With recent news that Warren Buffett is handing over the reins of Berkshire Hathaway (NYSE: BRK-A), many of his investing lessons are being revisited. One that deserves ample attention is embracing companies with wide moats.

For those not familiar or in need of a refresher, an economic moat is a competitive advantage possessed by a company that allows it to protect and grow market share and profitability. It doesn't necessarily mean a company has a monopoly, but many prime examples of wide moat firms feel that way. Think Apple (NASDAQ:AAPL), Google parent Alphabet (NASDAQ:GOOG), Microsoft (NASDAQ:MSFT) and Buffett's own Berkshire Hathaway.

In simple terms, a wide moat can be defined by the following hallmarks: enviable brand recognition, cost advantages, intangible assets, switching costs and networks. Again, a company doesn’t need to hold a monopoly or be part of a duopoly to have a wide moat, but let’s be honest. There are plenty of examples of modern day quasi-monopolies on the market today and a new exchange traded fund seizes upon that theme.

The Strategy Shares Monopoly ETF (CBOE: MPLY) debuted last week, ratcheting up the wide moat investing premise.

MPLY Embraces Monopolies

Some housekeeping items regarding MPLY. The new ETF doesn’t hold shares regulated utilities whose pricing mechanisms are overseen by federal or state oversight boards. Second, the fund, which is managed by Neil Azous’s Rareview Capital , is unabashed when it comes to holding companies that have faced antitrust scrutiny. In fact, “Historical antitrust reviews” is a phrase found on MPLY’s homepage.

“MPLY can be a core solution and a potential replacement for a portion of a portfolio’s stock market exposure,” said Azous in a statement. “The Fund seeks to capture market upside, but may act more defensive on the downside. The companies the Fund invests in generally have sustainable competitive advantages, tangible barriers to entry, and defensive earnings streams. As a result, they typically have the potential to generate high returns on invested capital that may compound over long periods.”

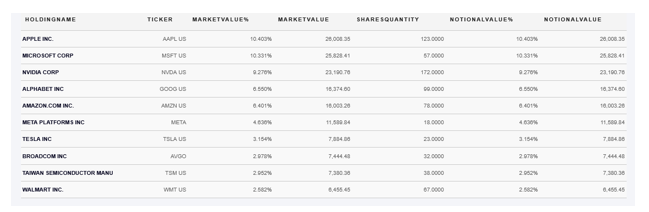

As highlighted by the table below, MPLY doesn’t shy away from companies that have been accused of perpetrating monopolies.

(Chart Courtesy: Strategy Shares)

MPLY Perks

There are risks associated with shares of companies painted with the monopoly. Microsoft has been down that road before. Meta’s Mark Zuckerberg has spent his share of time testifying on Capitol Hill due to his company being viewed as a social media monopoly of sorts. And for those wondering why Alphabet shares are down 12% year-to-date, a lot of that decline can be attributed to fears that regulators will force the company to sell its Chrome browser.

On the other hand, there are benefits to investing in companies operating in the monopoly/duopoly spheres. Beyond the obvious competitive barriers to entry, these firms, including MPLY components, often exert pricing power, possess deep network effects and have treasure troves of intellectual property and patents.

“MPLY’s defined focus on companies with Monopolistic Attributes extends to organizations that either individually dominate a market with limited to no competition for its products or services or dominate a market collectively with one or more other companies that sell similar products or services with limited to no competition,” concludes Strategy Shares.