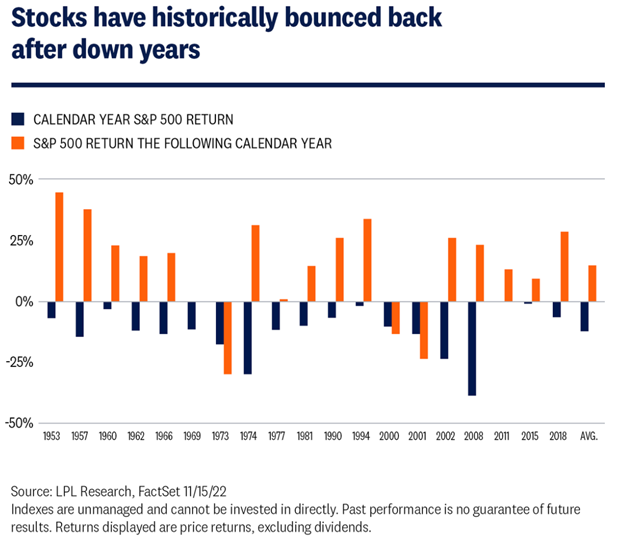

After a bad year, the S&P 500 rebounds 83% of the time by an average of 15%.

Why it Matters:

If you had those odds in Vegas, you’d never leave the table.

While some years are down, over time, the stock market is undefeated. Read that again.

People are booking losses in the window of time that the market is trading down due to emotional panic-selling or poor cash need planning.

To avoid those, do these two things instead:

- Have a plan that makes you financially unbreakable by establishing a cash reserve that sits until you need it to fund your lifestyle in exchange for selling when the market is down, and:

- Be aware of the statistics when they are in your favor.

Going Deeper: Some Stats to Be Aware Of

Here’s an important statistic that goes back to 1950:

After a down year, the S&P 500 rebounds with a positive return 15 out of 18 subsequent years with an average return of 15%.

15 out of 18 years of positive subsequent year returns is equal to 83.3%.

Want another one?

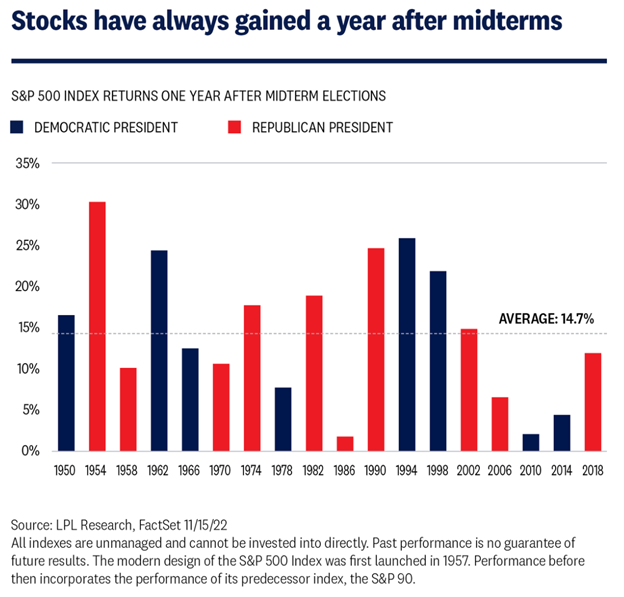

Since 1950, the third year of a presidential cycle (the year after mid-terms) is historically strong and has a track record of being positive 100% of the time. The average return of those 18 years is 14.7%. Of course, that’s no guarantee of anything – especially since the fiscal stimulus is essentially over. But still, you play the odds.

More Odds in Your Favor:

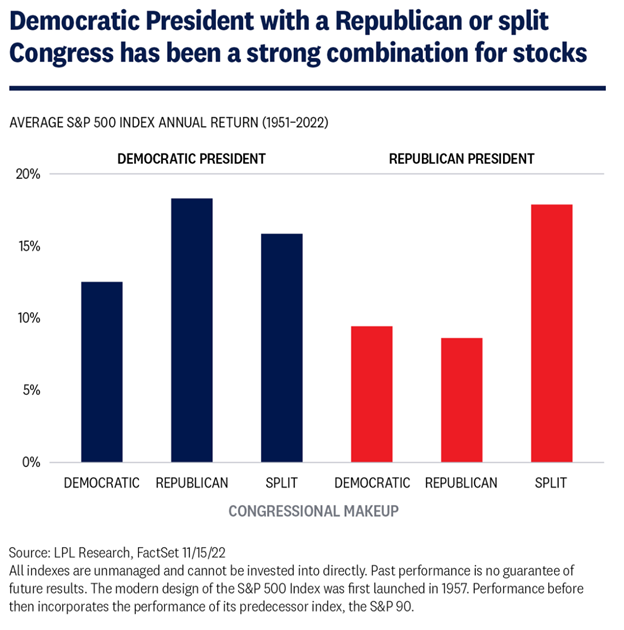

Again since 1950, the average return for the S&P 500 in years with a Democratic President, coupled with a Republican or split congress, is 17.5%. Given that the annual rate of return on the S&P 500 hovers around 10%, these are more good odds in your favor.

Update From Me (Trying to Compete with TikTok Scrollers)

I’ve decided to work on a new writing style for the blog. I’m going with a short title, a one sentence “eye-grabber”, a “why it matters” and then, a “going deeper” section for those who make it take far and want the guts of things. People have become scanners, so I’m trying a new less is more format to compete with TikTok scrollers.

Let me know if you like or dislike it.

Also, thanks to LPL Financial for the graphs and stats below – miss you all.

Related: Will Legislation Changes in the New Year Impact Your Approach To Saving and Investing?