It's often said that it's always Infrastructure Week on Capitol Hill and that's often to little avail when it comes to tangible results. Advisors should be forgiven if they feel the same way about biotechnology mergers and acquisitions rumors because, well, it sure feels as it's always time for that consolidation to pick up.

Of course, things don't always pan out that way. It's hard to tell if this time will be different, but it's clear biotech could, no pun intended, use a shot in the arm. With value outshining growth this year by a country mile, biotech – the growth corner of the healthcare sector – is languishing. The widely followed Nasdaq Biotechnology Index is up just 4.62% year-to-date.

At least that benchmark is up on the year. Exchange traded funds dedicated to mid- and small-cap biotech stocks are in the red. Alone, that's discouraging, but it's all the more ominous when considering smaller stocks are performing well in 2021. Making the smaller biotech situation all the more concerning is that plenty of small-cap growth indexes, though they're lagging value counterparts, are in the green year-to-date.

M&A to Save the Day?

Owing to the coronavirus pandemic, biotechnology consolidation lagged the 2019 last year, but plenty of vaccines on the market and more on the way, mature biotech and pharmaceuticals companies can get back to shopping. Some need to do just that.

“Within the life sciences ecosystem, the development of biotechnologies and the shift in drug pipelines from small to large molecule have been picking up speed for a decade,” notes Adam Lohr of RSM US LLP. The pandemic has also served as a catalyst to propel the sector and its capabilities into the mainstream of investor interest and public understanding.”

What makes the biotech consolidation thesis as compelling as ever is twofold notion of need and resources. Some of the most cash-rich companies in the U.S. are older pharmaceuticals dealing with slim product pipelines, patent cliffs or both. Those scenarios can be ameliorated with the right M&A strategy, something that's been deployed time and again in the healthcare sector.

“Over the last 20 years there have been 36 life sciences mergers that cost more than $10 billion, and they have collectively transferred more than $1 trillion in consideration, according to our analysis of Bloomberg data,” says Lohr.

He goes on to note what many advisors have already seen with their own eyes: The past decade has brought about a shift where suitors pursue innovative, often smaller biotechnology companies, leading to a spate of deals with price tags of $500 million or less.

Small Stocks, Big Potential

Advisors know something else. They know about peril and potential of smaller biotech equities. In fact, plenty of advisors have likely discussed such opportunities with clients that bemoaned missing out on a stock that doubled in a day on favorable Food & Drug Administration (FDA) news.

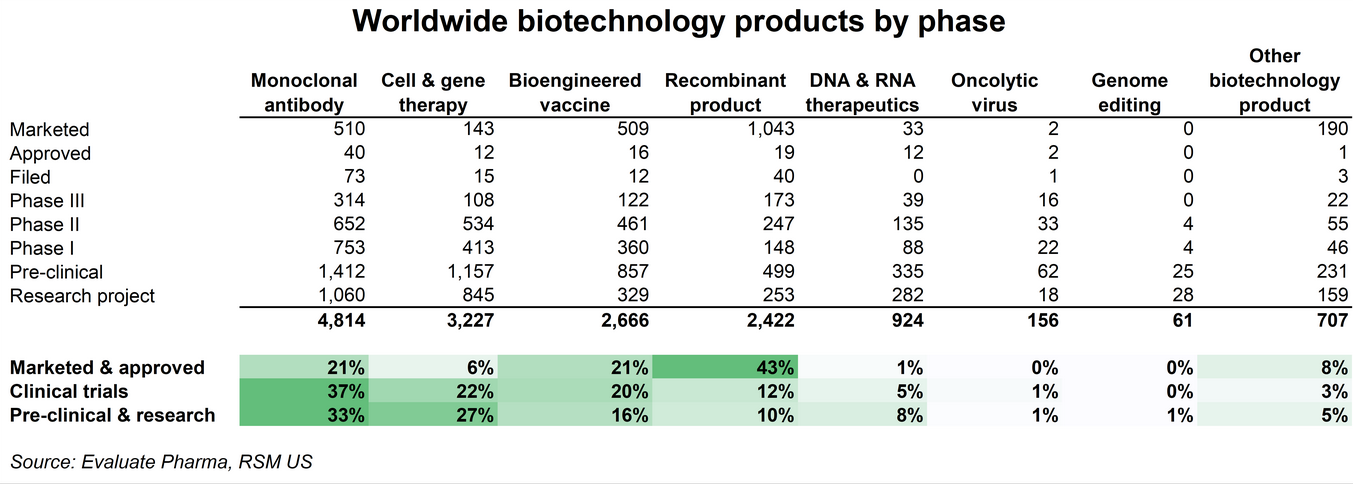

Advisors also know that stock-picking to that effect is difficult. One way they can add value for clients is to emphasize the practical and eliminate the speculative. In this case, “practical” meaning companies with drugs and therapeutics in later stage trials. As the chart below indicates, that's a significantly smaller number than the overall figure of biotech products currently being worked on around the world.

Courtesy: RSM US LLP, Evaluate Pharma

There are some efficient avenues for tapping into smaller biotech stocks with M&A prospects, including the Defiance Nasdaq Junior Biotechnology ETF (NASDAQ:IBBJ) and the ALPS Medical Breakthroughs ETF (NYSE:SBIO). Both are chock full of potential takeover targets and both should participate in any material rebound by life sciences equities.

Advisorpedia Related Articles:

Short-Term Chip Supply Constraints Won't Derail Long-Term Tech Trends

How the Chip Shortage Highlights a Demand for Technology & Innovation