Investing in smaller companies can be accomplished a number of different ways. Each avenue comes with its own challenges, opportunities, and unique risk/reward profiles: private equity, venture capital, or through public investing. Not as well understood, or as proactively followed, lies the microcap universe of public companies.

Micro-cap stocks are generally defined as public companies under $300 million in capitalization, which represents the bottom two deciles of securities ranked by market capitalization; small-cap stocks in contrast are defined as deciles 6-8. There are approximately 4,300 exchange-listed micro-cap public companies. This number expands to approximately 7,000 when over-the-counter (OTC) traded micro-cap public companies are included. For reference, while the micro-cap universe occupies the lowest deciles of market capitalization, it is approximately 43% of the public company investment opportunities.

To more fully explore the intricacies and opportunities within the microcap investment universe, we reached out to Institute members Kevin Rendino, CEO and Portfolio Manager, and Daniel Wolfe, President and Portfolio Manager of 180 Degree Capital Corp., a publicly traded closed-end fund (NASDAQ: TURN) and registered investment adviser that manages its own capital alongside separately managed accounts. Their firm focuses on positively impacting the business and valuation of microcap companies through a process they call “constructive activism.” Their goal is to invest in and provide value-added assistance to undervalued small, publicly traded companies that have potential for significant turnarounds. These efforts hopefully lead to a reversal in direction for the share price of these investee companies, in other words, a “180-degree turn”.]

Hortz: What are the unique structural aspects of the microcap marketplace?

Rendino: These small market capitalization companies have small floats and low trading volume making investing large amounts of capital practically impossible for funds with larger asset bases. While most of these companies are listed on a national exchange such as the NASDAQ or NYSE, some companies trade over-the-counter. In some cases, these OTC companies may be ones that were listed on a national exchange and were delisted due to delays in filing financial statements with the SEC. Many funds and brokers limit the ability to invest in companies that do not have up-to-date financial statements, are not listed on a national exchange, and/or have stock prices that trade below $5 per share.

In short, the number of investor eyeballs digging into the businesses, financial statements, and other important aspects of these microcap companies is significantly less than companies with larger market capitalizations. But do not think that every smaller cap company has reporting or delisting issues. They do not. We have found real companies, with real cash flows managed by fine executive teams. In fact, many executives are tired of working at bigger, bureaucratic companies and seek the more entrepreneurial and fast-paced environment offered at small public companies. Examples within our own portfolio include the CEO of Potbelly, who was the COO of Wendy’s, the CEO of Lantronix, who was the President and COO of Microsemi, and the CEO of Arena Group Holdings, who was the interim CEO of Yahoo!.

