With year-end beckoning, now is an appropriate time for advisors to discuss taxes with clients and there's plenty to discuss this year.

Owing to the Biden Administration's effort to raise capital gains and income taxes on wealthy individuals and couples (those earning $400,000 or more annually or $450,000 for couples), advisors are likely fielding plenty of inquiries from high net worth clients and that's without the proposed tax increase being law. For now, it's just a proposal.

There's more. Directly related to the White House's revenue-raising efforts, the chairman of the Senate Finance Committee is considering a plan that would eliminate the tax benefits enjoyed by exchange traded funds – all in the name of raising $205 billion over a decade. In Uncle Sam terms, that's peanuts.

It's unlikely the ETF tax pitch sees the light of day, but the aforementioned broader tax hike is causing some anxiety among clients. That is to say advisors have their hands full with tax talk as of late and all that doesn't include one of the strategies that can used here and now: Tax-loss harvesting.

Simple, Effective Tax Tab Trimmer

Many clients don't know about tax-loss harvesting, let alone the value the strategy offers. That's why advisors are meaningful on this front.

Even better, the concept is easily conveyed to clients. Tax-loss harvesting is the act of selling a losing position to offset some of the capital gains obligations on profits on a winning trade. Michael Barrer, WisdomTree director of capital markets, details why tax-loss harvesting is beneficial to clients in the following example.

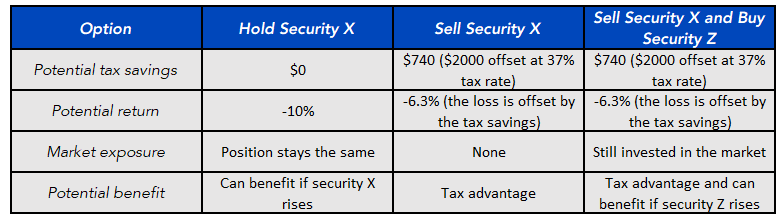

“Imagine you invested $20,000 at the beginning of the year in security X. But toward the end of the year, security X is down by 10% and is worth $18,000. What can you do?,” notes Barrer. “First, you could just hold on to the security. Second, you could sell the security, take the $2,000 loss, deduct that loss from your taxable income, and pocket the remaining cash. Third, you could sell the security, take the loss and the deduction, while reinvesting your proceeds in a different security.”

Barrer includes an effective chart, featured below, that advisors can use to illustrate to clients the perks of tax-loss harvesting.

Courtesy: WisdomTree

Advisors can also help clients employ tax-loss harvesting in their discretionary accounts. Say a client is holding shares of a once hot stock that has turned sour and the outlook is bleak and also wants to trim exposure to a value fund that's surged this year, Tax-loss harvesting is appropriate here because it gets the client out of the losing position and offsets some of the capital gains liability on the winning investment.

Another Perk

Something else advisors are well-versed in that many clients are not is the wash rule, which states that if a losing position is being sold for tax purposes, the proceeds cannot be directed to a “substantially identical” within 30 days.

For example, an investor can't sell a losing position on Coca-Cola (NYSE:KO) on Monday and direct that cash to Pepsi (NASDAQ:PEP) on Thursday and still hope to retain to tax-loss harvesting benefits.

However, there are benefits for clients that are looking to get out of mutual funds and move into ETFs.

“It’s worth noting that ETFs are not currently considered substantially identical to mutual funds. You may be able to use this fact to maintain your investment exposure, while still capturing losses for tax purposes,” adds Barrer. “The bottom line is that tax-loss harvesting can help you manage your investment losses.”