The intersection of investing and politics is often frustrating for advisors and clients, if not downright unpleasant.

To the point about frustrating investment propositions and policymakers not acting, here we are almost halfway through 2021 and there's still been no tangible results on President Biden's infrastructure proposal – something that was widely discussed on the 2020 campaign trail, resulting in stout appreciation for a variety of related assets.

In the essence of eschewing political commentary that won't win anyone over, I'll point out a positive and negative about the president's infrastructure ambitions. On the bright side, President Biden is living up to a campaign promise – a rarity among politicians regardless of party affiliation.

However, the negative is that he and his team should have known the Senate votes weren't going to be there to pass the bill in its original form and that doing so through budget reconciliation – still on the table, by the way – will leave a bad taste in some politicians' mouths and likely eliminate any near-term hopes for bipartisanship.

Indeed, when politicians get involved, infrastructure investing loses some of its allure.

Good News: More to Infrastructure Thesis

For advisors and clients, infrastructure's political burden is eased considerably by its reputation as an inflation fighter and a strong one at that. Some of listed infrastructure's inflation-fighting prowess is tied to income.

The FlexShares STOXX Global Broad Infrastructure Index Fund (NFRA) yields almost 2%. That's not jaw-dropping, but it's a lot better than clients get from the S&P 500 and 10-year Treasuries. That yield enhances the fund's relevance as an inflation topper as well its potential potency when included in 60/40 portfolios.

“Investors seeking income and portfolio diversification may benefit from infrastructure investments. Our analysis suggests that infrastructure issuers tend to have predictable cash flows as they provide essential services used in all economic environments,” according to FlexShares research. “Infrastructure stocks carry both equity and interest rate exposure, and can provide an alternative source of income that may be attractive in a low interest rate environment.”

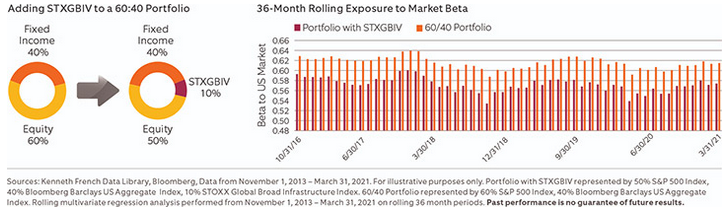

NFRA tracks the STOXX Global Broad Infrastructure Index (STXGBIV). As its name implies, that's a global benchmark, helping advisors add some geographic diversification to client portfolios while reducing correlations to domestic assets. It's also an effective beta reducer.

The impact of a 10% allocation to that index in a 60/40 portfolio “has been to reduce the overall portfolio exposure to US equity market beta* by an average of 6.3% from November 1, 2013- March 31, 2021,” adds FlexShares.

Courtesy: FlexShares

Beating Inflation Part Two

For those that need a bit more convincing, the infrastructure proof as inflation-beating avenue is in the pudding. In fact the asset class is better at beating rising consumer prices than several of its popular, prosaic counterparts.

“Since 2001, global listed infrastructure has been able to cover the inflation effects of high inflationary periods 73% of the time, outpacing more traditional asset classes like fixed income (62%), global equities (67%) and TIPS (69%),” notes FlexShares.

In other words, Capitol Hill will continue looming large over infrastructure, but there are reasons to discuss this opportunity with clients and those reasons won't lead to political disappointment.

Advisorpedia Related Articles:

How Advisors Can Deliver Quality Positioning in Next Leg of Economic Boom

Smaller Financial Stocks Get Their Grooves Back

Don't Lampoon the Idea of Summer Vacation with European Equities