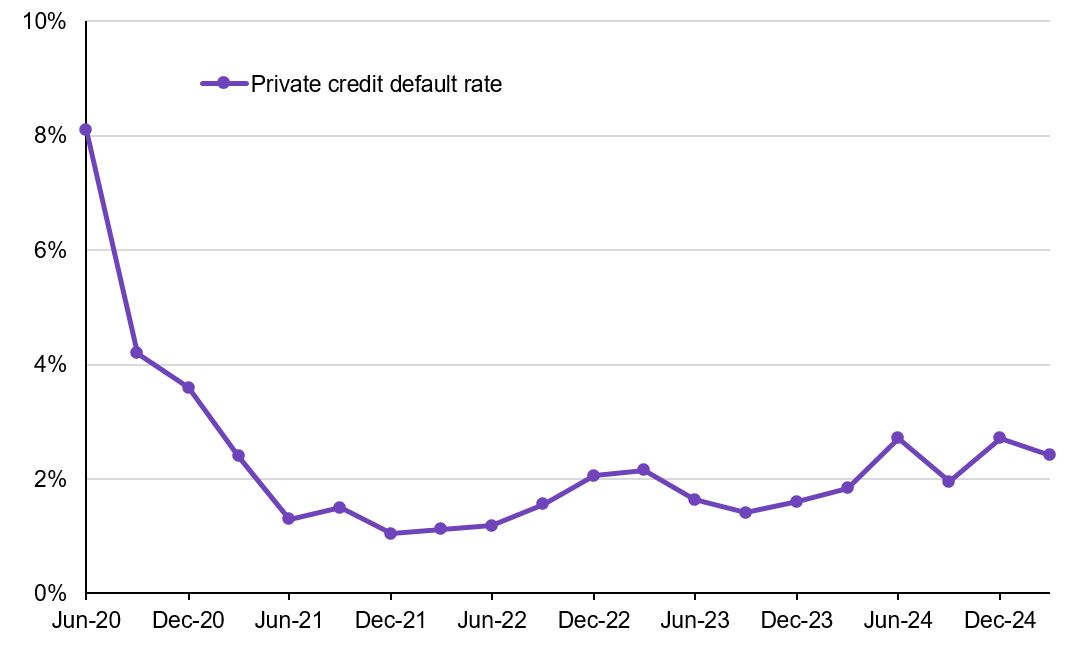

Headline default rates today are low (see chart), though deeper analysis of credit metrics is often needed to evaluate stress in portfolios.

There are a number of specific risks that investors should be mindful of, should we enter a more challenging economic environment.

- Tariffs: Shocks to corporate profits from tariffs could put pressure on borrowers exposed to international trade. Having a diversified exposure to private credit is important to avoid concentrated risks.

- Higher interest rates: Higher rates are attractive to investors, but it’s a two-sided coin: they also translate into higher interest payments for the borrowers which makes it more challenging to keep up with their repayments. Persistent inflation could cause the Federal Reserve to be slower to cut rates. Diligence of underlying portfolios is important to ensure borrowers are not over-leveraged.

- Lower returns: Continued economic uncertainty and a pause on deal-making could make it more challenging for private credit funds to put money to work and generate the high returns investors have come to value. Investing in secondaries strategies can mitigate this risk, as they are already deployed and generating yield.

Private credit structures are built for resilience and flexibility, enabling lenders to renegotiate terms with borrowers during challenges. But manager selection is vital in private credit, as skilled managers ensure strong underwriting standards and can effectively leverage these structures to protect investments.

Headline default rates within private credit remain low

Proskauer Private Credit Default Index, quarterly, 2Q20 - 1Q25

Source: Proskauer, J.P. Morgan Asset Management.

The private credit default rate is calculated by dividing the number of defaulted loans by the aggregate number of loans in the Proskauer Private Credit Default Index.

Data are based on availability as of May 9, 2025.