Written by: Jack Manley

2022 has been a year of remarkable volatility across asset classes. Stocks, bonds and cryptocurrencies have been rocked by a confluence of challenges that could be described as a “perfect storm.” This volatility stems from a number of factors: COVID-19 and its impact on growth in Asia; the war in Ukraine and its impact on global commodity prices; severe economic slowdown thanks in part to a massive fiscal drag; midterm elections, which lead to uncertainty surrounding future policy; multi-decade high inflation; and steadily rising interest rates as global central banks shift policy from accommodative to restrictive.

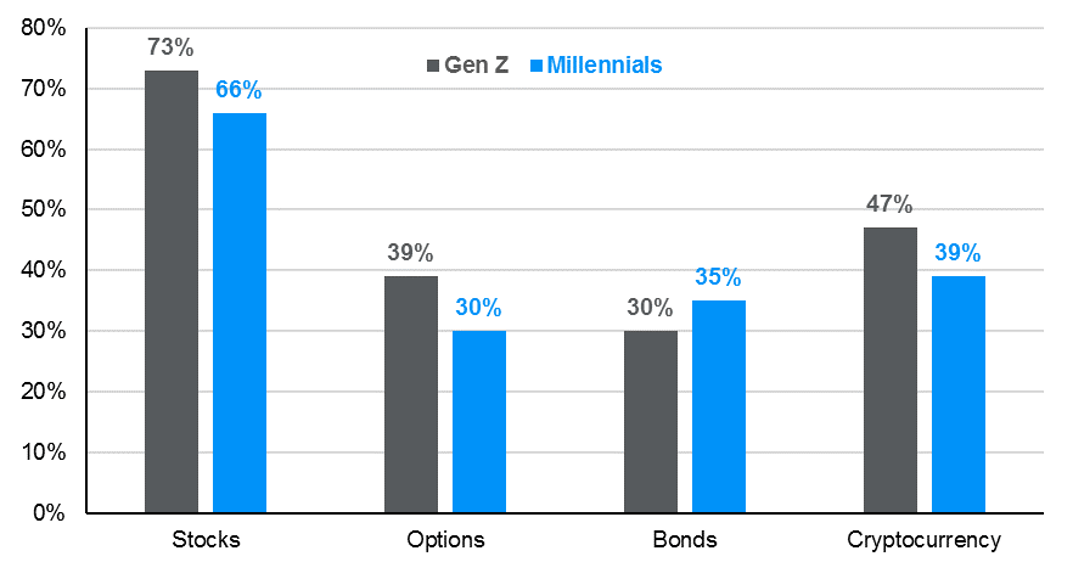

Asset price volatility impacts all investors regardless of age or income levels. Still, younger investors - namely Millennials and Gen Zers - may struggle more than most. Some of this can be attributed to their relative inexperience in markets, as many had not invested through a bear market; some can be attributed to the lack of guardrails in modern investing, with online brokerage platforms allowing for low- or no-cost access to markets without corresponding advice; and some can be attributed to the composition of younger investors’ portfolios, which heavily favor single securities (like stocks and cryptocurrencies) and options.

Given these circumstances, many younger investors may be wondering how to make sense of current conditions. Broadly speaking, there are three simple steps to better weather volatility:

- Diversify portfolios away from heavily concentrated positions in risky assets. The benefits of the “democratization” of investing in recent years are myriad and it would be imprudent to recommend that young investors liquidate volatile but long-term assets like cryptocurrency. However, it is worth building a well-diversified portfolio around these riskier holdings to mitigate volatility while still embracing risk, which is necessary for young investors given their long-term time horizon, relatively low liquidity needs and poor short-term market prospects.

- Dollar-cost average into markets to avoid market timing pitfalls. Ideally, most young investors are already dollar-cost averaging through regular contributions to 401(k)s. Moreover, these 401(k)s can be “enhanced” by increasing contribution amounts or shifting, if appropriate, into a post-tax “Roth” vehicle. If an investor has reached their contribution limit, investments into non-qualified accounts can be made in the same manner.

- Recognize that heightened volatility is structural in modern markets. Markets, and information more broadly, move faster today than ever. Given the rise of algorithmic trading, high-frequency trading and a more empowered retail investor, this trend will likely accelerate. For this reason, young investors should recognize that future markets will continue to be volatile and become comfortable with this volatility.

All told, younger investors may find today’s volatile market environment uniquely challenging. However, it is possible to manage through these challenges and emerge on the other side with better financial health.

Asset ownership by age group

Investments by asset type, for investors

Source: Motley Fool, J.P. Morgan Asset Management.

Data are as of September 30, 2022.