Written by: David Lebovitz

The start of this month saw the release of our 2023 Long-Term Capital Market Assumptions, where we forecast economic growth, inflation, and asset returns over a 10–15-year horizon. The current report stands in stark contrast to prior years, which were characterized by a relatively muted outlook for returns from both stocks and bonds. In fact, the combination of higher yields and lower valuations – both of which have materialized in the wake of extreme shifts in the macro landscape this year – now suggest that markets offer the best potential long-term returns in more than a decade.

In crafting these assumptions, we start with the outlook for economic growth and inflation. Despite the volatile macro backdrop of the past few years, the growth and inflation assumptions have remained relatively stable. We continue to see capital deepening and productivity as the main drivers of trend growth, while the labor contribution is expected to be more modest, or in some cases, act as a drag. Meanwhile, the inflation risks appear more balanced, and as a result the forecasts – as well as our expectation for the volatility of inflation – have moved higher. However, inflation expectations remain relatively well-anchored, and we expect that central banks will focus on and have the tools to successfully hit their long-term inflation targets. Furthermore, long-term deflationary forces like technology adoption and globalization have slowed, but not disappeared.

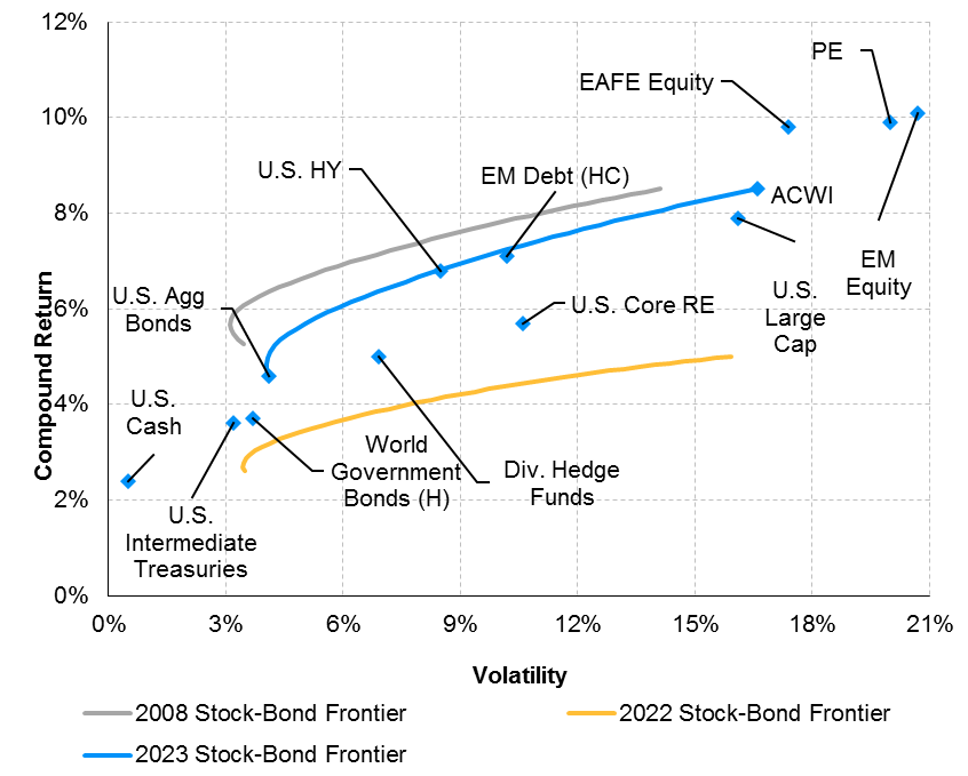

While the macroeconomic backdrop has exhibited stability, expectations for asset returns have markedly improved. The swift normalization of interest rates this year left bonds once again as a plausible source of income and diversification. Higher risk-free rates have also translated to improved credit return forecasts, with spread assumptions remaining relatively stable. On the equity side, current valuations present an attractive entry point, with public equity returns notably higher across the board. Meanwhile, alternatives still offer alpha, inflation protection, and diversification benefits, but manager selection will be key. Finally, with the U.S. dollar more overvalued than at any time since the 1980s, FX translation will be a significant component of forecast returns.

The turmoil of 2022 has brought asset return forecasts close to long-term equilibrium; the 60/40 can once again form the bedrock for portfolios, with alternatives acting as a key complement. Once today’s market turbulence clears, investors will have more scope to achieve long-term portfolio return objectives. Furthermore, many secular themes affecting our outlook will demand higher capex, just as the decade of free money seems to be coming to an end. As financial markets are called upon to efficiently allocate scarce capital, it seems reasonable to expect the outlook for active management has improved as well.

Stock-bond frontiers: 2023 vs. 2022 and 2008 (USD)

Source: J.P. Morgan Asset Management; estimates as of September 2021 and September 2022 *EM = Emerging Markets; DM = Developed Markets

Related: How Can Millennials Ride Out the Current Market Storm?