Written by: Jordan Jackson

Bond investors may still be picking up the pieces after last year; however, a closer look would suggest today’s bond market looks a lot different than a decade ago. For much of the previous expansion, fixed income was poisoned by slow growth, low inflation, and ultra-accommodative central bank policy which kept yields low. As a result, investors received very little income and insurance from their fixed income holdings and looked to other alternatives to meet their income and return goals. Today, for investors seeking both income and insurance, bonds can be an antidote.

Aggressive central bank tightening to ward off inflation has pushed yields higher across the yield curve. The Federal Reserve’s (Fed) intention to lift policy rates into restrictive territory to constrain growth and bring down inflation has deeply inverted the curve, pushing yields on short term instruments up to 1-year in maturity above the yield on the Bloomberg U.S. Aggregate Index, the benchmark for the core US bond market. Investors can generate attractive income in short-term fixed income.

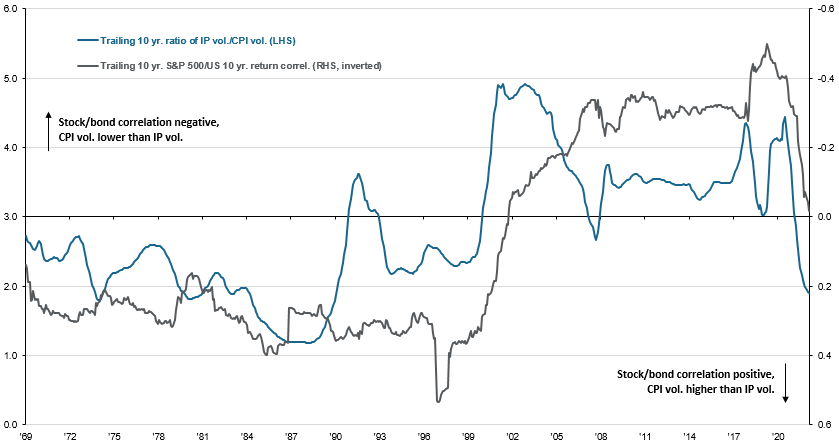

For long-term investors there should be a bias to overweight duration particularly if equity-bond correlations turn negative again. Over the last two decades, equities and bonds have traded with a consistently negative correlation given the expectation that inflation would remain low, suggesting changes in nominal yields are more sensitive to shifts in real growth dynamics than inflation developments. Conversely, in prior decades when inflation uncertainty was elevated due to volatile oil/energy prices and higher wage inflation, the correlation between equities and bonds was positive. If inflation uncertainty begins to recede in the coming months as the Fed focuses on getting inflation well under control and investors focus returns to growth, it is likely that the equity-bond correlation will once again turn negative. With significantly higher yields relative to the past decade, the takeaway for investors is if inflation continues to moderate, high quality duration may once again act as a buffer during periods of equity sell-offs.

To some extent, this may be a small window of opportunity. By the second half of the year, growth is likely to slow as the cumulative effects of higher rates are felt and inflation moderates as food and shelter consumer price index (CPI) soften. Moreover, even if the Fed remains restrictive through year-end, it seems reasonable to expect its next course of action would be to cut rates. All this suggests yields could come down across the curve removing some income in short-term bonds and insurance from owning duration. Given this, owning some cash may be appropriate given the attractive income, and increasing exposure to high quality longer-dated bonds to add buffer to portfolios seem like a good investment strategy.

Stock-bond correlation has trended positive as inflation volatility has spiked relative to growth uncertainty

Ratio of trailing 10 yr. standard deviation of y/y change in industrial production to trailing 10 yr. standard deviation of y/y change in headline CPI, 10 yr. correlation between S&P 500 and US 10 yr. Treasury total return

Source: Federal Reserve Board, Standard & Poors, Bureau of Labor Statistics, Haver Analytics. Industrial Production volatility is the standard deviation of the 12-month change in Industrial Production. Consumer Price Index is the 12-month change in the CPI for All Urban Consumers: All Items in U.S. City Average. The ratio is the 10-year standard deviation of year-over-year change in IP over the 10-year standard deviation in year-over-year CPI. Data are as of February 15, 2023.

Related: China Is Unavoidable for Investors