“We have cash sloshing all over the place.”

That is how a nonprofit leader described the state of her organization’s cash reserves. While this might sound like a dream come true, nonprofits that rely on grants and major gifts that arrive with irregular timing often find themselves wrestling with the labyrinthine exercise of mapping numerous pots of cash to operations and programs as required.

If a nonprofit is sitting on cash to be dispersed to numerous programs and expenditures over multiple years, those funds can easily grow to large amounts, exposing the organization to various financial risks. For example, reserving everything in the organization’s bank account could lead to loss in purchasing power. Alternatively, investing all cash reserves in the stock market in the hopes of earning a better return could result in unexpected losses. Well-run nonprofits reduce risk by aligning the timing of the financial expenditure with the appropriate investment vehicle, ensuring programs and operations are appropriately funded. To find the proper risk/reward balance needed for a strong cash optimization program, nonprofits should answer the following three questions.

How much?

Many nonprofits hold large bank deposits to pay for immediate operational and programmatic needs. While this makes sense to ensure adequate liquidity, a Federal Deposit Insurance Corporation (FDIC) insured bank will cover only $250,000 in deposits per account per owner to protect against bank failure. Coverage is the same for National Credit Union Administration (NCUA) insured credit unions. While bank failures are rare, they do happen. Per the FDIC website there were four bank failures in 2020. Accounts that exceed $250,000 at a single institution are at risk of losing deposits in the event of a bank failure.

There are solutions to minimize this risk. Large, national banks are less likely to fail, yet they are typically more expensive and offer fewer high-touch services than local, community banks. Nonprofits with cash reserves over $250,000 could open accounts at other insured banks to cover all their deposits, but for very large amounts that can be unwieldy to set up and manage. There are alternatives to extending FDIC coverage that involve fintech solutions, providing customers the ability to distribute funds to a network of financial institutions in a more automated way.

How long?

When nonprofits receive grants and donations to fund expenditures and programs over several years, they could be exposed to a loss of purchasing power if those funds are invested without recognizing the time horizon, or the interval from when funds are received to when they are spent. If the nonprofit’s cash reserves are planned for expenses to be paid within 18 to 24 months, nonprofits should focus on liquidity, or the ease with which an asset can be converted into goods and services without significantly affecting the price. Liquid assets will have a high probability of maintaining value over the short term, giving organizations confidence that they can fulfill planned expenditure in that time frame. Checking and savings accounts, CDs and money market funds are typically the most appropriate investments for these short-term funding needs.

When the nonprofit’s cash reserves are for purchases after 24 months, most bank products are not sufficient to protect against purchasing power. Purchasing power is the ability of a unit of currency to buy goods and services. Due to inflation, or the general rise in prices over time, purchasing power of a dollar typically declines. For example, a basket of goods worth $100 in the year 2018 would cost approximately $105 today or 5% more, based on data provided by the Bureau of Labor Statistics. In other words, a nonprofit that had stashed away funds in 2018 to pay for programs and other goods and services in 2021 might experience a 5% general increase in prices. Compare that to the savings account at my local bank that over the same period would earn you about 0.15% or 15¢ for every hundred dollars invested. We go into more detail about purchasing power in this post.

If the gap between expected returns or income and expected inflation is significant, the nonprofit might find themselves in a financial squeeze. Nonprofits may have to accelerate fundraising or cut expenses at the worst time to make up funding gaps due to loss in purchasing power. Investments more appropriate for a longer time horizon might be considered by the organization to provide potentially higher returns.

How risky?

Once a nonprofit starts to consider investing multi-year grants and donations in stocks and bonds, the organization needs to understand its investment risk appetite. We go into more detail about risk appetite in this post. For example, if your nonprofit socked cash away in an investment that changed value significantly from one period to the next, how would leadership react? Could the organization ride out losses in the expectation of future gains? An asset whose prices swings widely, rising and falling over a sustained period, is said to be volatile. Volatility describes the amount of change a price experiences over time, typically measured by the statistical metric standard deviation. Capital market asset prices never follow a straight line even when they generally go up, as the recent stock market performance of 2020 would suggest. And there’s no telling how long a price slump may last before an investment turns positive.

To demonstrate volatility, let’s look at two charts. The first is shows biweekly performance of the S&P 500, a basket of the 500 largest US stocks, since June 26, 1981. Notice how jagged the intra-period performance is despite delivering a 3,103.41% return over the forty-year period, with some market crashes along the way. Stock investors with time on their side have a higher probability of positive returns. But in a short timeframe, due to volatility, no one—not even the smartest of investors—can time the market perfectly to ensure they’re buying low and selling high.

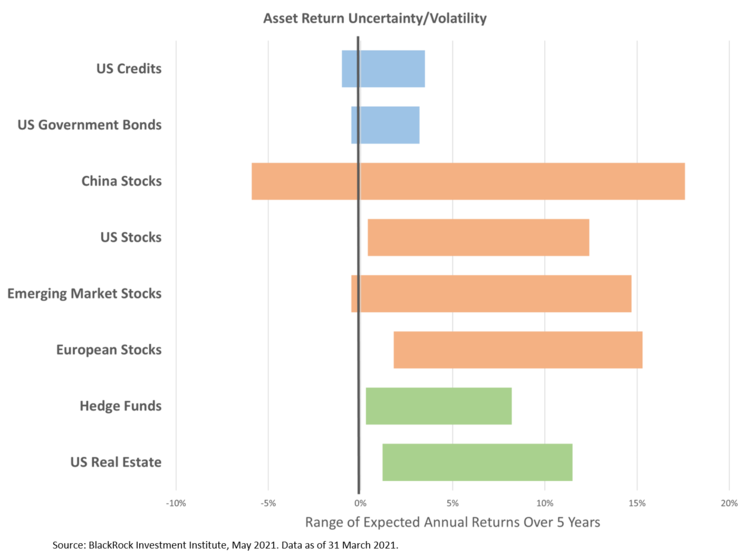

The second chart shows the range of expected five-year returns of various asset classes, or investment types, as projected by the BlackRock Investment Institute. Notice how some investment types have a wide range of expected rate of return, like China stocks, while others are less volatile, like U.S. Government securities.

There is no one-size-fits-all approach to managing cash reserves, particularly when the amounts are high, the timing of expenditures varied and the risk culture of the organization is a consideration. A mix of approaches is best for nonprofit cash reserves to increase the likelihood of fulfilling funding needs.

Related: SPACs, Dogecoin, Meme Stocks: The Dangers of Social Media Investment Sensations