Late last year, value stocks commenced an epic rally that's proven durable for most of this year. Then with the support of declining Treasury yields and strong earnings growth, growth stocks got their respective acts together again.

In fact, as of Aug. 13, the S&P 500 Growth Index sports a modest year-to-date advantage over the S&P 500 Value Index. Don't forget quality stocks. The S&P 500 Quality Index is beating its growth and value counterparts as well as the S&P 500 this year.

Put all that together and it's safe to say there's been a lot of variability between pro-cyclical (reopening stocks) and secular (high growth) exposures, meaning factor-based strategies are in the spotlight. Of the major investment factors, only exchange traded funds tied to low volatility are bleeding money this year. That variability also confirms that factor timing in 2021 is as difficult as it's ever been.

So here's what advisors are contending with this year: Lack of established factor leadership, which is an anomaly because factors usually lead for more than just a few months and can perform admirably for years on end.

Wild Year for Factors

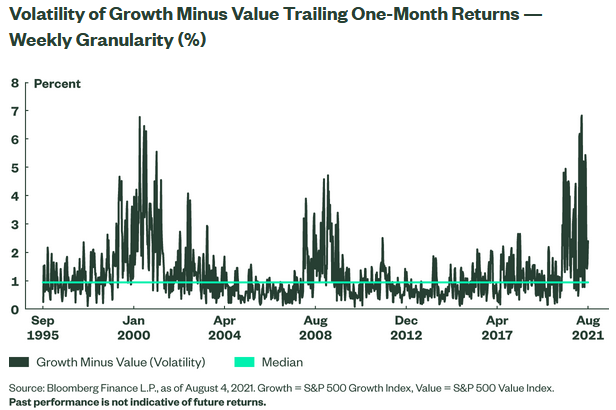

Here's an example of just how fluid and fickle growth and value have been this year.

“In June, growth was underperforming value by 5% over the prior four weeks (i.e., rolling one-month returns), a two standard deviation event,” notes Matthew Bartolini, head of SPDR Americas Research. “Fast forward one month, and growth was outperforming value by 10% in the middle of July — a more than three standard deviation event. As of the end of July, growth’s outperformance did decline (+5% versus value in the prior four weeks), but was still above one standard deviation.”

Alone, that scenario is interesting, but it's even more so when considering the dispersion in returns and volatility being created by the recent spate of growth vs. value turbulence.

“The standard deviation of the trailing one-month excess returns has been severely elevated of late, peaking in April 2021. It has been well above levels witnessed at the onset of the pandemic and beyond prior peaks (dot-com bubble),” says Bartolini. “In fact, there have only been a few weekly observations in 2021 that have registered below the long-term historical median.”

Courtesy: State Street Global Advisors

A big part of the reason factors, particularly growth and value and perhaps size, are having difficulty establishing lengthy leadership this year is the tug-of-war that's at play in the economic cycle. One minute, advisors are evaluating the intensity of the reopening trade and the utility of cyclical stocks. The next, the Delta variant is commanding headlines, leaving advisors to ponder a slower growth economic environment, which would likely favor growth stocks.

In other words, if the coronavirus could finally be effectively vanquished, clients might be treated to more traditional factor and environment.

We're Going Streaking! Wait, No We're Not.

Historical data confirm that over the past three decades, every calendar brought a period in which growth or value went on a lengthy winning streak against the other. That hasn't happened in 2021.

“In 2021, however, there has been no such streak. This reinforces the lack of persistency of a particular style as the market lacks clear direction amid concerns over the vibrancy of the recovery, as we witness yet another rise in cases and mobility restrictions alongside uneven economic data,” adds Bartolini. “Until there is clear evidence of the direction of the recovery, this current trend is likely to persist.”

Absent a credible growth or value streak, quality could be the way to go. It offers some intersection with growth and is actually inexpensive today, perhaps even more so than value.

Advisorpedia Related Articles:

Growth Comeback to Be Built on Foundation of Declining Treasury Yields

Passive Savings Are Still Savings

How to Score Dependable Dividends on the Cheap

There's Still Momentum for Cyclicals, But There's Shelflife, Too