Institutional investors are increasingly allocating to alternative assets in pursuit of yield, diversification, and downside protection. Private credit has gained significant traction due to its stable cash flows, non-correlated returns, and customized structuring.

However, a lesser-known asset class, life settlements, shares many of the same characteristics and benefits with private credit, making it highly analogous in terms of investment behavior and strategic role in a portfolio.

Similarities Between Life Settlements and Private Credit

1. Cash Flow-Oriented / Income-Producing

- Private Credit: Lenders receive interest and principal payments over time from borrowers.

- Life Settlements: Owners receive income from death benefits collected over time from underlying life insurance policies.

Both assets are underwritten and priced to deliver consistent and predictable return profiles.

2. Non-Correlation with Traditional Markets

- Private Credit: Generally shows low correlation to equity and public bond markets.

- Life Settlements: Exhibit even lower correlation; outcomes are tied to life expectancy and policy mechanics, rather than economic cycles or corporate earnings.

During market volatility or economic downturns, life settlements tend to preserve value and maintain performance.

3. Idiosyncratic Risk and Diversification

- Private Credit: Exposes investors to borrower-specific credit risk; each loan has unique structuring and covenants.

- Life Settlements: Exposes investors to longevity risk (how long the insured lives), which is statistically predictable in diversified pools.

Both offer diversification benefits by introducing different types of risk: credit vs. longevity. Of these two risks, life settlements are not as closely tied to macroeconomic conditions.

4. Illiquidity Premium

- Private Credit: Investments are locked up for 5–10 years; investors are compensated for giving up liquidity.

- Life Settlements: Similar time horizon (5–10 years, depending on the pool), with potential liquidity through sales or structured exits.

Investors in both are rewarded for longer investment horizons.

5. Proper Underwriting and Management Are Critical

- Private Credit: Success hinges on underwriting borrower risk and structuring the deal.

- Life Settlements: Success relies on accurately assessing life expectancy, policy selection, and premium optimization.

Both asset classes are less commoditized and more dependent on skilled managers to extract value and manage downside risks.

6. Attractive Absolute Returns

- Private Credit: Target net returns of 7–12%, depending on seniority and risk level.

- Life Settlements: Target net IRRs of 8–14% depending on pool structure, eligibility criteria, and portfolio guidelines.

Return expectations are highly competitive, and both exceed core fixed income returns.

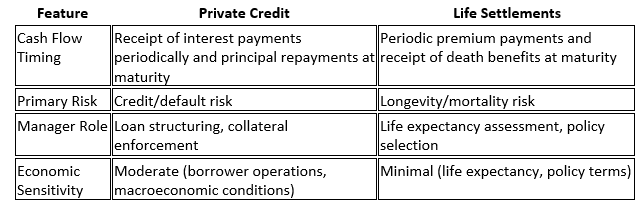

Key Differences and Why They’re Still Strategically Equivalent

Despite structural differences, the roles they play in an investor’s portfolio are similar.

Portfolio Role for Institutional Investors

Both asset classes are viewed as income-oriented alternatives to traditional fixed income. In a 60/40 or endowment-style portfolio, they offer:

- Yield enhancement without excessive credit or duration risk

- Diversification from equities and traditional bonds

- Downside protection in volatile markets

- Capital preservation with income distributions

Conclusion

Institutional allocators often turn to private credit for higher yields, customized structures, and downside protection. However, life settlements check all the same boxes and can offer superior return characteristics, especially when longevity risk is pooled and managed effectively.

Life settlements are best positioned as an adjacent or complementary allocation to private credit. They serve a similar function in portfolio construction, with different underlying mechanics but equally compelling outcomes.

Related: The Power of Radical Honesty: How Self and Situation Analysis Can Expand Your Practice