Thanks in large part to exchange traded funds, the concept of hedging currency risk in equity portfolios became more accessible to a broader swath of end users.

Currency has been around for decades, but was once the territory of professional investors with intimate knowledge of the vast forex universe went mainstream in 2013. That was about the time the Federal Reserve was tapering asset purchases and the Bank of Japan was unleashing massive easy monetary policy of its own.

As a result, the WisdomTree Japan Hedged Equity Fund (DXJ) burst onto the scene (the fund is actually 15 years old), capturing $9.3 billion worth of inflows in 2013 and 2014 combined. That's impressive work of country-specific ex-US fund, particularly one that has an added layer to it.

As advisors well know, aim of currency hedging is straight forward and easy to explain to clients. In ETF form, the end result is an equity-based portfolio with a currency overlay designed to protect or even potentially deliver added upside in strong dollar environments.

Criticized, But Why?

Hedging away currency risk, particularly without having to be directly involved in the forex market would seem to be a compelling approach for advisors looking to added needed international equity diversification to client portfolios. That's even more true today when it's becoming clearer some Fed governors would like to ratchet up the rate tightening timeline, likely strengthening the dollar in the process.

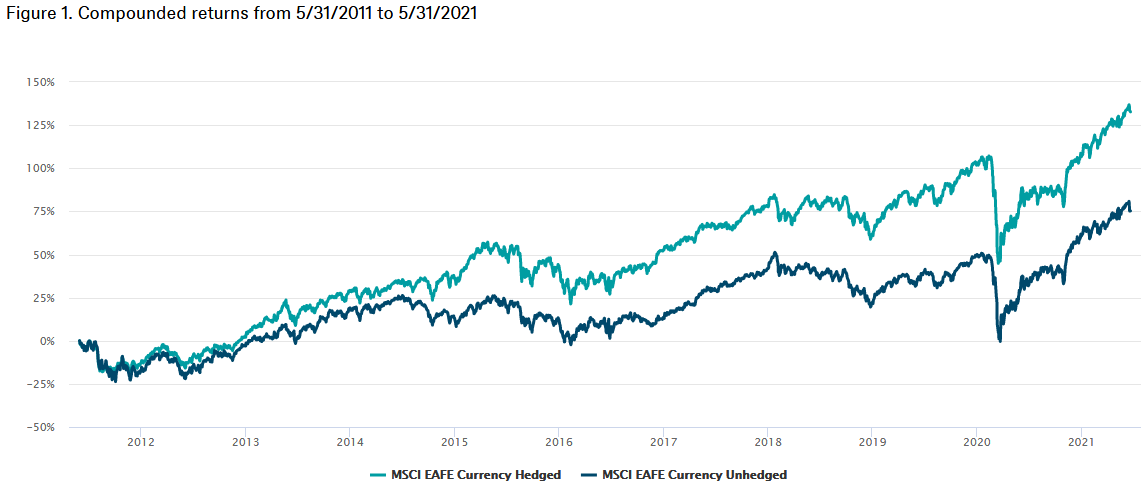

For whatever reason though, currency hedging is one of those strategies that seems to draw a chorus of boo birds. The naysayers, typically prosaic in approach, say long-term investors don't need to worry about currency fluctuations and that broad-based, low-cost, non-hedged international equity funds will do right by them over time. Thing is, that's opinion. As the comment and chart below suggest, currency hedging is actually quite potent in terms of long-term total returns.

“Looking at empirical performance, we can observe that the MSCI EAFE Currency Hedged Index has returned 133% (or about 8.45% annualized) versus MSCI EAFE Currency Unhedged Index return of 75%, or about 5.54% per annum,” writes Jason Chen of the DWS Research Institute.

Courtesy: DWS

That's one of the “a picture's worth a thousand words” type of scenarios. Making currency hedging all the more appealing, at least regarding the popular MSCI EAFE Index, is that it can also act as a volatility reducing mechanism,

“Over the same time frame, annualized volatility has been about 13.6% for MSCI EAFE Currency Hedged versus about 15.1% annualized volatility for MSCI EAFE Currency Unhedged,” adds Chen.

For the 11 years spanning May 31, 2011 through May 31, 2021, the MSCI EAFE Currency Hedged Index only had a larger maximum drawdown than its unhedged counterpart on two occasions – 2013 and 2016 – and the differences were negligible. An average of -1.05%, in fact.

Can't Ignore the Risk

Advisors know a couple of things. First, clients often come to them with portfolios that are too heavily concentrated in domestic stocks. Second, currency risk is a very real consideration and its ill effects should not be underestimated as the above data points confirm.

However, many clients aren't aware of the need for some international diversification and even fewer adequately understand currency hedging. In other words, this is a value add opportunity for advisors. Fortunately, they've got data on their side.

“The historical results of currency hedging EAFE equity exposure added tremendous benefit to investors both in terms of increased realized returns to the tune of 2.9% per annum but also acted to reduce volatility by about 1.5%,” concludes Chen. “We can establish that while the return side of the equation is somewhat more balanced, the calculus of owning an implicitly levered portfolio of equity and currency risk results in higher levels of volatility, and by extension, more severe market drawdowns, for EAFE investors who choose not to hedge their currency risk.”

Advisorpedia Related Articles:

For Value-Loving Clients, Quality Is Necessary

Prime Day Prime Time for Revisiting E-Commerce Investing

Inside Infrastructure's 'Other' Benefit

How Advisors Can Deliver Quality Positioning in Next Leg of Economic Boom