Advisors that have clients with younger children and teenagers know that for many of those folks, college is on the horizon. They also know that associated costs have risen at an unchecked pace.

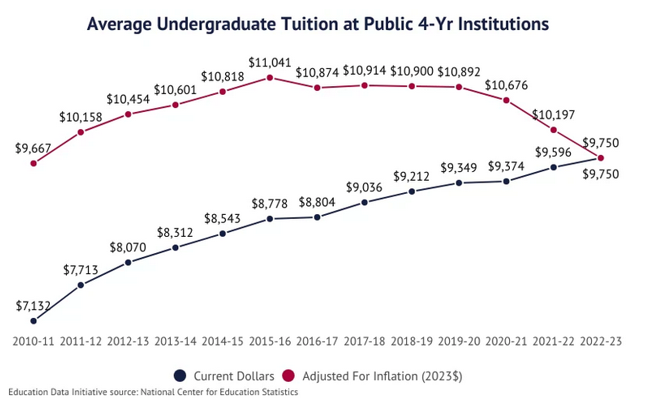

As noted by the Education Data Initiative, the average annual cost of tuition at a public 4-year college is 40 times higher today than it was in 1963 as of September 2024. That includes a nearly 37% tuition increase from 2010 to 2023 and “after adjusting for currency inflation, college tuition has increased 197.4% since 1963.” Worse yet, those increases arrived as the dollar’s purchasing power declined.

(Chart Courtesy: Education Data Initiative)

Point is college costs are rising unabated and, unfortunately, there’s no reason to believe allegedly non-profit institutions are going to change their ways.

Fortunately, advisors have tools with which to help clients bolster college savings, including 529 plans and Coverdell accounts. As a brief refresher, 529 plans feature several attributes that are likely attractive to a broad swath of clients, including tax-deferred growth, the ability to efficiently change beneficiaries, no federal tax implications and the ability to roll excess funds, up to $35,000, over into a Roth IRA. What’s interesting – and it’s a call to action for advisors – is that many Americans don’t even know about 529s.

529 Education Is Needed

With 529s, clients and parents can contribute as much as they want per year, but there are some tax considerations. Namely, a single donor can “only” realize $19,000 annually per beneficiary ($38,000 for married couples) in federal gift tax exemptions. Contributions above that amount are subject to IRS gift tax rules.

The tax issues are just one example of why clients need advisors to help them navigate 529 plans. The other big reason is many Americans simply aren’t aware of these vehicles. A new Edward Jones survey indicates 52% of those queried don’t know about 529s. That’s nearly quadruple the amount (14%) currently or planning to use these plans. That points to an education gap that needs to ameliorated at a time when there’s no indication college costs will retreat.

Adding to the significance of 529 conversations is the fact that many Americans, including those with college-aged kids and teenagers, aren’t confident in their education savings progress.

“Only two out of five respondents (38%) feel like they are saving enough to reach their goal for future education expenses, a slight drop in confidence since 2024 (40%). This number decreases further for Gen Xers, with only 28% feeling like they're saving enough,” adds Edward Jones.

Time Is Now to Discuss 529s

Given the unfavorable outlook for college costs, the 529 conversation shouldn’t be delayed. If anything, advisors ought to consider initiating it with clients who are parents. Chances are those folks will be appreciative of advisors shining light on an education savings tool they probably weren’t thinking about.

“The majority of respondents (78%) do not typically consult a financial advisor before making decisions related to education savings, but 21% say that working with a financial advisor would help them feel better about covering the costs of future education expenses,” observes Edward Jones. “Financial advisors can act as an impartial third party to develop tailored strategies to help meet families' educational savings goals, especially within the context of their broader financial goals.”

Plus, advisors can also inform clients that 529s aren’t confined to college. Funds saved in those accounts can be used for private K-12 education as well as trade schools, among other options.