Written by: Joseph Hill | Hargreaves Lansdow

The UK stock market hasn’t been popular with investors. For most of the past decade, stretching back to 2016, investors have sold more UK stocks than they’ve bought, and not by a small margin.

The pain has arguably been felt most acutely in the smaller companies sector.

Fund managers here have had to continually sell undervalued holdings to meet redemptions from investors selling.

But why are investors selling and not buying smaller companies?

A cautious UK consumer

One reason that could explain the lack of investment in the sector is confidence.

How much UK consumers are saving can help tell the story.

The savings rate figure, which represents the percentage of household income after taxes and benefits which is saved and not spent, has hit 12%.

It’s the highest level since 2010 (excluding the start of the pandemic) and compares to just 3.7% in the US.

ONS analysis shows much of these savings in recent years have been held as cash rather than invested, suggesting British households are in wait and see mode.

As a result, any pickup in UK consumer confidence and spending could fuel growth. And smaller companies could be the key beneficiaries, given they make more of their money within UK borders, than larger companies do.

We asked Fund Manager Will Tamworth what it might take to unlock this.

What will it take to boost confidence and get UK consumers spending?

Will Tamworth, Co-manager, Artemis UK Smaller Companies fund

"Real incomes are rising, unemployment is low, and consumer debt has been falling as a proportion of income for 17 years. The UK consumer is in a better position than commonly perceived. What’s missing? Confidence.

But confidence can change quickly. The increase in National Insurance is now behind us and there hasn’t been a big increase in unemployment (and we don’t expect there will be). As job security improves, consumer confidence will move in lockstep.

UK interest rates have fallen from 5.25% to 4.25% and are expected to continue to trend gradually lower. As interest rates fall, the incentive to make early mortgage payments reduces (mortgages below 4% are available) as does the returns on savings. The opportunity cost of spending is lower.

We shouldn’t overlook the knock-on implications. Many of the beneficiaries of consumer spending – retailers, pub companies, travel – are big employers. As consumer spending picks up, there’s an economic benefit which stimulates further spending. Getting the first person onto the dancefloor is the hard bit, but once there, others will follow."

Hargreaves Lansdown may not share the views of the author.

Looking small for big value

Downward pressure on stock prices has seen UK companies trading at well below their long-run average valuations, and particularly in small cap.

Lots of takeovers and a slowdown in IPO activity reflects this – these are effectively two sides of the same coin.

Depressed stock prices create a ripe environment for takeovers.

The average takeover in the UK stock market in 2024 came in at a whopping 44% premium to the share price before the bid.

From a business owner’s perspective, the motivation to IPO when valuations are low, is understandably limited.

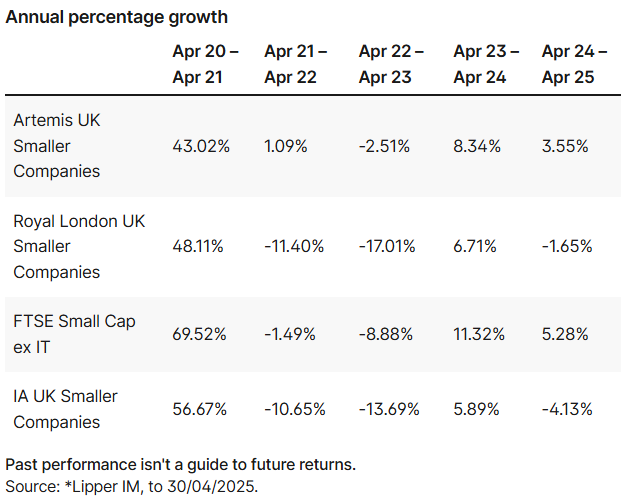

It’s been a tough time, and with the headwinds faced, investors would be forgiven for thinking the sector had been best avoided. But that would’ve meant missing out on some pretty good returns.

In weighing the effect of this up, we asked Fund Manager Henry Lowson for his view.

This article isn’t personal advice. If you’re not sure an investment is right for you, ask for financial advice. Remember, unlike cash, all investments and any income from them can rise and fall in value, so you could get back less than you invest. Past performance also isn’t a guide to the future.

Has the lack of IPOs left you short of good investment opportunities?

Henry Lowson, Lead manager, Royal London UK Smaller Companies fund

"One exciting aspect of small cap investing is the size of the universe and therefore the potential to find undiscovered ‘gems’.

While it is true that the universe has shrunk in recent years as a consequence of both the dearth in IPO activity (particularly since 2021) and the frenzy of merger and acquisition activity, there are still nearly 1000 investment opportunities across the FTSE Small Cap, FTSE AIM and the FTSE 250 indices.

It remains a stock pickers ‘paradise’.

Well publicised outflows from the UK stock market, together with a tougher macroeconomic backdrop, have created the opportunity to buy well managed, high growth and cash generative companies on extremely appealing valuations.

Therefore, there is now a very real opportunity to generate attractive returns from both a recovery in company earnings and in rising valuations from these levels."

Hargreaves Lansdown may not share the views of the author.

Want to know more about UK small cap stocks? – 2 fund ideas

Looking forward, we think the long-term case for UK smaller companies is compelling.

There’s an opportunity for investors to add excellent long-term growth potential to their portfolios at attractive valuations.

Smaller companies tend to be under researched, which creates lots of opportunities to uncover hidden gems.

We think this is an area where investors need to be active and we have two UK Smaller Companies funds on our Wealth Shortlist, featuring managers we think can demonstrate their stock-picking edge.

Investing in smaller companies is higher risk – investors should invest for the long term and be prepared for volatility along the way.

Investing in funds isn't right for everyone. Investors should only invest if the fund's objectives are aligned with their own, and there's a specific need for the type of investment being made. Investors should understand the specific risks of a fund before they invest, and make sure any new investment forms part of a long-term diversified portfolio.

For more details on each fund and its risks, please see the links to their factsheets and key investor information below.

Artemis UK Smaller Companies

Mark Niznik and Will Tamworth and aim to grow an investment over the long term by investing in UK smaller companies.

The managers employ a valuation-focused approach, meaning the fund invests differently to many of its peers.

The managers won’t invest in pre-revenue companies because of their focus on generating cash.

They’re also sceptical about investing in small businesses with very ambitious growth expectations. The outcome of this process is a value style bias.

This higher-quality approach and focus on valuation means we expect the fund not to fall as much as some others during down markets. But it could lag its growth-focused UK smaller companies peer group in a rising market.

Royal London UK Smaller Companies

Henry Lowson and Henry Burrell invest in some of the smallest companies in the UK stock market, using a growth-focused investment approach to try and achieve long-term growth.

The fund approach is centred on finding quality companies trading at attractive valuations.

The managers assess companies using the acronym ‘SIMBA’ – scalability, innovation, management, barriers to entry and unique assets.

They require companies to have at least four of these characteristics before they’ll invest.