During this Covid-19 crisis, what skills did you draw upon so that you could properly serve your clients? Did you find a greater need to demonstrate your capacity for compassion and authenticity? Did you acquire a greater appreciation for the critical leadership role you play in the lives of your team, staff, and clients?

Consider the fiduciary standards being proposed by regulators: Is there anything in these proposed standards that could have helped you or your clients during the crisis? Given the level of anxiety and stress most of your clients are experiencing, do you think now is a good time to ask your clients to sign a complex disclosure document?

Proposed fiduciary standards are going to cause more harm than good; they’re going to be the contagion that we’re now calling the Fiduciary Flu.

The fact that during this Covid-19 crisis regulators and the CFP Board are still moving forward with their so-called fiduciary standards is further evidence that their rule-making has been fueled by politics, power, ego, and greed. There is nothing in these rules that’s going to increase the public’s level of trust in the financial services industry, nor anything that’s going to improve investment or financial planning outcomes.

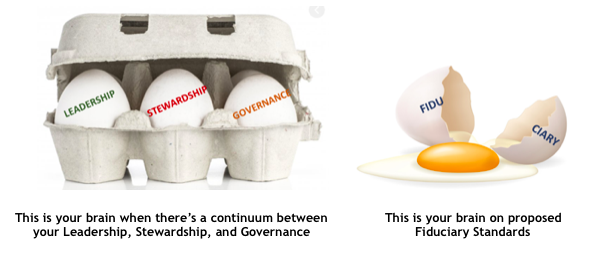

Soon, everyone will be a fiduciary…and yet, they won’t…and that’s a big problem.

These are the six steps we suggest you take to help protect your practice from the Fiduciary Flu:

Step 1: Examine how you’re marketing your firm, products, and services. Is your total package designed to inspire and engage others? The two operative words are ‘inspire’ and ‘engage.’ These two words define the very essence of leadership, and are critical to the formation of trust.

Step 2: Show that you’re passionate about protecting the long-term interests of others, and that your passion is aligned with your sense of purpose and core values. This is the very essence of stewardship.

Step 3: Demonstrate to prospects and clients that you’re disciplined about managing the details of a prudent decision-making process. Adopt a universal framework that your clients also can use to manage their own organizations. This is the very essence of good governance.

Step 4: Simplify how you communicate your process. Often, complexity is an inhibitor to the formation of trust. Somewhere along the way, we adopted the misguided belief that clients would trust us more if we demonstrated just how much we know. The behavioral sciences now inform us that frequently the opposite is true. The formation of trust is based on compassion, character, and competence – in that order. Taking twenty-five minutes to explain to a prospect the difference between a Traditional and a Roth IRA does not reveal your capacity for compassion, nor that you’re a person of good character. It simply alerts a prospect to the possibility that you may be a competent nerd.

Step 5: Clean your house, and take the garbage out to the curb. The crisis has taught everyone the value of being a trusted advisor and that integrity matters – it matters a lot! During the recent extended bull market it was tempting to turn a blind eye to the misconduct of certain individuals, service providers, or the CFP Board. Everyone was making money – no one was getting hurt – integrity didn’t matter all that much. As we move forward, the greater premium is going to be placed on individuals and organizations that can demonstrate a superior capacity for moral and ethical decision-making.

Step 6: Stop marketing yourself as a fiduciary – it’s no longer going to be a point of differentiation. Stop defining your value proposition in terms of fiduciary, funds, and fees. Stop thinking of yourself solely in terms of being a cog in the financial services industry. You’re more than that – you’re a leader and a steward.

What Covid-19 and the Fiduciary Flu share in common is that both are going to force you to redefine your margin of excellence. And, both contagions are going to force you to reevaluate how you want to be perceived by those you serve.

Never forget what you’ve learned during this Covid-19 crisis, for you’re going to need to apply these lessons to help you quarantine your practice against the Fiduciary Flu.

Related: 55 Critical Questions Financial Advisors Need to Answer for the New Normal