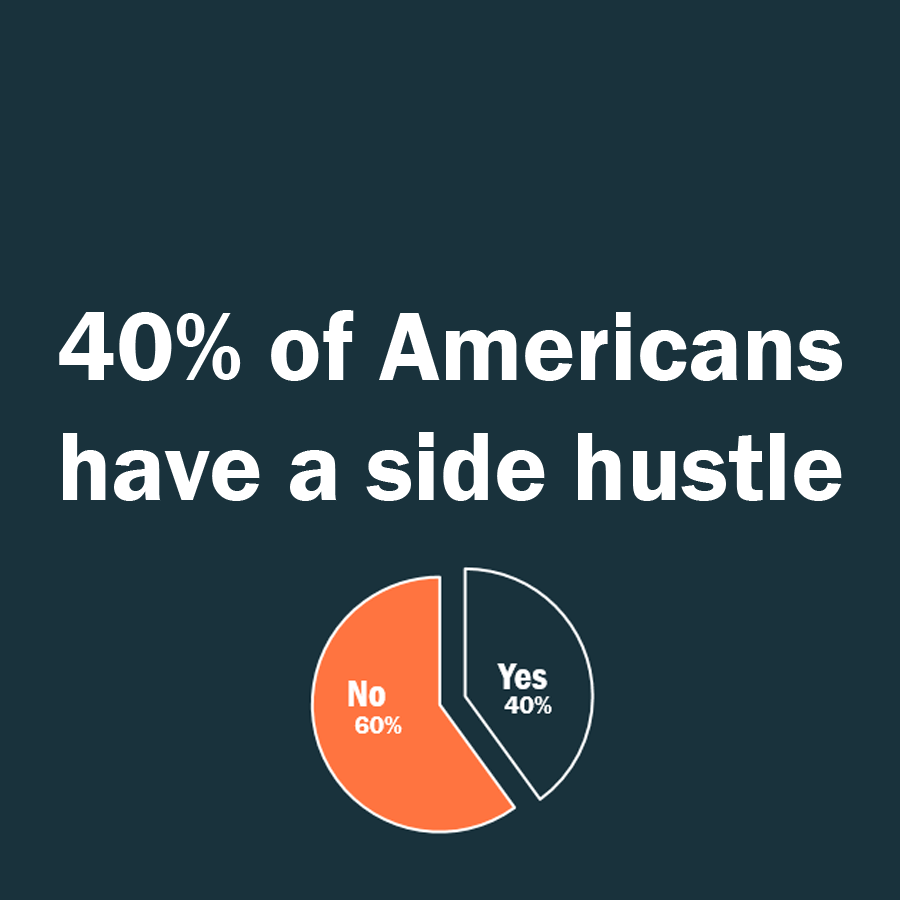

In our most recent Koski Research Future of Money study we found that 40% of Americans say they have a “side hustle”—a job beyond their primary job that brings them extra income.

Side hustle defined as: A job or project you have in addition to your main source of income. It could be a project you do for fun to make extra income, or a way to generate additional income besides your main job. For example, your own business, driving for Uber, AirBnB listing your home/property, or dog walking.

Is the gig economy the Future of Money?

Perhaps more surprising is that half of Americans who work full time say they have a “side hustle”. If this is the case, then there could be over 60 million people in the United States with a side hustle — a large potential market with different financial needs over the typical worker.

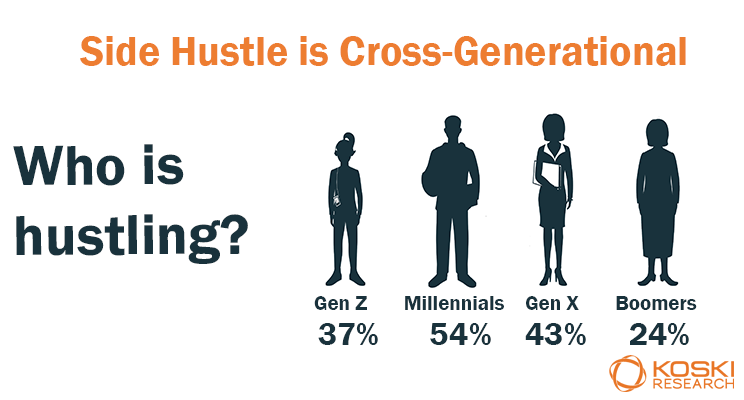

Is the side hustle just for Millennials?

The side hustle is cross-generational. While Millennials are doing the most hustling at 54%, the side hustle is common. Forty-three percent (43%) of Gen X, 37% of Gen Z, and almost a quarter of Boomers (24%) report having a side hustle.

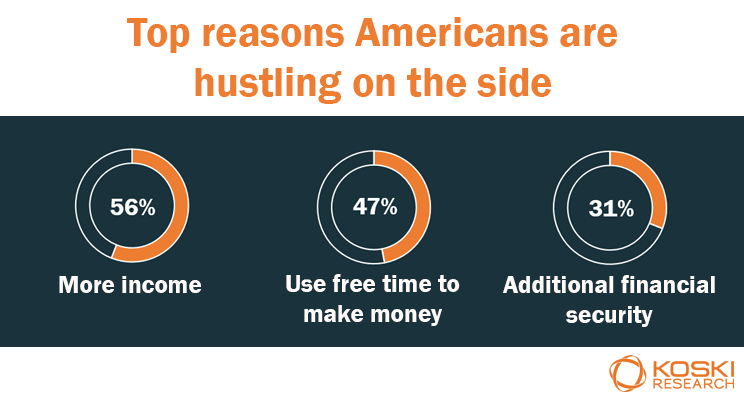

Although technology is enabling the infrastructure needed to support more gig workers, wage stagnation could also be a push. Americans in our study largely cite financial reasons for having a side hustle:

Secondary reasons are about lifestyle and creativity: 19% want more schedule flexibility, 18% want to pursue their dream, 16% want to use free time to build something. According to a recent bankrate.com study , these additional jobs contribute an average just under $700 a month in income. Our results show that Americans are looking for additional income, while also having some flexibility and ability to pursue additional interests.

Related: The Future of Investing for Gen Z Teens

What do gig workers need?

With the gig worker comes the need for new products and services to help them achieve their financial goals. They need tools to manage income streams, expenses, taxes, and save for retirement. Do you have the insights you need to market to the gig worker?