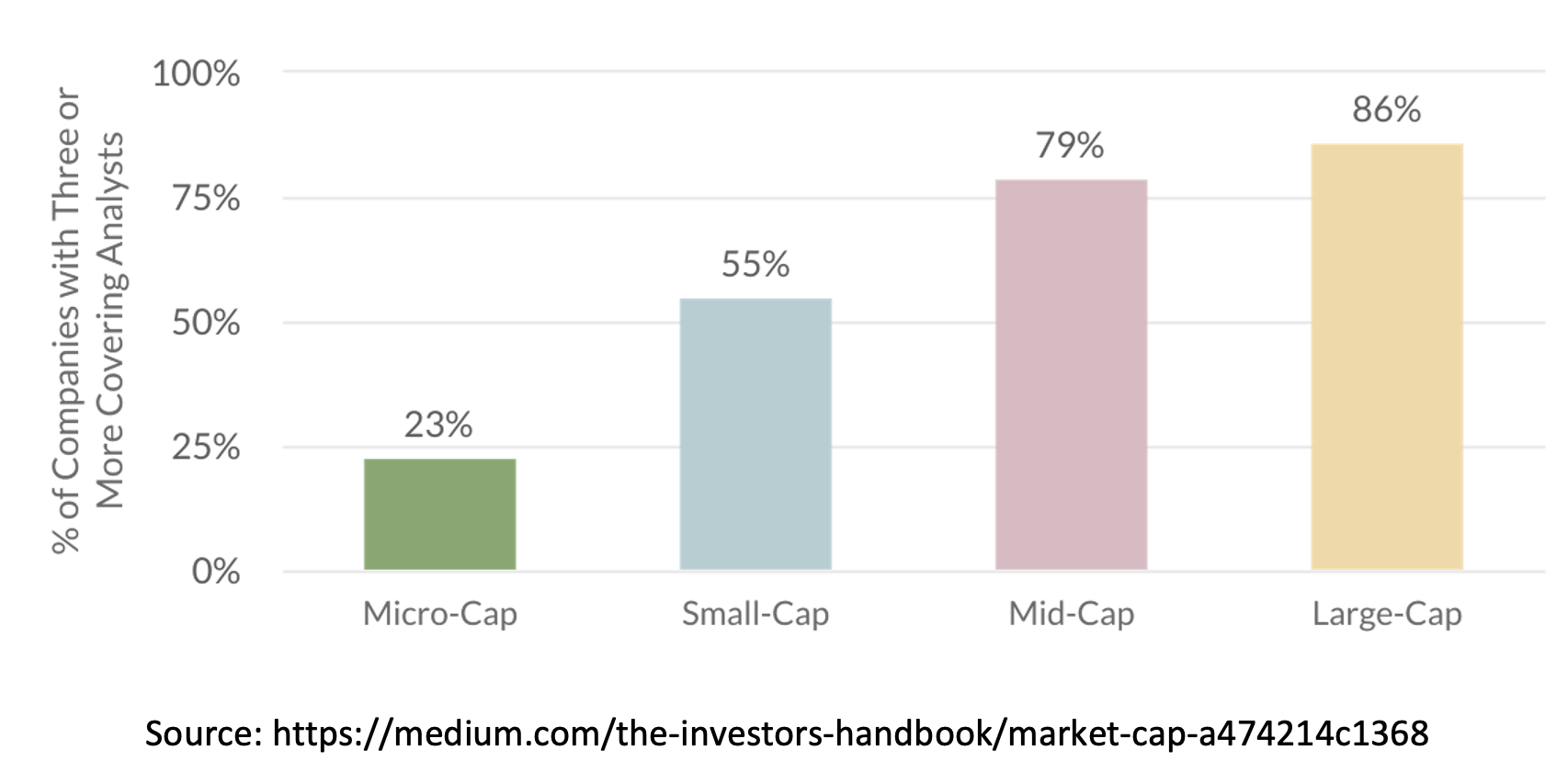

Wolfe: The same is true on the bank analyst side. As this chart shows, nearly 75% of companies in the micro-cap space are followed by less than three analysts. Our experience suggests that a vast majority of these names are not covered by a single analyst. Analysts and institutional investors are simply unable to spend the requisite time to familiarize themselves with these opportunities due to position size limitations, liquidity restrictions, and overall capacity constraints. This dynamic creates a compelling opportunity for those investing in the micro-cap universe to be on the forefront of discovering overlooked, orphaned investment opportunities and to benefit from the forthcoming value/size appreciation that can follow if these companies can execute on their business.

Hortz: What are some of the opportunities unique to the microcap universe of companies?

Wolfe: Fortunately, the lack of analyst coverage and investor attention is not an indication of poor businesses or inferior management teams. In fact, one of the primary drivers of opportunity in this part of the market is the ability to identify situations where quality management teams are leading businesses that have fallen out-of-favor relative to the market, creating an asymmetric risk/return profile.

