It’s often said that “cash is king”, but that royal status comes by way of how that cash is deployed and the proverbial sidelines aren’t the place where royalty is born.

Yet, despite data confirming the value of remaining invested, the sidelines are exactly where massive amounts of cash resides today. Due to rising interest rates, a record $6 trillion was allocated to money market funds as of the end of 2023. That was a nice risk-free bet for a while, but with Treasury yields poised to matriculate lower, the greater risk to clients may be not being invested.

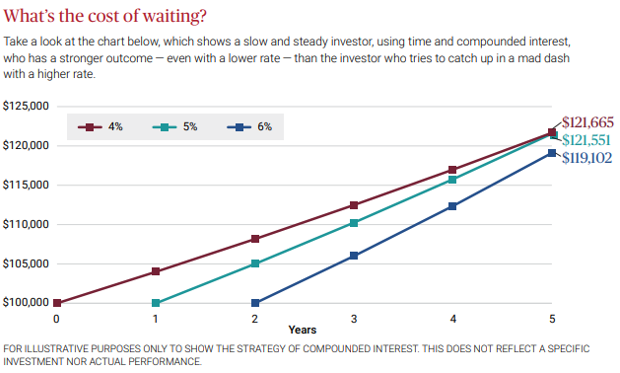

That is to say playing catch-up isn’t easy nor is it as rewarding as remaining invested. Consider the chart below, courtesy of Lincoln Financial Group.

In plain English, assuming a compounded interest rate of 4%, a $100,000 investment grows to $121,655 over five years, but that declines to $121,551 if a client waits just one year in hopes of that 4% increasing to 5%. Wait two years and even if the return jumps to 6%, the investor is left with $119,102.

Annuities Ideal for Deploying Idle Cash

Cash sitting in a high-yield savings account or money market fund is idle relative to capital deployed to bonds and equities. Fortunately, even conservative instruments, such as Lincoln Financial’s annuities, life insurance, long-term care and retirement plans, allow for market participation with protection.

Many clients aren’t aware of the risks of being overweight cash. Nor are they aware that there are strategies available that help mitigate risk while providing some upside exposure. Financial professionals should articulate to clients the positives of leveraging time and compounding – benefits that ring true even when accessed in less risky fashion.

“Today, you have a priceless asset that you will slowly lose over the years: time. Combined with the ‘magic of compounding interest,’ investments made today at a lower (actual) interest rate may reap bigger results than a higher (hoped for) future rate,” notes Lincoln Financial.

Lincoln fixed annuities could be appropriate for clients looking to realize potentially better outcomes relative to basic cash instruments. Benefits include a guaranteed minimum interest rate, tax-deferred earnings, and steady retirement income.

Four Pillars of Lincoln Annuity Success

As advisors know, there hundreds of companies offering thousands of annuities, but being selective in this space is required. It helps when issuers set themselves apart.

Lincoln Financial annuities are rooted in four simple but effective pillars: Name, people, process and products. The company is nearly 120 years old, meaning the firm and its clients have weathered a variety of market environments and that venerability leads into the product side of equation, indicating Lincoln annuities are applicable not only to today’s retirees, but can evolve to help meet the retirement needs of younger demographics.

Those attributes are linked to a streamlined process that makes product selection easier for advisors and clients alike. Of course, a company and its process and products are only as good as its people and that’s another example of where Lincoln stands out because the firm is an industry leader that’s set the standard for annuities offerings and cash alternatives.

Ready to learn more about how Lincoln Financial annuities can help you achieve your clients’ goals? Visit LincolnFinancial.com.

Related: Clients Can Have Their Cake and Eat It Too With Tax-Smart Income

A fixed annuity is intended for retirement or other long-term needs. It is intended for a person who has sufficient cash or other liquid assets for living expenses and other unexpected emergencies, such as medical expenses.

Lincoln fixed annuities (contract form ICC18-625MVA and state variations) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Contractual obligations are subject to the claims-paying ability of The Lincoln National Life Insurance Company.

LincolnFinancial.com Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates.