Jordan Terry | Coinstats

NFTs have done more for the mainstreaming of the crypto and blockchain industry than any other use cases such as DeFi, etc. have done. Especially since the year 2021 was termed as the year of NFTs, the interest has sky-rocketed to unprecedented levels. You can now see NFTs everywhere and are being endorsed by big companies, celebrities, etc. The two most recent examples are the Bored Ape Yacht Club NFTs being featured in the latest Eminem and Snoop Dogg song and Binance’s partnership with Cristiano Ronaldo to launch his own NFT collection. But that does not take away anything from cryptocurrency tokens and how far they have come in terms of utility and as an investment opportunity. So, in this article, you will learn everything about Fungible vs Non-Fungible Tokens: What is the difference? And also how to invest in NFT.

Fungible vs Non-Fungible Tokens

At a glance, they might sound like two very technical terms but the reality is very different. A fungible token is simply a token that can be exchanged for another token. For e.g., you can purchase ETH for your BTC, or even one BTC can be exchanged for another BTC and it would still hold the same value. So in simple words, fungible means exchangeable.

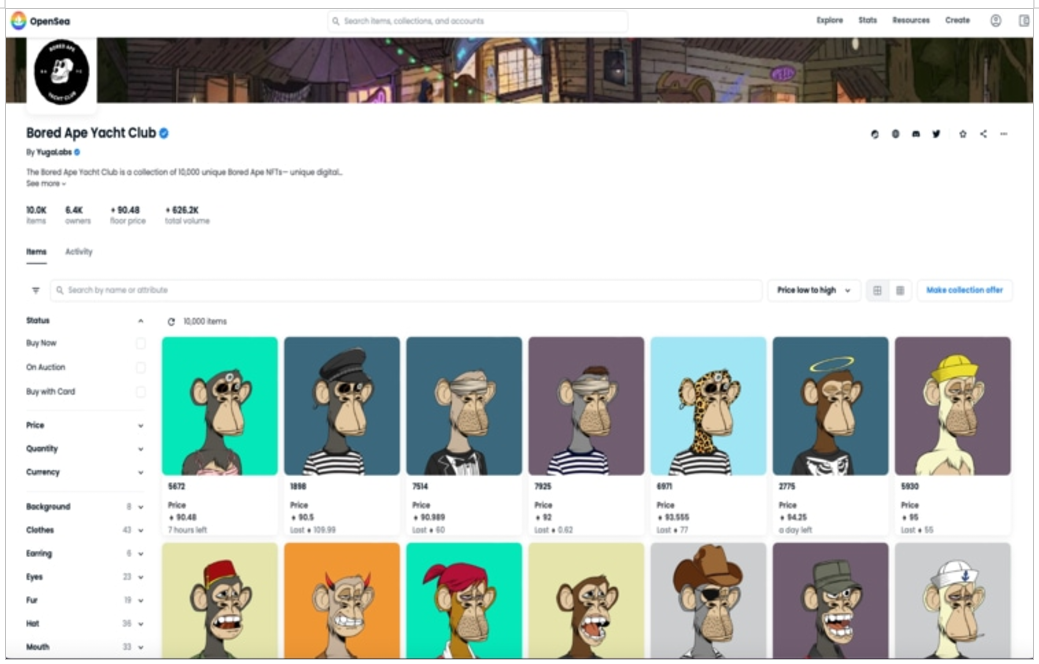

Non-Fungible Tokens on the other hand mean tokens that are unique and can’t be exchanged for one another. NFTs is a short form for Non-Fungible Tokens as each NFT has its own unique address over the blockchain and they are not similar to one another. Even NFTs from one collection such as BAYC are also different and have a different value attached to them.

Bored Ape Yacht Club on OpenSea

Moreover, a fungible token like BTC, ETH, DOGE, SHIB, etc. does not have any underlying asset attached to it. Whereas, an NFT may or may not have any underlying asset attached to it. For e.g, if a singer wishes to sell their work as an NFT, they can create an NFT for it and sell it, and that NFT would have an underlying asset. NFTs can also be associated with an identity like in the case of NFT profile pictures on Twitter. You can buy your favorite NFT and use it as a profile picture, and that would be your unique identity. But that does not mean that only you have the right to view that picture, rather anyone can see it but you hold the ownership rights over it.

While cryptocurrency tokens or fungible tokens are more like decentralized versions of fiat currencies for e.g stablecoins such as USDT, BUSD, USDC, etc. NFTs are more unique in nature and are digitized and decentralized versions of tangible or intangible assets.

Another major difference between fungible and non-fungible tokens is that a fungible token can be divided into other smaller parts, like when you buy BTC in fractions and not in its entirety as the price might be too high. Whereas, you can not divide an NFT into smaller parts and it is supposed to be traded as a whole.

Fungible tokens are a store of value as well, for e.g. the price of BTC is the value it stores. While in the case of a non-fungible token it is a store of data, i.e. it stores all the data about that NFT including its source, ownership, etc.

Now that you know the difference between a fungible and non-fungible token(NFT), let us understand the different ways how you can invest in NFT and make money.

How To Invest In NFT

There are multiple ways in which you can make profits from the NFT boom that we have witnessed so far and is only going to grow in the future. Some of the ways are:

Making NFTs

If you are an artist or even a content creator, you can create NFTs of your art, and content and sell them over at NFT marketplaces such as OpenSea, Rarible, etc.

Hire NFT Makers

You can launch your own collection of NFTs by hiring people to create an NFT collection, and promote it on social media and on various platforms. Finding people to create collections can be easy as a lot of freelancers across the world will do it for you at a cheap rate.

Flipping NFTs

It is one of the most lucrative ways to make money on NFTs. All you need to do is buy an NFT for cheap and then sell it for a higher price. A lot of newly launched NFT projects give away whitelist spots for cheap or free minting of NFTs which can then be sold at a profit.

Conclusion

The difference between fungible and non-fungible tokens is very clear and there is good money to be made from both of them if done correctly and prudently. But one should vary that investments in them are very risky as the market is very volatile and the prices can go up and down within a matter of minutes, so always invest wisely.

Related: Impact Investing Guidance for Private Foundation Clients — Part 2