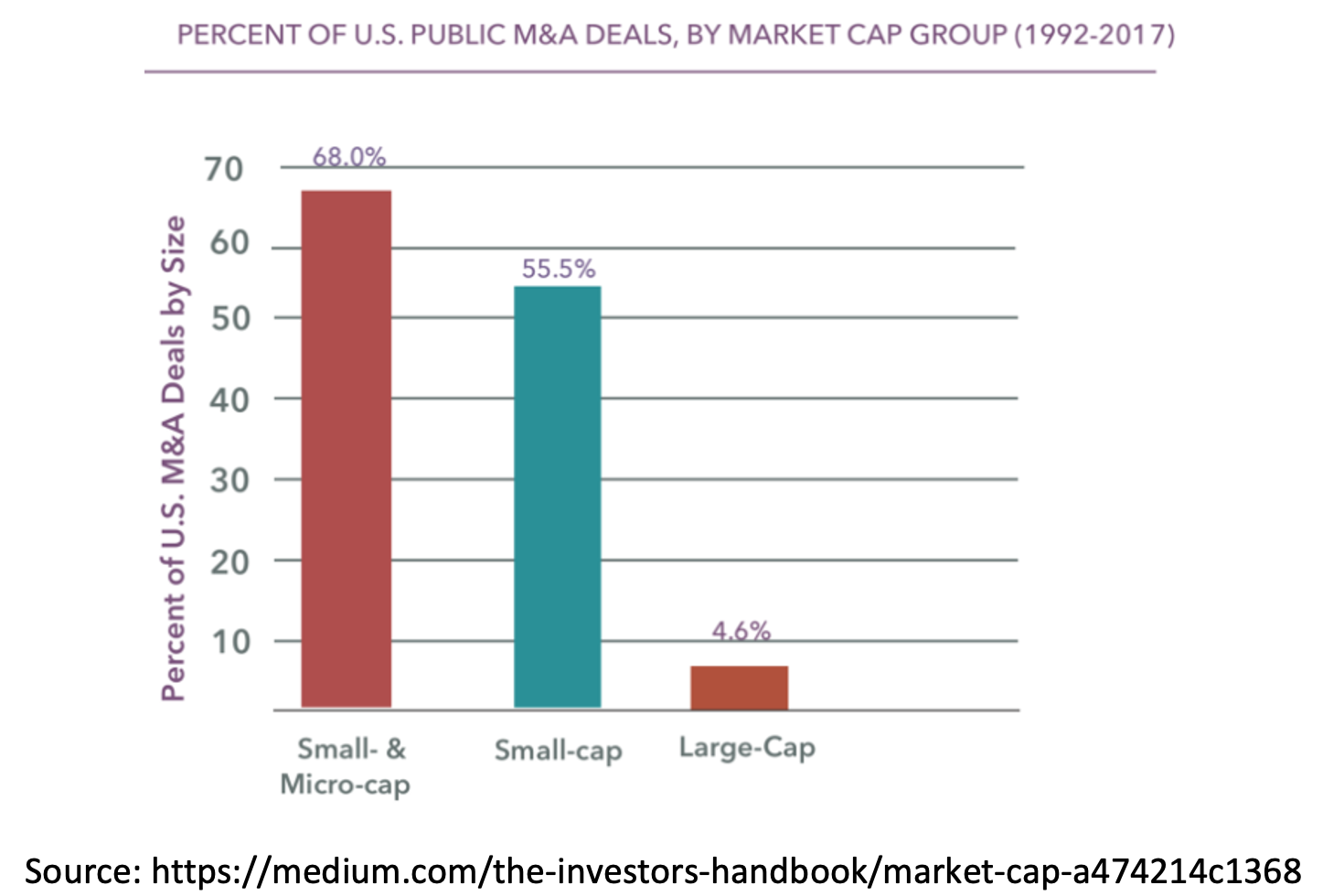

Many of these opportunities can have several underlying catalysts that, when identified and pursued, can drive substantial value appreciation. For example, a natural outcome in many of these situations across the broader micro-cap space is an M&A event. Nearly 70% of acquisitions throughout the equity market involved small and micro-cap companies. Properly identifying and positioning within this potential universe of targets typically introduces an opportunity for an investment exit at substantial premiums.

Rendino: In addition to enhanced M&A opportunities, there are numerous other potential catalysts that can provide opportunities for micro-cap companies to outperform the market. Among these catalysts are removing unwieldy capital structures, new management teams, monetizing undervalued real estate assets, and even resolving prior legal or accounting issues.

All of these potential catalysts have multiple things in common. First, they create the potential for a business to be undervalued relative to peers and to their current results. Second, given the size of these companies, it is often the case that management and boards are unsure of how to fix their problems to catalyze such value-enhancing events, and further, they are often on their own in terms of coming up with any potential solutions. We are there to help.

Hortz: How can an activist investor approach particularly help capture these microcap opportunities?

