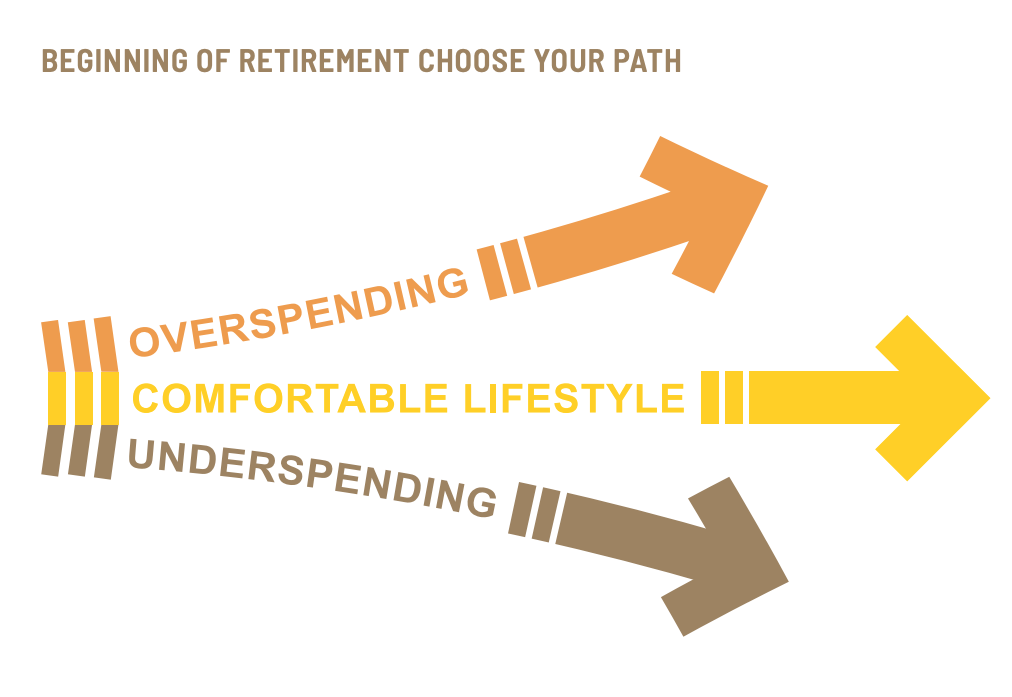

When considering your budget in retirement, there are three general paths people take: those who spend too little; those who spend too much; and those who identify the optimal spend level.

People who spend too little often live in constant fear that they will run out of money. They forego the fun things many of us associate with retirement, like trips to see grandchildren or golf club memberships, but also the little things like a new pair of reading glasses or healthy food at the grocery store.

People who overspend risk running out of money and forfeiting the lifestyle they desire as they grow older. A recent survey found that households led by adults over 65 with debt have increased from 41.5% in 1992 to 60% in 2016.¹ With life expectancy nearly doubling in the 20th century,² overspending is a serious risk for many Americans.

Income planning can be a great way to ensure that you find the optimal spend level, so you enjoy a comfortable lifestyle free from overly burdensome financial anxieties. Protection is the base to a good income plan so that regardless of market ups and downs, essential expenses are covered. To get on the optimal spend path toward a comfortable lifestyle, it is important to consider four easy steps:

- Set clear retirement goals, e.g. pay for my daughter’s wedding, be able to stay in my home as long as I live, or secure long-term care insurance for unpredictable health concerns;

- Calculate a monthly retirement budget and distinguish between your essential needs, your wants and your wishes. Cover your M.U.G. first (shorthand for essentials like mortgage, utility, groceries, etc.), and then wishes and wants;

- Identify your security gap – the difference between guaranteed monthly income and the essential expenses you must pay;

- Secure protected lifetime income streams to cover your security gap and probable income streams so you can be optimistic about achieving your wants and wishes.

Protected lifetime income streams include social security, pensions (if you’re lucky enough to have one), and annuities. Depending on how close you are to retirement, you will take a conservative, moderate or aggressive approach to securing probable income. But, without protection for essential expenses, you risk your needs for your wants and wishes.

Financial professionals can help develop a retirement income plan and cover your essential expenses with protected lifetime income.

Learn more at www.protectedincome.org.

Related: Advisors: People Like Mary and Ed Need Your Help

1 NCOA Survey of Consumer Finances, https://www.ncoa.org/economic-security/money-management/debt/senior-debt-facts/ 2 NIH National Institute on Aging, https://www.nia.nih.gov/living-long-well-21st-century-strategic-directions-research-aging/introduction Annuities are long-term investments designed for retirement purposes. The value of variable annuities is subject to market risk and will fluctuate. Product guarantees are subject to the claims-paying ability of the issuing insurance company. Earnings, when withdrawn, are subject to federal and/or state income tax, including a 10% tax penalty for withdrawals before age 59½. Some income guarantees offered with annuities take the form of optional riders and carry charges in addition to the fees and charges associated with annuity products. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses. Investments in annuity contracts may not be suitable for all investors. Northern Lights Distributors, LLC, a FINRA/SIPC member, has been retained to facilitate FINRA review of the material in order to meet certain requirements of its business partners. Northern lights Distributors, LLC is not affiliated with The Alliance for Lifetime Income