Were you kicking yourself back in March? “I should have known…I should have seen this coming and sold some stuff in February to raise cash for [insert need].”

You may want to think hard about that feeling because the market is going to sell off – I can just feel it. Can’t you?

In fact, I can ASSURE you that a market sell-off is coming…I’m even confident enough to give it a 100% probability…that’s pretty cocky forecasting, huh?

Oh, come on, admit it…you knew where I was taking this. Of course, the market will sell off…you’ll just never know when until after it happens.

Just like the fact that a rally is going to happen (and DID happen), but with the same problem… you’ll never know when until afterward.

My opinion on forecasting is well documented. (For example, see “Don’t be an investi-guesser” and “Uncertainty, forecasting and The Real Housewives—what they have in common.”)

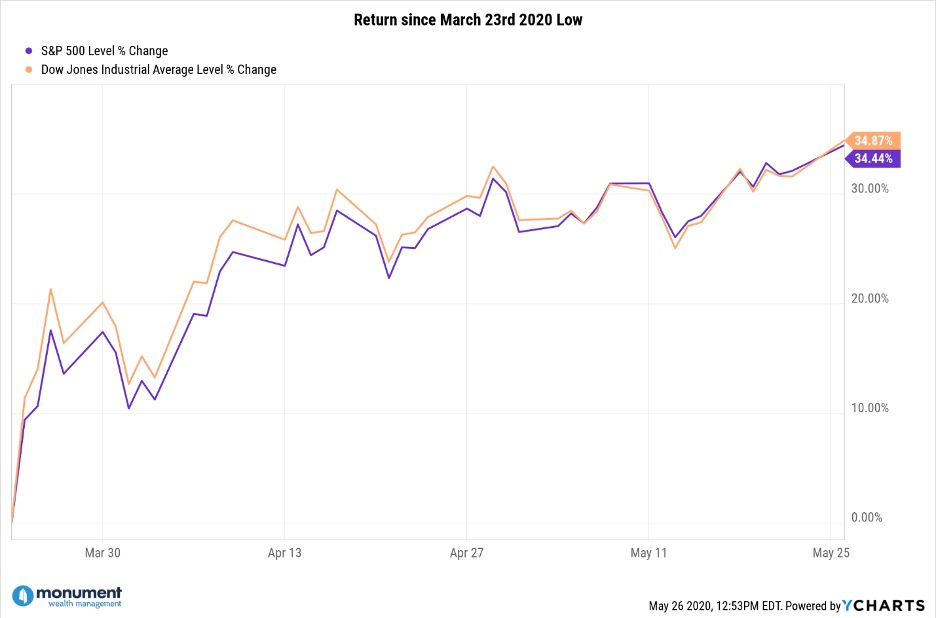

No one was predicting we’d have recovered this much off the March 23rd low. Since then, the S&P 500 and the Dow have both recovered a smidge over 34%.

Truckloads are increasing, air travel and hotel bookings are up a little bit, but still – they’re up. It’s hard to believe, but mortgage applications are growing, and people are applying to open new businesses.

So maybe now is the perfect time to do what you wish you had done earlier this year: Raise some cash.

Say what?

What about these early signs that the U.S. economy is slowly coming out of its quarantined funk? The trucking, the business applications, the mortgage applications…we are finally seeing good news, improving conditions, and some conditions simply not getting worse, AND YOU ARE SAYING RAISE CASH?

Yeah–I am. If you need it…or don’t have it…or were one of those investors kicking themselves back in March, do it. Now.

Investing is rarely just about making more money. It’s usually more of a balance between protecting capital, planning for cash needs, AND making more money.

So yeah, if you didn’t have cash earlier this year and wish you did, you have caught a nice tailwind to fix that.

Is now the perfect time? No one knows. But is now a GOOD TIME?

Because a market sell-off IS COMING–you just don’t know when. Make sure you understand there is a difference between identifying a market top (or bottom) and identifying an OPPORTUNITY. It’s also not about the “right” time or the “wrong” time. No one can know if now is the right time to fix any deficit in cash holdings but it’s a great opportunity to not be wrong.

If you’re reading this and you’re not already a client, you may be spending time validating your current advisor or evaluating your options. Monument’s value proposition is that our creative, self-assured, and fun culture combined with our unfiltered opinions and straightforward advice offers an entirely unique alternative for individuals looking to solve their wealth management problems.

Let us know if we can help.

Keep looking forward.

This first appeared on Monument Wealth Mangement.