Wolfe: Ideally, these catalysts are identified previously by the company’s existing management team/board of directors who are actively pursuing solutions. Even when management and boards of these companies understand the problem, solutions are often not obvious to them as they can be too close to the problem or lack the experience or expertise to rectify them. Our form of constructive activism employs a multi-layered strategy to explore these potential catalyst opportunities alongside the executive teams to ultimately unlock shareholder value.

Rendino: There are several additional reasons why some micro-caps have difficulty reaching the “next-level” in the company’s life cycle. Many of the more common situations are as simple as proper communication and messaging to the broader investment community. Other situations may require a more hands-on approach to address issues such as misaligned incentive structures, improper corporate governance protocols, or the aforementioned complicated legacy capital structures.

While each of these situations are unique, all present an opportunity to use activism constructively to unlock significant value creation for shareholders in these micro-cap companies. Simply put, we believe using a constructive activism approach can enhance investment results and drive suitable outcomes for the companies we invest in. We believe pairing micro-cap investing with activism has enabled us to differentiate from other micro-cap investors.

Hortz: Can you offer some comparisons between investing in microcaps versus private equity? Are there any microcap benefits for private equity investors?

Rendino: Every investment we make incorporates some version of activism. It spans the spectrum and can be as little as referring a company to a certain IR firm or as much as a full-blown proxy contest to unseat a Board. We are bottoms up oriented investors and characterize ourselves as “always being involved” on some level. Our activist investing can incorporate private equity like involvement.

Private equity firms not only provide alternative forms of financing, but they also regularly engage to restructure a company's strategy, management team, or overall operations. The bones of our investment process look quite a lot like that of a private equity firm. In fact, the two asset classes are currently experiencing a convergence of investment activity as activists are looking to deploy more capital to outright take over companies, while private equity firms are beginning to utilize activist tactics to seize greater control of companies. Most recently, Elliot, a well-known activist firm, teamed with private equity firm Brookfield to take Nielsen Holdings private.

Wolfe: While there are several similarities regarding our investment approach in microcaps to those used by private equity - including a common focus on finding deeply undervalued companies - our structure and investing in microcap public companies provides a level of liquidity for investors that is not possible with private equity investments. More specifically, private equity funds are usually 10 years in duration during which time the investor does not have the ability to access the invested capital unless the private equity firm makes a distribution. Those distributions occur when a portfolio company is listed publicly or is sold.

Investing in microcap companies that are already public provide immediate liquidity for us to be able to trade around positions, or to sell out completely when a company reaches what we believe to be our target exit value. Investors in our closed-end fund (TURN) have additional liquidity in that they can buy and sell our company’s stock daily just like the investments we make in micro-cap public companies.

Hortz: With so much concern over inflation today, how has microcap stocks historically reacted to a high inflation environment?

Wolfe: Interestingly, using history as a guide, we see the current sell-off as an opportunity as it relates to the small/microcap market generally. In fact, the small cap market, which includes micro-cap companies, is the only major asset class to outpace inflation during every decade since the 1930’s. Further, going back to 1926, the small cap market is the only major market that has on average been able to outperform inflation even when inflation moves above 5%.

