Written by: Lei Qiu, and Wentai Xiao

Technology stocks have been buffeted by market volatility in early 2025, with shares tied to artificial intelligence (AI) hit especially hard. Enthusiasm for AI-driven technology companies began unraveling with DeepSeek’s breakthrough in January and has continued with tariff-fueled uncertainty.

We believe this turbulence will eventually ease, and some of the more ephemeral drivers of today’s unstable markets will reset. In the meantime, tech’s big shake-up could present a compelling opportunity for long-term investors—if they know where to look.

The Changing Nature of Pricing Power

So, what has driven the technology revolutions of the 21st century so far? Decades of globalized trade policy resulted in lower input prices for consumer goods—from apparel and footwear to furniture and electronics. In turn, digital native giants were able to provide networks for shopping, payment and advertising based on capital-light business models. That’s because their competitive moats were secured by network effects (value that increases the more people use a product or service) that were digital, rather than physical.

But the world is changing. Shifting geopolitics and rapid technological innovation are driving companies to invest more, whether to reconfigure supply chains or build next-generation AI data centers. In short, we now live in a world of increasing capital intensity. This poses new questions for investors¬ to consider, including who the future tech leaders will be and which companies will earn robust returns on invested capital (ROI), our preferred measure of profitability.

Ultimately, we think it boils down to pricing power. In our view, firms with pricing power will be the clear winners in a world of increasing capital intensity.

We believe companies with pricing power have three key hallmarks:

1. A defensible business model: Firms with defensive business models have built significant competitive moats via strategic research and development, or scaled manufacturing capacity that can withstand disruptions.

Over the past two decades, markets have rewarded asset-light business models driven by digital network effects. While the network effect may still hold today, it has evolved to include intellectual property, physical economies of scale, and a feedback loop between design, engineering and manufacturing.

In particular, firms that have invested in local-for-local capacity have effectively “pulled forward” the penalties created by tariffs, while those that have underinvested may face future penalties in an increasingly fractured world.

2. Strategic industries: In a period of growing protectionism, investors need to figure out which products and services consumers can’t do without. These are unique, differentiated offerings that are difficult to replicate—essentially, the new staples of the digitized world, such as components for smartphones and AI servers. As we see it, companies that can produce technological staples in strategic industries will increasingly be standouts. These firms should benefit from structural tailwinds, irrespective of near-term cyclical pressures.

3. Strong balance sheets: Financial strength is key to healthy businesses in good and bad times alike. Given today’s tariff-driven uncertainty, companies with healthy balance sheets are better positioned to absorb macroeconomic stress and reinvest strategically in an increasingly capital-intensive world. Clean balance sheets give firms the durability to see their strategic initiatives through volatility.

The Rewards—and Penalties—Are Often High in Technology

Firms that meet these criteria will be better positioned to earn high ROI, in our view. And we believe the market is typically willing to pay high multiples for companies with superior profitability.

But to determine winners, investors need to consider what kinds of returns firms will earn consistently over the long run—not what they’re earning today. In our view, investors shouldn’t penalize companies for strategic investments today; nor should we reward companies that are earning phantom profits because of chronic underinvestment. Understanding a company’s future pricing power is essential to this analysis.

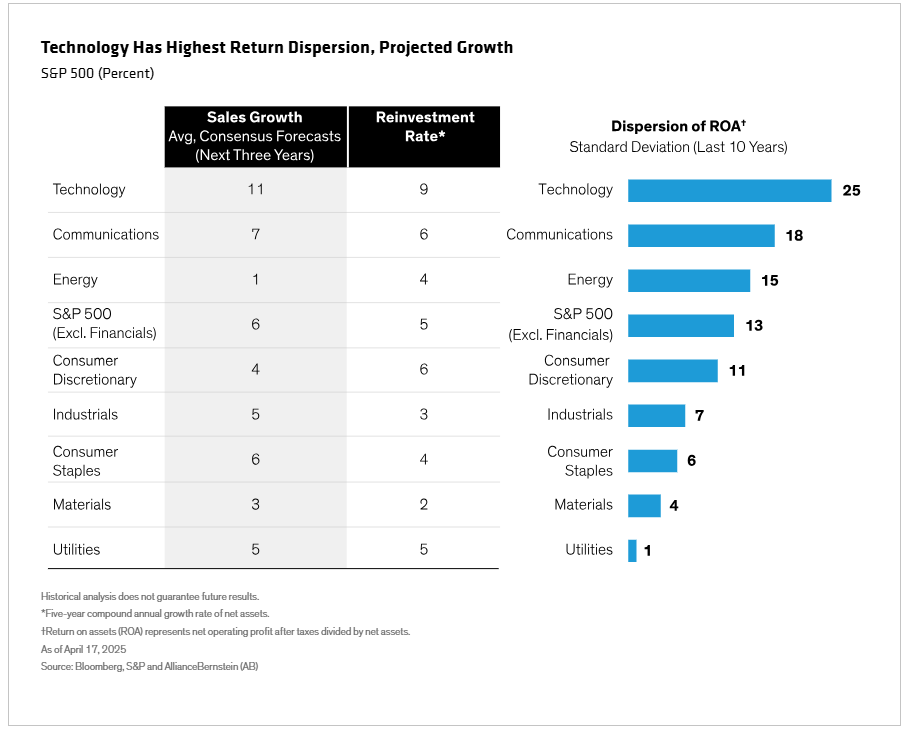

Nowhere is this more important than technology, which has the widest dispersion in returns on invested capital of any sector (Display). That’s because the rewards—for example, investing appropriately or leading a product cycle—are the largest in a sector with the highest level of innovation. Similarly, the penalties of underinvesting—such as overbuilding or missing a product cycle—are the most extreme.

In other words, nowhere is it more important to determine future pricing power than in the technology sector. This underscores the importance of relying on fundamental research and skilled active managers. After all, the faster the pace of innovation and disruption, the more important it is for companies—and investors—to get it right.

Related: The End of US Market Supremacy? What It Means for Equity Investors