Larger Tax Deductions and Accelerated Retirement Savings

A Primer on Profit-Sharing and Cash Balance Plans

Many business owners and partners of firms are looking for larger tax deductions and accelerated retirement savings. Profit-Sharing and/or Cash Balance plans may be the perfect solution for them.

What is a Cash Balance plan?

A Cash Balance plan is a type of IRS-qualified retirement plan known as a “hybrid” plan. In a Cash Balance plan, each participant has an account that grows annually in two ways: first, an employer contribution and second, an interest credit, which is guaranteed rather than dependent on the plan’s investment performance.

How much can be contributed for me in a Profit-Sharing or Cash Balance plan?

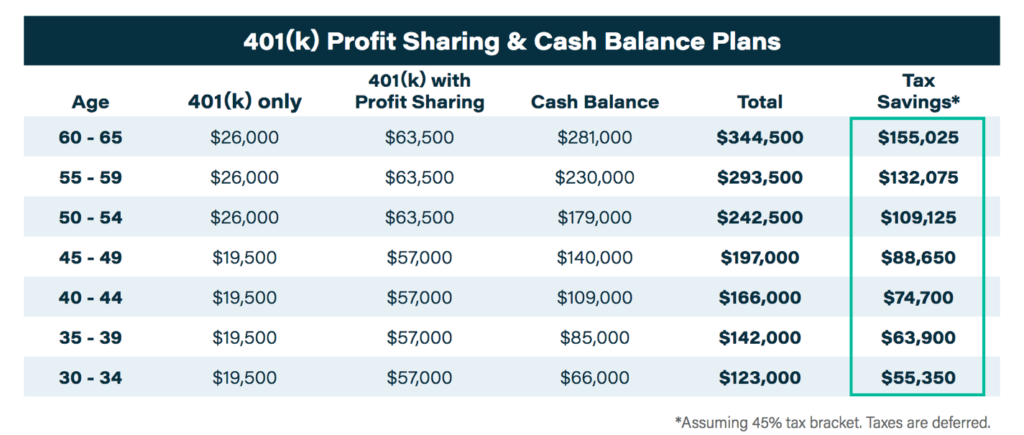

The employer contribution is determined by a formula specified in the plan document. It can be a percentage of pay or a flat dollar amount, age-weighted or a new comparability. Below are the limits for 2020:

Who might benefit from a Profit-Sharing and/or Cash Balance Plans?

1. Principals seeking a tax deduction of more than $50,000 or making more than $250,000 per year

2. Highly profitable companies of all types and sizes

3. Successful family businesses and closely held businesses

4. CPA and law firms, medical groups and professional firms

5. Older owners who need to squeeze 20 years of retirement saving into 10

How does a Cash Balance plan work?

The annual interest credit is guaranteed and is not dependent on the plan’s investment performance. The interest credit for smaller plans is usually a fixed rate of return of 4% and for some larger plans, an actual rate of return (ARR) may be appropriate. When participants terminate employment, they are eligible to receive the vested portion of their account balance.

How are plan investments handled?

Plan assets are pooled and invested by the trustee or investment manager. If the plan’s investment earnings exceed the guaranteed rate, the excess will be used to reduce future employer contributions. This will not affect the amount that is credited to the participants’ accounts. Conversely if the plan’s investment earnings are less than the guaranteed rate, then future employer contributions will be increased. This make-up is typically spread out over seven years. A wide range of investment vehicles can be used by the plan sponsor to achieve the interest crediting rate.

Can Cash Balance plans be offered in addition to 401(k) Profit Sharing plans or other plans?

Yes, the employer can offer a combination of qualified retirement plans in order to produce a larger contribution. In fact, in most cases, a 401(k) Profit Sharing plan in conjunction with a Cash Balance plan is necessary to produce the desired owner and employee contributions. What are the distribution options upon retirement or if leaving the employer? Any vested account in a Cash Balance plan can be paid as a lump-sum distribution or annuity. A lump sum distribution can be rolled over to an IRA or another qualified retirement plan.

Can Cash Balance contributions change?

Yes, but with restrictions. Cash Balance plans can be amended periodically to permit different contribution levels. Usually, any reductions must be made before any employee works 1,000 hours during a plan year. In addition, a plan can also be frozen or terminated. Certain 15- to 45-day notices are required to participants when benefits are reduced. Must everyone participate equally in the Cash Balance plan? No. Each participant can have a different amount contributed for them. What about tax deductions and allocation of plan contributions for partnerships? Tax deductions for contributions made on behalf of non-partner employees are taken on the partnership tax return. Tax deductions for contributions made on behalf of partners are taken on their personal or corporate tax returns. (However, to be sure that the amount deducted for tax purposes by a partner as shown on Schedule K-1 is the same as the amount contributed on behalf of the partner, the partnership’s agreement must permit this method of allocation. Most partnerships that adopt Cash Balance plans do not want the partners’ contributions allocated like most other firm expenses, in proportion to ownership.) Either the partnership agreement or internal policy should assure that each partner is allocated an appropriate share of the plan’s cost.

Is the plan subject to IRS nondiscrimination testing?

Yes, like any other qualified plan, a Cash Balance plan is subject to nondiscrimination testing. Employers can anticipate contributions in the range of 5% to 7.5% of pay for staff if the owners or partners receive the maximum Cash Balance contribution. The exact percentage required for employees depends on the number of employees included in the plan and the results of nondiscrimination testing.

How does the cost to set up and maintain a Cash Balance plan compare with the cost of a 401(k) Profit Sharing plan?

Although it may appear that Cash Balance plans are more expensive to set up and maintain than 401(k) Profit Sharing plans, Cash Balance plans are typically more cost-effective. Because of the legal contribution limits imposed on 401(k) Profit Sharing plans combined with fees to cover the high cost of plan administration, 401(k) plans are a more costly way to deliver retirement savings. Cash Balance plans ultimately help employers and participants save more with significantly higher tax-deferred contribution limits and major tax deductions.

How do I get additional information about Profit-Sharing and Cash Balance plans?

Call (630) 799-8350 or us at info@crosspointwealth.com