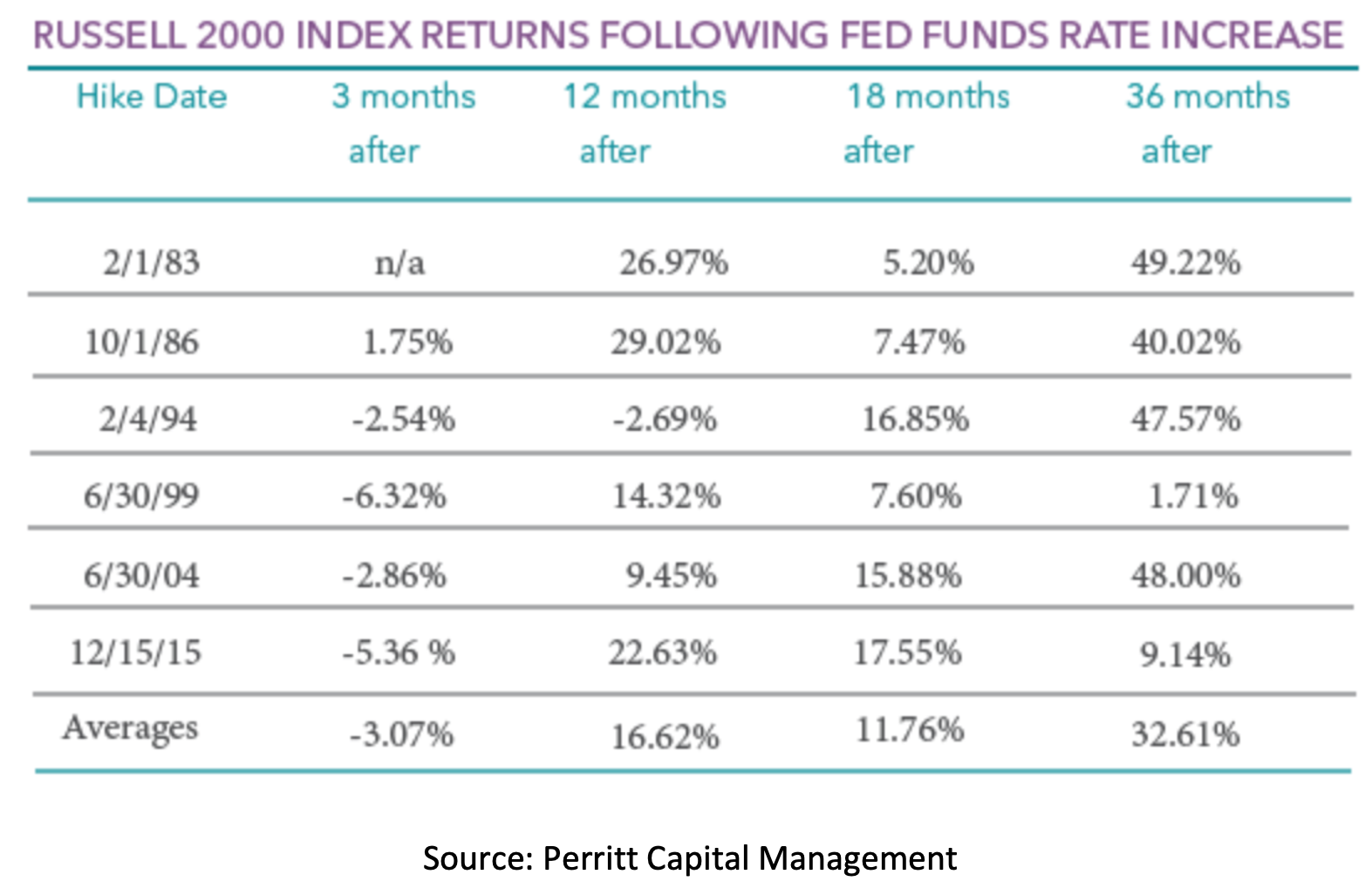

If we drill down further and examine the six most recent cycles of fed funds rate hikes, we see that following an initial selloff, the small cap market consistently produced attractive rates of return for the 12-36 month period following an initial rate increase.

Rendino: There are a number of likely factors driving this outperformance. For example, many analysts see benefits in the flexibility and maneuverability afforded management during more volatile economic environments in running a smaller enterprise versus a large company.

Also, to the extent global factors represent a key driver to the market conditions (which they clearly do now), smaller companies are often more insulated from these impacts as their business are less geographically dispersed, particularly in terms of customers. Another reason for small cap outperformance is that smaller companies often produce outsized growth in a growing economy than rising rates imply, and they are often able to pass on price increases to customers in an inflationary environment.

Taken together, we believe the current fear-driven sell off is providing significant opportunities in the small cap market particularly for a microcap investor.

Hortz: Any recommendations for advisors on how to look at microcaps for their client portfolios?

Rendino: Looking at this stock universe strategically, the micro-cap market has historically provided higher levels of return than other equity markets, low correlation to market indices, less sell-side involvement, greater M&A activity, and is the only asset class to historically outpace inflation.

We believe that when combined with a constructive activist approach to problem solving, the micro-cap market provides an extremely attractive return profile that should be a part of a broader investment portfolio. TURN has a very differentiated approach, and we believe our shareholders and our managed accounts are positioned well to benefit from investing in our strategy.

Related: The Performance Dispersion Opportunity for Active Investors