In the world of investment, winning and losing has much to do with the concept of risk.

In fact, in my experience, the best investors are those who look at investing as an art, rather than a science. The tools they rely on most are common sense and experience.

What I was most intrigued by in the book, “Top Dog: The Science of Winning and Losing,” by Po Bronson and Ashley Merryman, is the discussion of whether individuals are wired to win or lose—and how this affects innovation and responses to setbacks.

From a financial planning point of view, here’s how I believe people’s perspective on winning and losing relates to saving for retirement:

Now let’s talk about risk.

Each individual shows diverging competitive styles at different stages of life. Traditional views hold that the level of risk tolerance flattens out as people approach later stages of life.

Bronson and Merryman explain this in “Top Dog,” pointing to a 2011 study in the journal Psychology and Aging . The study found that people tend to become more competitive until about age 50, when their competitive fire gradually begins to cool.

In this sense, as individual investors gain more experience with investing or other forms of competition throughout the course of their lives, they may develop a heightened sense of confidence about their financial decisions. Experience and intuition, however, are not always reliable: they need to be constantly monitored and adjusted to ensure consistency with one’s life financial goals.

Fundamental differences between men and women affect their investing approach.

Countless studies have shown what we all know: Women are more comfortable with taking risks only when they are reasonably sure about the chance of winning; while men seem to enjoy competing against all odds.

I have seen this phenomenon in my office when some couples seek financial planning and investment advice. Sometimes the views of the individuals in the couple are so divergent that the couple needs an intermediary to help them reach a consensus toward their goals and strategies.

For a couple to get the best financial advice possible, the individuals in the couple need to know themselves and each other well, and be able to communicate well with each other before seeking financial advice from a third-party.

When it comes to financial planning, keep this in mind:

1. Volatility in the financial markets has been unprecedented over the past few years following the global financial crisis. Notably, the S&P 500 index finished flat in 2011. If you invested in the in the S&P 500 through an exchanged traded fund or index fund, would you call yourself a winner or a loser?

2. Investors may be conditioned to think that they are only winners if they consistently select funds that increase in value. In working with my clients, because financial planning is the foundation of our relationship, clients are not as focused on performance numbers, but stay focused on their progress towards their life goals. This is the only constant we can control—our own view of where we stand in relation to our definition of winning and losing.

3. Remember, investment planning in isolation does not constitute financial planning. Without a clear link between your investments and goals, it’s easy to have trouble distinguishing the forest from the trees. Financial planning helps you understand the impact that each financial decision has on other areas of your financial life.

4. Financial planning is about controlling spending, managing credit, reducing taxes, increasing savings, protecting family and assets, and building wealth for the future. This process entails gathering financial information, establishing life goals, evaluating your current financial status, and developing a strategy to help you achieve your life goals.

5. Developing a strategy is critical, but monitoring the strategy is equally important. Be sure to monitor your progress toward your goals. Even if your goals have not changed, the world around you may have changed. For example, laws on tax deductions and credits change, and so do retirement plan contribution limits and interest rates.

The Bottom Line

In my mind, we are all winners when we set goals, develop a plan to reach goals, implement the plan, and properly monitor our progress toward goals.

I don’t agree with the perspective in the song by ABBA that says, “The winner takes it all, the loser standing small.” To me, these lyrics reinforce the notion that life is all about winning and losing.

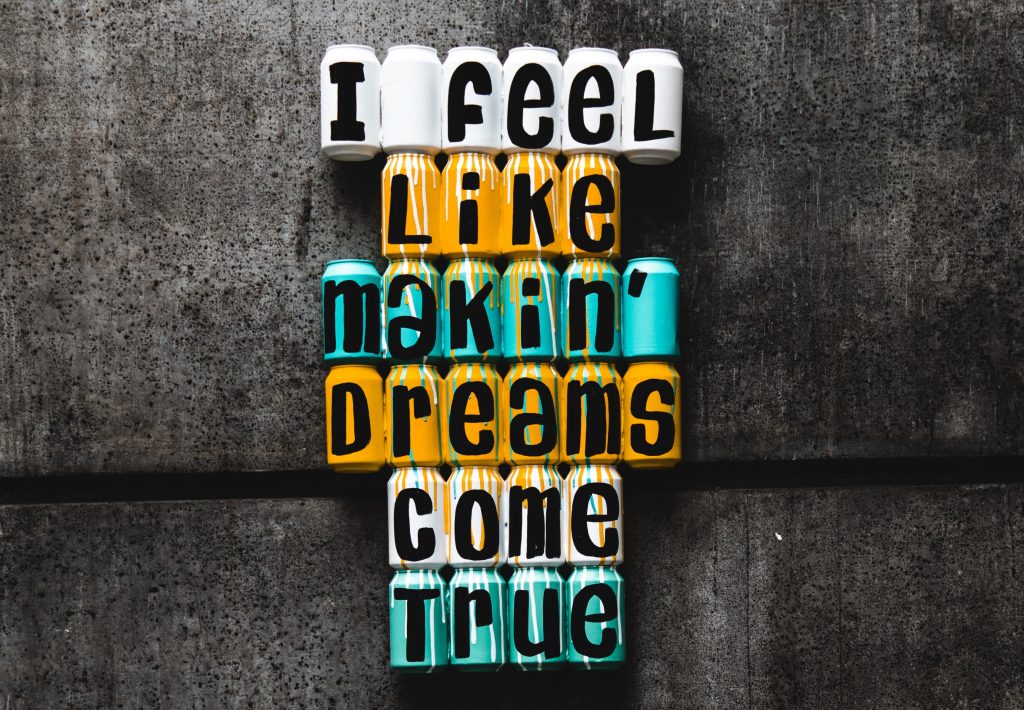

If your investment decisions are part of a strategic financial-planning process, then I firmly believe, like Lady Gaga sings, that: “Sometimes in life you don’t always feel like a winner, but that doesn’t mean you’re not a winner.”

I tell my clients and followers that if their investment portfolio funds their children’s education, their family vacations, and their retirement—then they are certainly winners in my book.

This post originally appeared in Inkandescent Magazine.