End of the month and first quarter of 2021. Is time going fast or slow? Markets have been moving at a dizzying pace to start the year.

The first quarter of 2021 is officially almost finished. Time flies when you’re having fun, right? While a broad correction did not happen by now, as I expected, the Nasdaq did enter correction territory twice since February. Despite the Nasdaq’s muted moves on Tuesday (Mar. 30), it’s right on the edge of its third foray into correction territory.

The market themes remain. There is still as much uncertainty for tech stocks as there were at the start of March. Until there’s some clarity on inflation and bond yields, I can’t foresee this ending anytime soon.

Consider this too. President Biden is about to unveil a $2 trillion infrastructure plan during Wednesday’s session (wasn’t it supposed to be $3 trillion?). While this is great for America’s crumbling infrastructure, let’s be honest- does this economy, while recovering, need anymore spending?

Plus, how do you think he will pay for this? Hiking taxes- namely corporate taxes . Those gains that high growth stocks saw after Trump cut corporate taxes in 2017 could very well go away. The market may have priced in a lot of optimism. It may have already priced in some pessimism from potential inflation. But one thing it has not priced in is a possible tax hike.

This concerns me.

Rising bond yields + Rising taxes= A double whammy of bad news for tech stocks.

However, despite the “what ifs,” for now, three pillars remain in motion as a strong backdrop for stocks:

- Vaccines

- Dovish monetary policy full of stimulus

- Financial aid

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

The market has to figure itself out.

More volatility is likely, and we could experience more muted gains than what we’ve come to know over the last year. Inflation, interest-rate worries, and the potential for tax hikes should be the primary tailwinds. However, a decline above ~20%, leading to a bear market, appears unlikely for now.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Russell 2000- Time to Pounce?

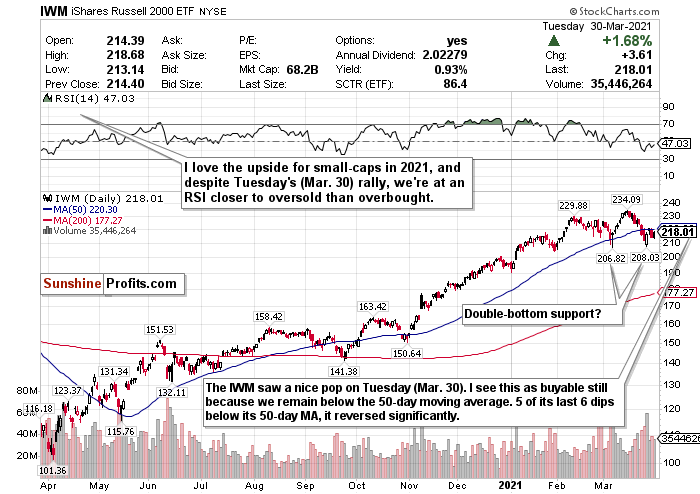

Figure 1- iShares Russell 2000 ETF (IWM)

The climate right now supports the Russell 2000. The current economic policy is tailor-made for small-caps. The best part, though? The Russell is still very buyable.

I kicked myself for not calling BUY on the Russell after it saw a minor downturn during the second half of February. I wasn’t going to make that mistake again.

After the iShares Russell 2000 ETF (IWM) went on its latest rally to start March, I checked out the chart. I noticed that almost every time it touched or minorly declined below its 50-day moving average, it reversed.

Excluding the recovery in April from last year’s crash, 5 out of the previous 6 times the Russell did this with its 50-day, it saw a sharp reversal. The only time it didn’t was in October 2020, when the distance between its 50-day and its 200-day moving average was a lot more narrow.

Fast forward to Tuesday (Mar. 23). The Russell 2000 saw its worst day since February 25, dropped below its 50-day, and I switched the call to a BUY.

Now, as we start the final week in March, we may be looking at the 6th reversal after dipping below its 50-day. The IWM has been up about 3% since March 24.

Aggressive stimulus, friendly policies, and a reopening world bode well for small-caps in 2021. I think this is something you have to consider for the Russell 2000 and maybe overpay for.

Consider this too. The Russell is on track for its first losing month in almost five months. According to the chart, it may have also found double-bottom support.

Based on macro-level tailwinds, its first losing month in five, potentially finding double-bottom support, its RSI, and where it is in relation to the 50-day moving average, I feel that this is a solid time to BUY.

For more of my thoughts on the market, such as tech, inflation fears, and why I love emerging market opportunities, sign up for my premium analysis today.

Related: The Three Pillars for Stocks

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.