Advisors in search of new clients pretzel themselves in order to project the proper image that will attract prospective clients without knowing for certain which shape will be the most appealing.

One might think proven knowledge about the investment environment, including performance proof of stock market gains and detailed description of service offerings, would be the top selling point for all investors. While such expertise does in fact lead the league in attracting new clients, it is not the only aspect of an advisor’s representation which is the most appealing trait.

Spectrem’s study on successful sales techniques – Preferred Sales Approach: Capturing The Wealthy Investor – asked investors to detail the maneuvers taken by advisors that they feel would be the most successful way to attract new business. The study also asks investors to describe the personal traits as well as the sales traits they appreciate from advisors, and those they dislike or disregard entirely.

While financial providers can provide results of their previous campaigns and efforts to attract clients, the Spectrem study looked at successful strategies from the investor’s point of view. While there may be overlap in the two directions, there are likely to be notable differences in what providers believe work and what investors want in a sales approach.

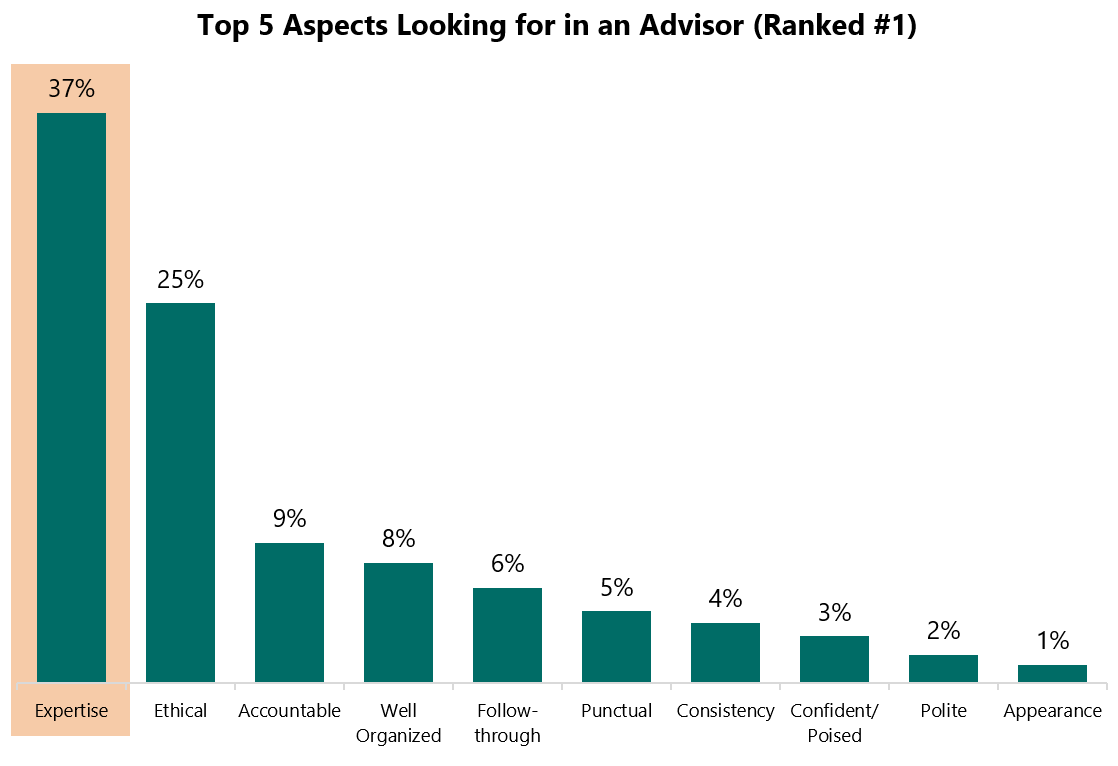

The investors were asked to name the No. 1 aspect of an advisor’s personal presence and information provided, and expertise was, in fact, the most popular choice at No. 1. However, only 37 percent of investors responded with that answer, meaning almost two-thirds of all investors said there was another most important aspect of an advisor’s initial sales pitch.

Expertise can be displayed through experience and credentials. Not all investors are impressed with credentials, but an advisor can provide information on their experience to demonstrate their knowledge and past successes in the areas an investor has the greatest interest in.

The second-most popular response, selected by 25 percent of investors, was that the advisor should be ethical. Again, it is difficult to exhibit this trait in an initial meeting. Perspective clients will judge an advisor on impressions, and investors who are concerned about the ethics of the advisor will be judged by the words an advisor speaks. “Transparency’’ is a very active buzzword these days, but advisors need to provide as much information as they can to prevent concerns over on-the-job ethics.

Between those two choices, almost two-thirds of all investors are represented. The remaining one-third-plus of investors scatter their answers between several other choices, including “being accountable” (9 percent), “being well-organized” (8 percent) and “follow-through” (6 percent). Those investors looking for “follow-through’’ obviously want to be wooed beyond the initial meeting, and it is fair for an advisor to ask a prospective client what period of time that investor would like to receive a second entreaty from the advisor.

Other choices selected by investors for the No. 1 aspect of an advisor’s presentation included “being punctual”, “consistency”, “confidence”, “politeness” and “appearance”.

Related: Women Don't Want Female Advisors