Written by: Hamilton Lane

A common question we hear from LPs is how fund size and sector, as it pertains to portfolio construction, should take part in the allocation conversation. We believe that, for most investors, middle-market funds offer the best risk and return trade off, and offer a deep opportunity set.

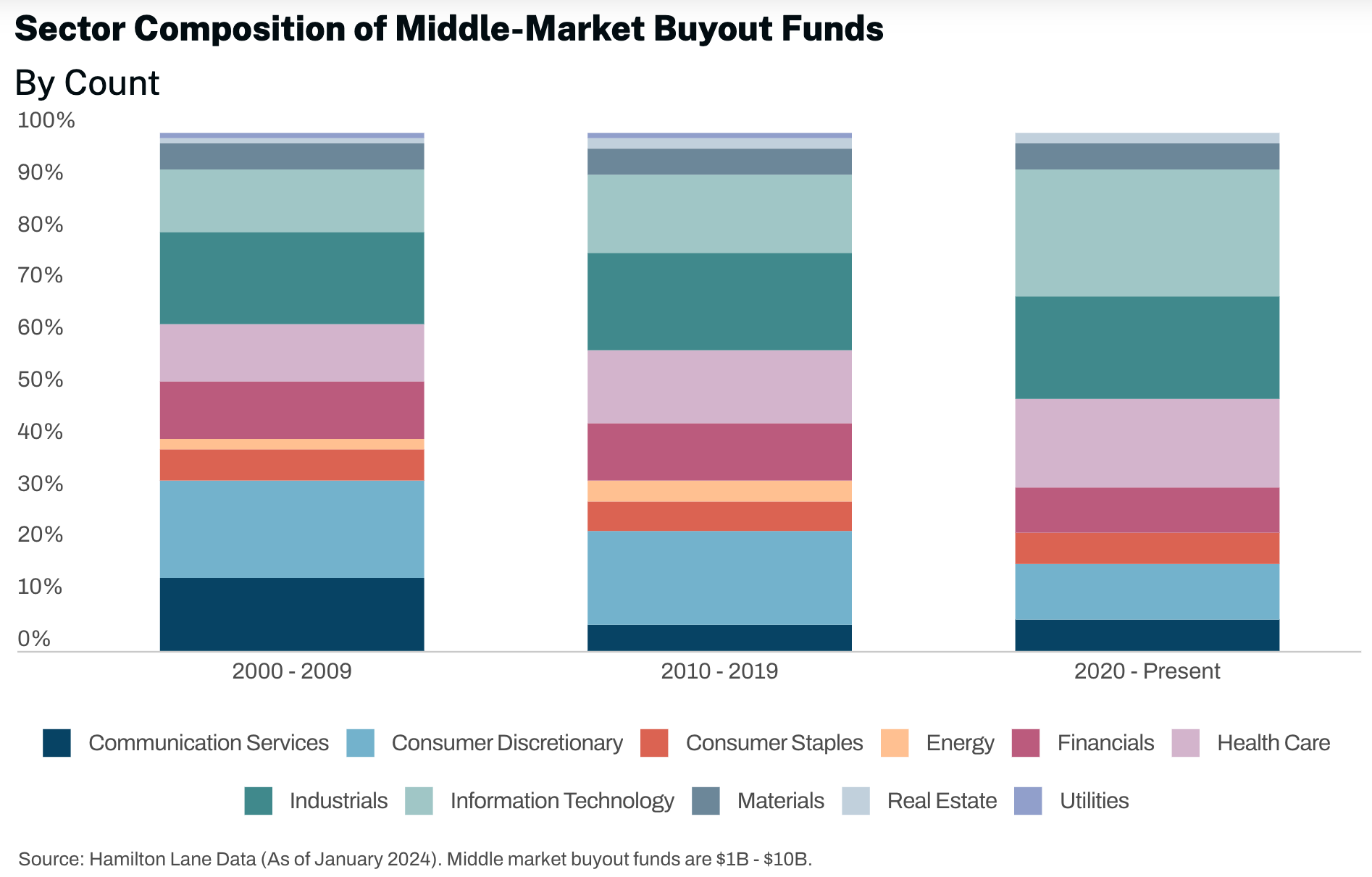

The sector allocation of these middle-market firms, in aggregate, has experienced notable shifts over time. Noteworthy trends include a discernible increase in emphasis on information technology-related sectors, coupled with a relative decline in consumer discretionary sectors. This evolution reflects the dynamic nature of market conditions and the varying returns generated by different sectors. It's evident that middle-market GPs often concentrate on just a few sectors, a strategic choice that aligns with their expertise and maximizes returns. Consequently, LPs engaging with middle-market funds should carefully consider these sector preferences when constructing their portfolios, recognizing the potential impact on overall fund performance. This nuanced approach to portfolio construction is essential for LPs seeking to navigate the evolving landscape of middle-market investments.

Related: The Zombie Fund Era

Definitions: Corporate Finance/Buyout – Any PM fund that generally takes control position by buying a company.