Written by: Nate Tonsager

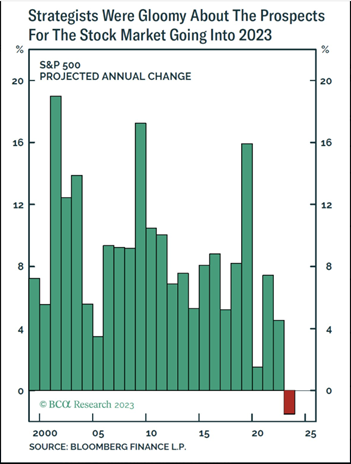

For the first time in a very long time, strategists were predicting a negative year for the S&P 500 in 2023. Just look at this chart showing their predictions over the past 20ish years.

Well… that’s not what happened. Instead, we enter December with the S&P 500 up +20.28% (as of 11/27).

So why should you care that these “experts” got it wrong? Because the investors who reacted to their forecasts and tweaked their portfolio to reduce equity, or worse, completely sold out of their equity positions in January missed out on what’s turned into a strong year for market performance.

I’m sure the analysts behind these predictions are intelligent, but no one has a magic crystal ball.

At Monument Wealth, we believe you should never make investment allocation decisions based on the short-term, or one-year, forecasts put out by the big, hotshot Wall Street firms – it’s illogical.

In all fairness, while the analysts missed it this time around, they have occasionally been right in the past. And chances are they’ll get it right again at some point in the future but there’s no way to know when. I don’t want to be predicting when their predictions will hit.

In fact, there is never a reason to even really try. Ok, well, except maybe if it’s just for fun or a Jimmy John’s sandwich. Listen to our Q1 2023 market recap here with our thoughts from earlier this year.

While we have fun making predictions on our quarterly market recap podcasts, we never let our feelings, or anyone else’s, dictate our portfolio decisions.

In my opinion, financial market predictions are an impossible task, and even if you are right, it’s probably more due to random luck than true skill. They say it’s better to be lucky than good, but what’s more important is to know when you’ve gotten lucky.

Being “lucky” isn’t a cornerstone for a solid plan. It doesn’t involve a repeatable process and if you don’t realize your own luck, you may walk right back into the same scenario you’ve experienced before, but get a drastically different, and possibly worse, outcome. Remember, your investment allocation should always be determined by your unique financial plan, situation & goals.

Here’s a good rule of thumb: Read predictions for fun and to gain a little perspective from smart minds, but don’t base decisions on them. No one has facts about the future. If you haven’t had any major changes in your financial life, you likely don’t need to make any significant changes to your allocation – even in volatile markets.

It’s completely normal for investors to feel uncomfortable at times, so don’t hesitate to reach out to us at Monument if you’re feeling this way. If you don’t feel like you are getting good advice, come get it from us.