Let’s face it. As we enter 2021 everyone is sick of the pandemic and politics. Spectrem’s recent research shows that women are particularly stressed about the current environment. While many women are working from home, the level of concern regarding the health of their families, the requirements of their job and the volatile political environment are adding to their levels of frustration and unease. Many are still assisting children who may be attending school at home. How can financial advisors assist women in confronting the various challenges of 2021?

1. Understand their personal situation.

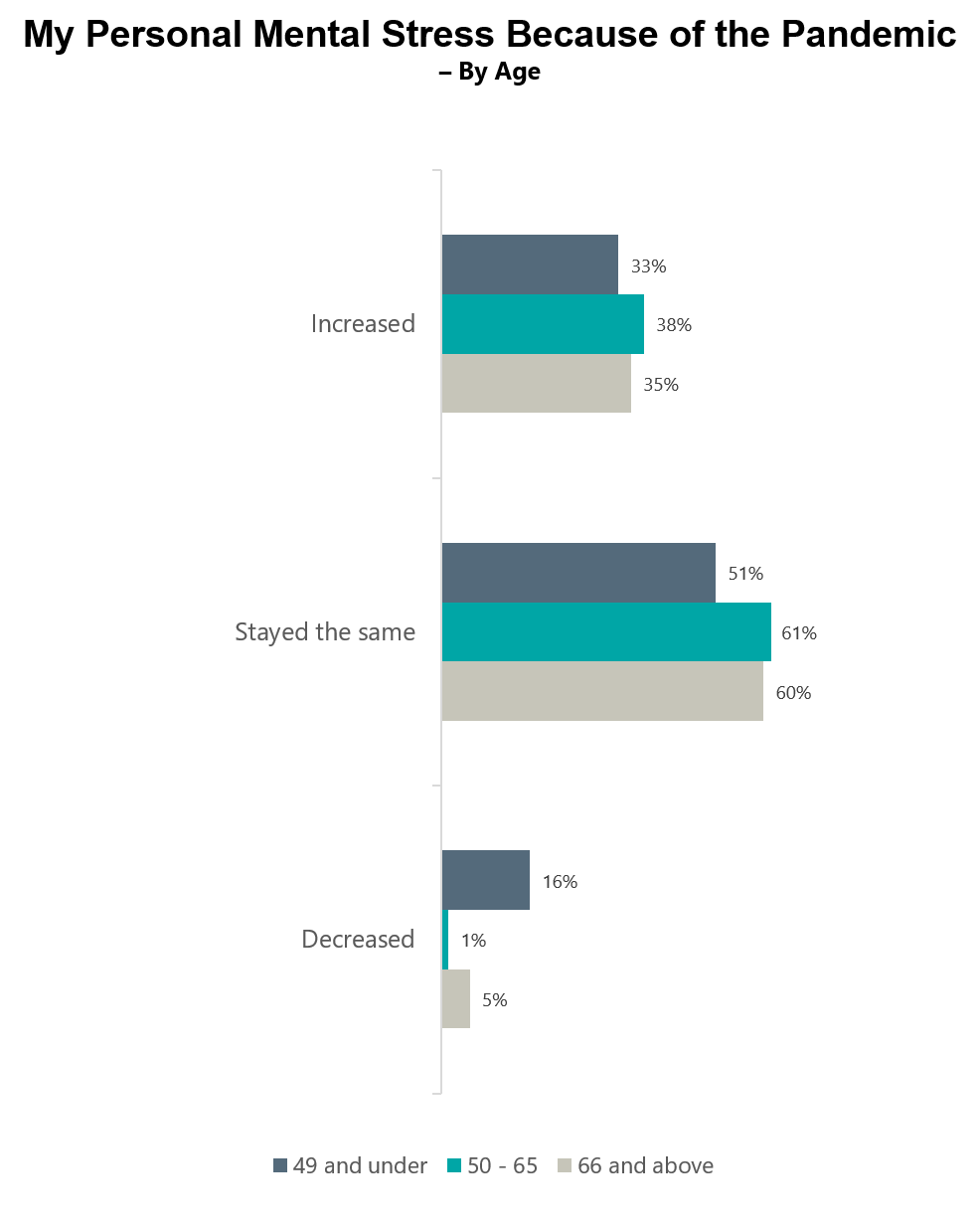

While more than two-thirds of wealthy women indicate that their financial well-being is the same since the onset of the financial crisis (See Spectrem’s Wealthy Women and Market Volatility in 2020), the same is not necessarily true of their emotional well-being. A large number of women under the age of 66 are working at home and while 45% indicate the experience is good, more than a third indicate that their personal mental stress has increased due to the pandemic. Advisors should communicate with female investors and make sure they are confident regarding their financial situation. Make sure you inquire regarding their personal situation and be able to provide insight regarding any topics they may be worried about. Note that 13% of female investors between the ages of 50-65 indicate they were laid-off from their jobs due to the pandemic. These women in particular may be stressed regarding the future and may need some additional support.

2. Financial values regarding obligations to their children will impact the financial planning of most women.

While saving for retirement and living through retirement are the most important goals for wealthy women, they are more likely than their male counterparts to consider key financial obligations of their children as part of their own personal responsibility. Three-quarters of wealthy women with children still at home believe they should help pay for their children’s college education and a quarter will pay for post-graduate education. Half want to assist with their child’s first car and more than a quarter want to help pay for their children’s first home. All of these factors need to be taken into consideration when assisting women with their financial planning and investments. Be sensitive to their feelings regarding these topics and assist in creating plans that will keep these major life events in mind.

3. Meet with female investors in 2021 in the manner they prefer.

While many wealthy women are supportive of keeping the social distancing and other protocols in place in 2021, more than half (51%) would be comfortable meeting with their financial advisor in person. While 60% prefer that that their advisor wears a mask during this meeting, 49% are comfortable coming to the advisor’s office. Thirty eight percent, however, would prefer to meet virtually only. Financial advisors need to keep in contact with their female clients during 2021. While many predict a robust market, there are still numerous uncertainties ahead. Make sure your clients know you are working in their best interests.