Written by: Samantha Russell

Client communication is easily one of the most crucial elements of a successful business. Being able to efficiently and effectively communicate with clients can be the difference between satisfied customers and scathing reviews. Customers want to understand what’s going on, and if a financial advisor can’t provide them with that information on a consistent basis, they’ll be losing them as a client. But even more than just losing clients, there are other consequences to having poor communication skills, such as bad reviews.

In this post, we’ll be going over ways to avoid making these mistakes and ensure your client communication is where it should be.

Findings to Be Aware Of

Every financial advisor has a different way of communicating with their clients. That includes frequency and tone, but before we can get started on the tips, you should be aware of a few important takeaways from our communications webinar with YCharts:

- An advisor’s success can be directly impacted by their communication strategies: Depending on how financial advisors communicate with their clients, they can be very successful, not successful at all, or somewhere in between. Additionally, the communication situation can influence whether or not clients will recommend you to friends, family, or anyone looking for a financial advisor.

- Clients have switched advisors since 2020 in search of more: Since the pandemic, customers have been wanting better communication in order to ensure their financial situation is being handled correctly.

- Less frequent contact can negatively impact clients’ confidence and comprehension: When financial advisors don’t communicate with clients, they can feel uneasy about their financial situation. Thus negatively impacting their confidence in themselves and their advisors.

Now, here are 4 tips for creating your communication strategy.

1. Commit to a Cadence

First up, it’s important to understand that people are creatures of habit. Whether that comes in the form of a daily exercise routine or the way they fold their laundry. People want to know what’s coming next, and that goes double for their financial advisor. As an advisor, it’s your job to deliver information and news on a consistent basis with a consistent tone and attitude. This is usually based on the brand voice you’ve established in the past. Using this voice to communicate with clients is a great way to keep them informed and knowledgeable while alleviating any worries they may have.

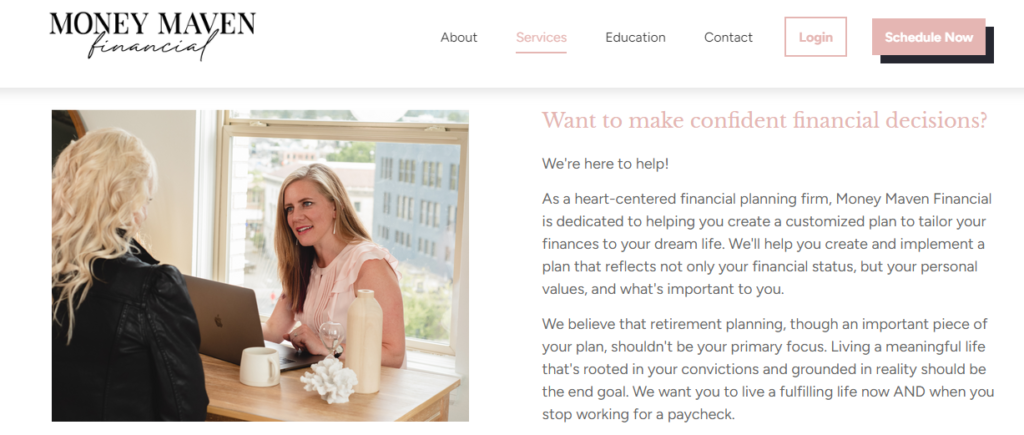

Below, you can see an example of Money Maven Financial’s cadence. Which is friendly and confident in their ability to help you. From here, they are able to transfer that same tone to their client communication and commit to their cadence.

Think of your constant client communication as talking to an old friend. They want to know that they’re communicating with someone they know and trust, which is why maintaining a consistent cadence or tone is essential. It reminds them they’re in good hands with someone they can trust.

2. Introduce New Touchpoints and Opportunities

Email is one of the most popular ways to not only market but also communicate with potential clients and current customers. Most, if not all, advisors use it to an extent, whether it’s sending out monthly newsletters or letting a customer know about any financial updates. The issue is that as customers receive more and more emails, they tend to just skim subject lines to determine whether an email is worth opening or not. That’s why it’s necessary to introduce new touchpoints, timely topics, or breaking news.

