What We Know; What We Don’t Know

In times like this it’s difficult to see through all the fog. As a colleague commented earlier this week, we have a virtual “cesspool of panic.”

There are some knowns about the state of the novel Coronavirus and, of course, a host of unknowns as well. One known that might provide a glimpse of how this plays out concerns the new daily cases inside China where the virus originated. New cases peaked about two weeks ago according to reported data. The first cases were reported on December 31, so the peak infection period was reached in under two months. As of this writing, China accounts for about two-thirds of the total cases and a slightly higher percentage of total deaths.

If you are interested in looking at country by country data these are two good sources:

We also know that we have been here before. Famed investor and author, Sir John Templeton famously wrote in 1933 that among the most dangerous words in investing are “this time is different.”

Worldwide Impact

We don’t know how much of an impact the Coronavirus will have on the worldwide economy. Our domestic economy has remarkable recuperative powers and this has been proven many times in the past.

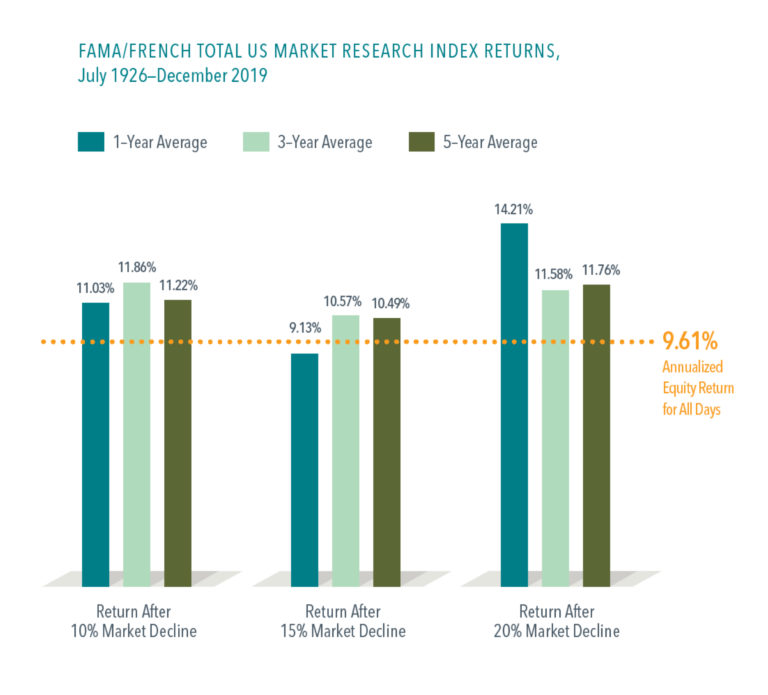

We know that the broad stock market has shown resilience in times like these and recovered quickly. Stated plainly, the economic engine that drives corporate profits and ultimately stock prices isn’t worth 20% less today than it was two weeks ago.

The excellent visual below details how well markets have adjusted previously to temporary pullbacks.

Inflammatory Media

If there is something different this time it’s the almost uniformly vitriolic and inflammatory media. For the main, the media has focused on stoking the flames of panic without regard to actual science and history.

A couple additional thoughts. We simply can’t control every aspect of our health or wealth. We can, however, control how we respond. Finally, while riding my Peloton yesterday, the instructor, Matt Wilpers said, “there’s a difference between exercising and training because training is focused on a goal.” Replace the word exercising with investing and change training to planning and that’s it. Planning is about a long-term goal that is meaningful to you and has little or nothing to do with the market today.

We will see the other side of this and the permanent uptrend will resume. Count on it. Start there.