This year’s Global Industry Classification Standards (GICS) changes will include several reclassifications which will have a large impact on the weighting of several different broad sectors along with investment strategies.

Why the 2023 GICS Changes Matter

While there are several small changes taking place, there are some key reclassifications that will materially impact the broad sector weightings and possibly investors’ investment strategies.

Here are the material changes:

- Both Visa (V) and MasterCard (MA) will be moved out of the Technology sector and into the Financial sector.

- ADP (ADP) will also be moved out of Technology and into the Industrial sector.

- Target (TGT) will be moved out of the Consumer Cyclical sector, and into the Consumer Staples sector.

These reclassifications are material because each of those four companies sit in the top ten of their current sectors by market cap.

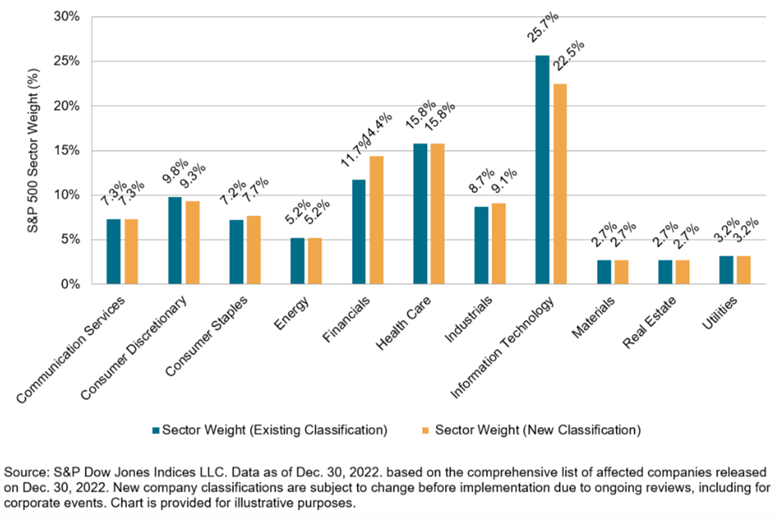

With the Financial sector picking up both Visa and MasterCard, it becomes the biggest gainer of all 11 sectors and will establish itself in 3rd place behind Information Technology (#1) and Health Care (#2).

Information Technology will still maintain its position as the largest sector, but it is losing over 3% of its total weighting within the total S&P 500 – the most of any other sector in the reclassification.

With ADP moving into the Industrial sector, it will bring that sector S&P 500 weighting up to 9.1%, which is just slightly lower than the Consumer Discretionary sector which lost Target to the Consumer Staples sector. All other sectors remain unchanged. The graph below shows the difference between the existing classification (blue) and the new upcoming classification (yellow).

If you maintain an investment strategy that focuses on ETF sector selection, this change is something to stay aware of.

If you’re a MONUMENT CLIENT IN THE MWM ETF STRATEGY, see more below.

Going Deeper on the GICS Rankings

The GICS rankings attempt to provide a framework for companies to be broadly classified and grouped together for research and strategy purposes. What it is really trying to do is to take into account how the market perceives these companies to provide both comprehensive and transparent groupings.

If you think about GICS as a hierarchy, the segmentations look something like this (from biggest to smallest):

- 11 Sectors

- 24 Industry Groups

- 69 Industries

- 158 Sub Industries.

Today I am just sticking with the 11 large sectors for this discussion. As a reminder, those eleven are:

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Healthcare

- Financials

- Information Technology

- Communication Services

- Utilities

- Real Estate

The groupings are reviewed annually with the intent of making sure general market segments reflect reality as companies shift strategy and products. While small updates happen annually, there are certain years where there are dramatic impacts on how the sectors are constructed and classified.

For example, one of the more impactful changes took place in 2018, which included shifting several companies out of the Information Technology space and the Consumer Discretionary space and into a brand-new Communications sector. That change saw some of the big giant tech names such as Facebook, Google, and Netflix consolidated into this new sector.

Another change took place in 2016 when the Real Estate sector was introduced as its own standalone sector.

The Bottom Line

Every few years we see material changes that reclassify how markets and sectors are defined. This upcoming reclassification is one of those material changes. Since these four sectors are being reorganized, it’s particularly important to be aware of any existing investments you have in sector ETF funds and ensure that they are still in a proper weight given your portfolio strategy.

The Monument Wealth Management Asset Management Team will be taking a look at sector exposure in our MWM ETF Portfolio and making some changes this quarter. Please call us if you have any concerns about upcoming changes in your ETF portfolio and how it may impact your tax picture.

Our ETF portfolio is coming up on its 20-year anniversary and is one of our longest-standing strategies. Changes to this strategy invariably involve capturing long-term capital gains. And while we are always trying to be tax-sensitive, we believe that it is more important to manage the portfolio for future growth than it is for tax avoidance.

Related: Why February Is a Weak Month for Investment Returns