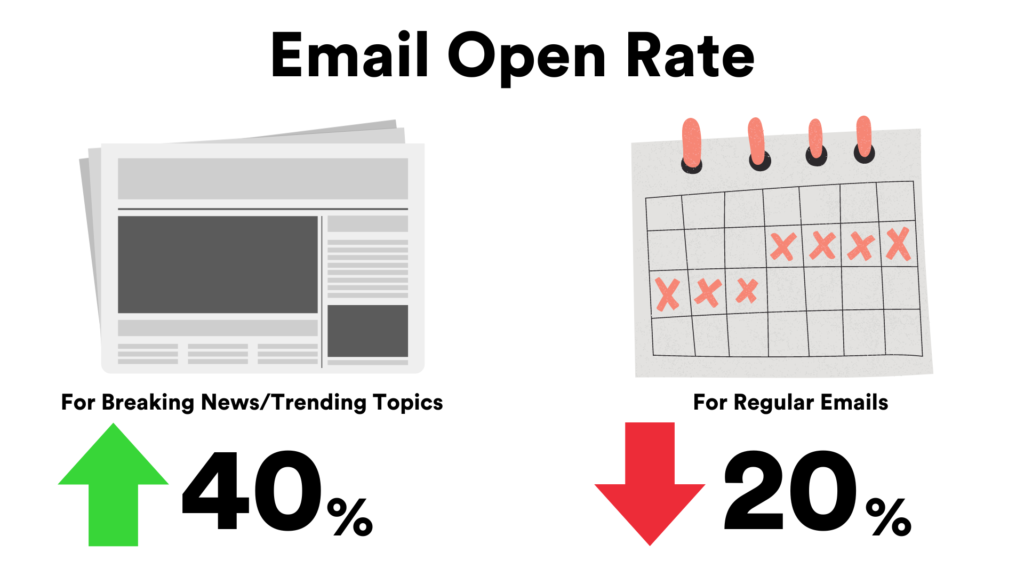

Touching on current events or breaking news that may impact them or their finances is a great way to increase email open rates. In fact, emails on timely topics tend to receive around a 40% open rate compared to the usual 20% average. Along with timely events, try introducing new opportunities that can benefit them. Maybe it’s a new program you’re offering that can increase their financial gain or a webinar that can help teach them about the best ways to save money for retirement.

While people want consistency, they also want to benefit, so communicate ways for them to do so. You’re sure to see success in client communication that has a positive impact on your customers.

3. Make Clients Feel Special

All customers want to feel like they matter to financial advisors regardless of how big an advisory is. They, of course, want to be treated well and be in the know when it comes to what’s going on with their finances. Unfortunately, you can’t give clients the “champagne” treatment all the time, so you have to find ways to special messages into your regular communication.

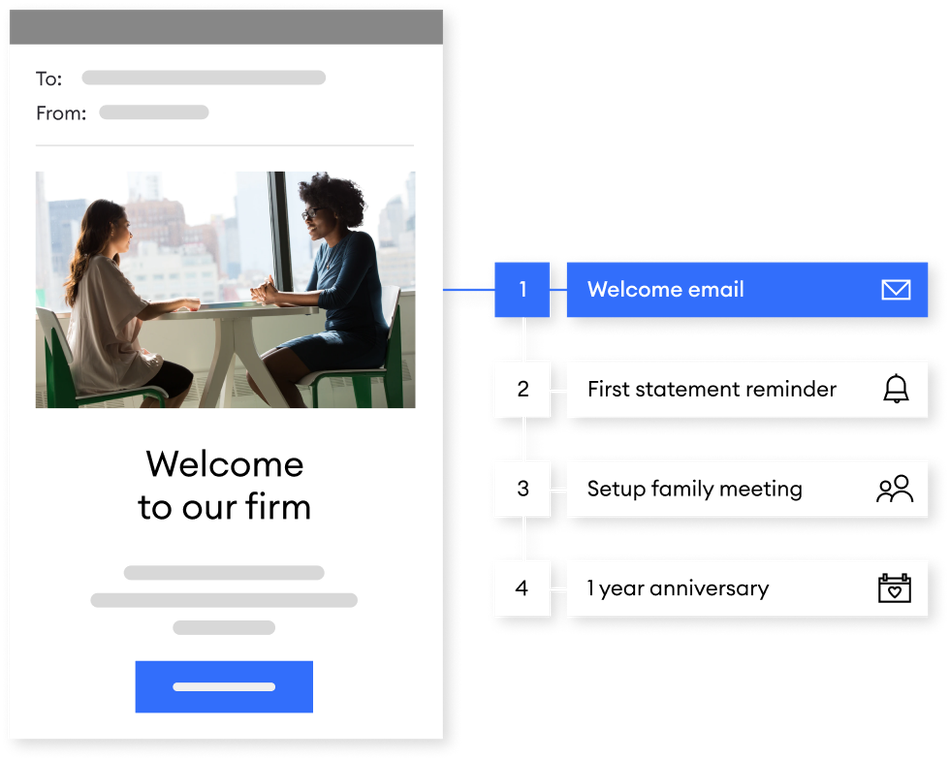

For example, try sending personalized check-ins every couple of months to see how your client is doing. A simple check-in or a personalized email can really help client retention. FMG’s email marketing tool makes it easy to accomplish this, giving you access to automated sequences – like our New Client Welcome Series – to reach out to clients with personalized messages at specified times.

4. Prioritize Your Clients Goals

Every client is going to have different goals. As an advisor, you’re well accustomed to that. Understanding your client’s goals, however, goes beyond their financial plan. The knowledge you have should also be used to inform your communication strategy by speaking directly to your client’s unique circumstance. Doing so not only demonstrates your expertise but reinforces your understanding of their long-term financial goals.