Written by: Jack Manley

Following the recession in the first half of 2020, U.S. equities rebounded quickly. Today, partly due to this and partly due to the strong domestic reopening story, U.S. equities make up roughly 79% of total investor equity allocation, just 20 bps shy of an all-time high. At the same time, U.S. equities appear to be facing rich valuations. As a result, many investors may be wondering: where do the opportunities lie within the U.S. equity market? Certainly, part of the answer lies in the macro-fundamental backdrop; but some will also lie in the flow of investor dollars. After all, the fundamentals matter little if there are no “buyers” of the story.

For some time, one of the most promising opportunities was the rotation into value stocks. Growth stocks, led by technology, have done exceptionally well over the last decade – and throughout COVID. With reopening well underway, more cyclical assets had a natural appeal to investors looking for a bargain. The rotation has now been ongoing for many months, and some investors may fear that the period of value outperformance is rapidly drawing to an end. Nonetheless, relative valuations still suggest that there is “value to be found in value.” Moreover, value sector earnings are much more levered to domestic GDP growth, which is set to run well above trend for several quarters. Sectors and industries like financials, energy and airlines are particularly well exposed.

Another attractive opportunity was the rotation into small cap stocks. Similar to the aforementioned rotation into value, the rotation into small caps appears to have more room to run despite recent strong performance: valuations remain attractive on a relative basis – especially within small-cap value – and small cap equities are generally more cyclical in nature.

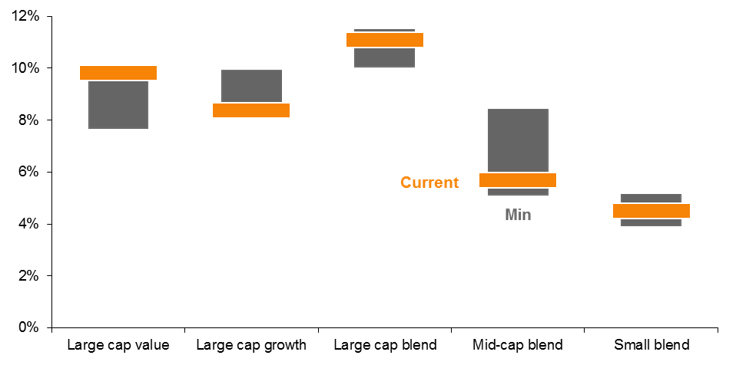

Portfolio positioning suggests that the potential rotation out of growth into value has been whole-heartedly embraced: as shown in the chart below, allocation to large cap value is among the highest seen over a trailing 12-month period; allocation to large cap growth is among the lowest. From a size perspective, flows into small and mid-cap stocks have been modestly positive. These rotations have led to heightened market volatility, which in turn has resulted in an attractive environment for prudent active managers: indeed, active management had one of its best months on record in May, with nearly 70% of managers outperforming the Russell 10001. Interest in active management has, as a result, increased.

Recent markets have only reinforced the evergreen concept of knowing what you own at both the portfolio and manager levels, as being vitally important. All told, investors should recognize that despite current headwinds at an index level, there still exist attractive opportunities within U.S. styles, sectors and sizes. More to the point, current challenges suggest an increased need for active management, even in traditionally well-researched markets like U.S. stocks.

Investor allocations in value are near historical highs

Trailing 12-month allocation, May 2021

Source: J.P. Morgan Asset Management. Data are as of June 7, 2021.

1 "'One of the best months in history’ for active management”, The Financial Times, June 8 2021