Written by: Lincoln Financial Group

What kind of retirement do you want? Perhaps you plan to spend your new-found free time exploring new places or visiting loved ones. You may have home renovation or relocation ideas. Whatever you envision, it helps to plan for protected income that matches your spending and supports your lifestyle in retirement.

The Lincoln ProtectedPaySM lifetime income suite, available with Lincoln variable annuities for an additional cost,1 includes options for people who plan to spend more during the early years of retirement:

Predictable growth

During the years leading up to retirement, your Protected Income Base could grow at a simple rate of 6%. If your account performance is higher, you lock in that amount.2

Protected income for life

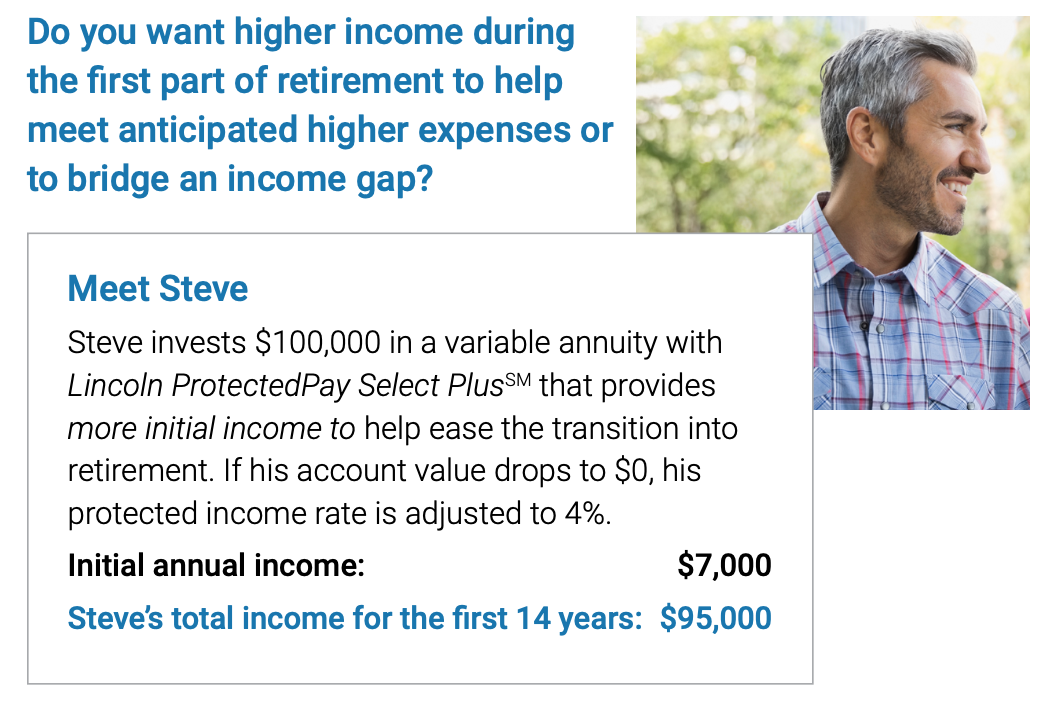

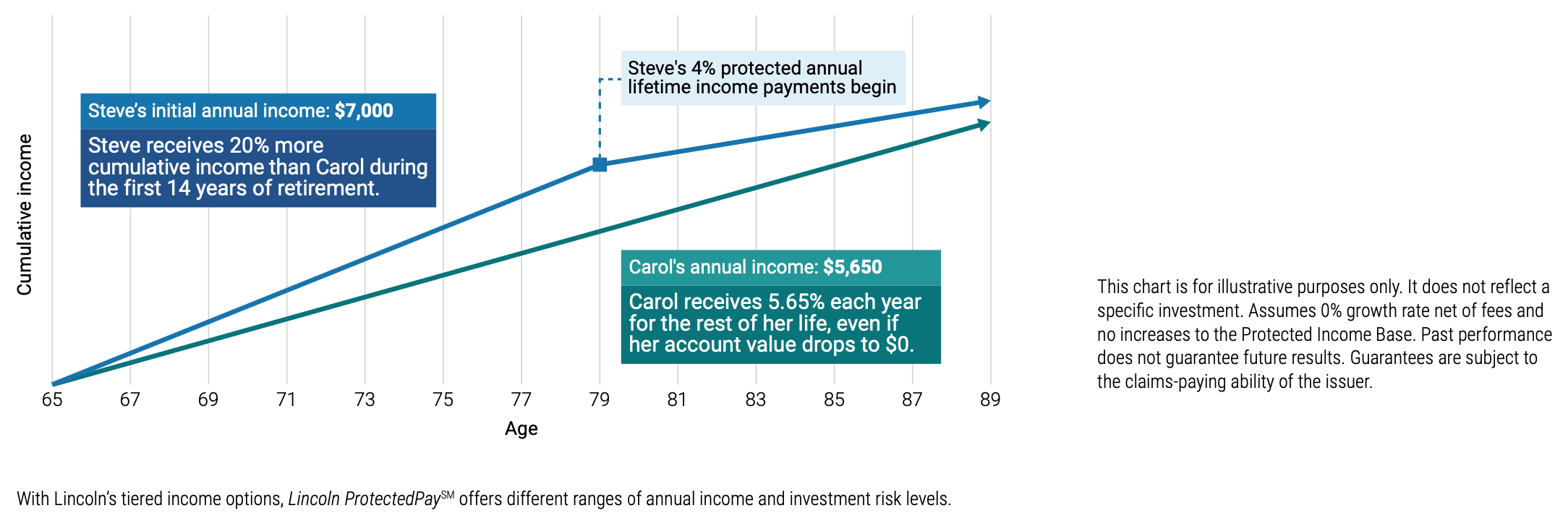

Including options that front-load more income for the earlier years of retirement, and provide adjusted, lower payments if account value goes to $0, that are guaranteed for life.

Potential for more

Investment choice and flexibility to build a portfolio that fits your goals and investment preferences.

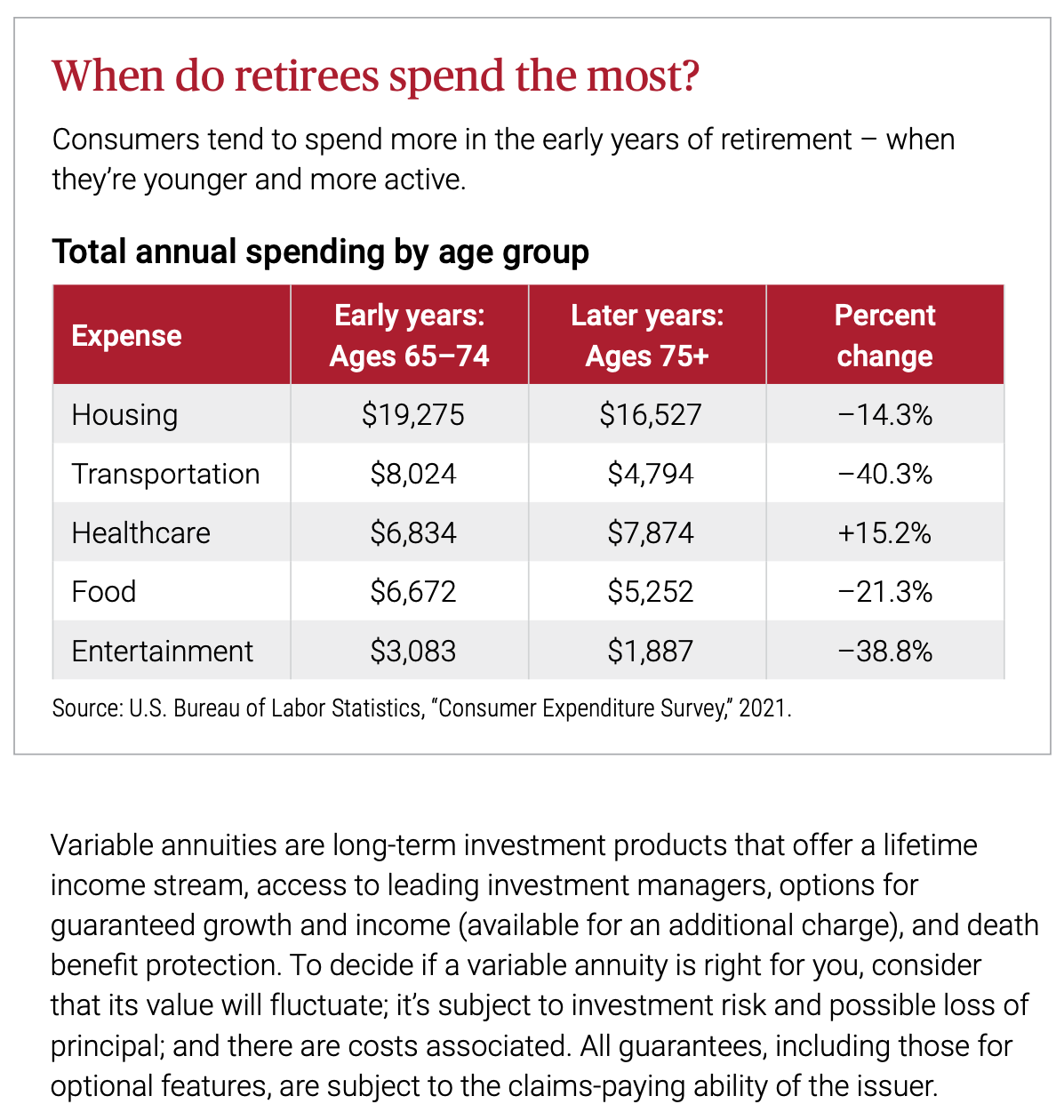

Match your retirement income with your spending expectations

More potential for your portfolio

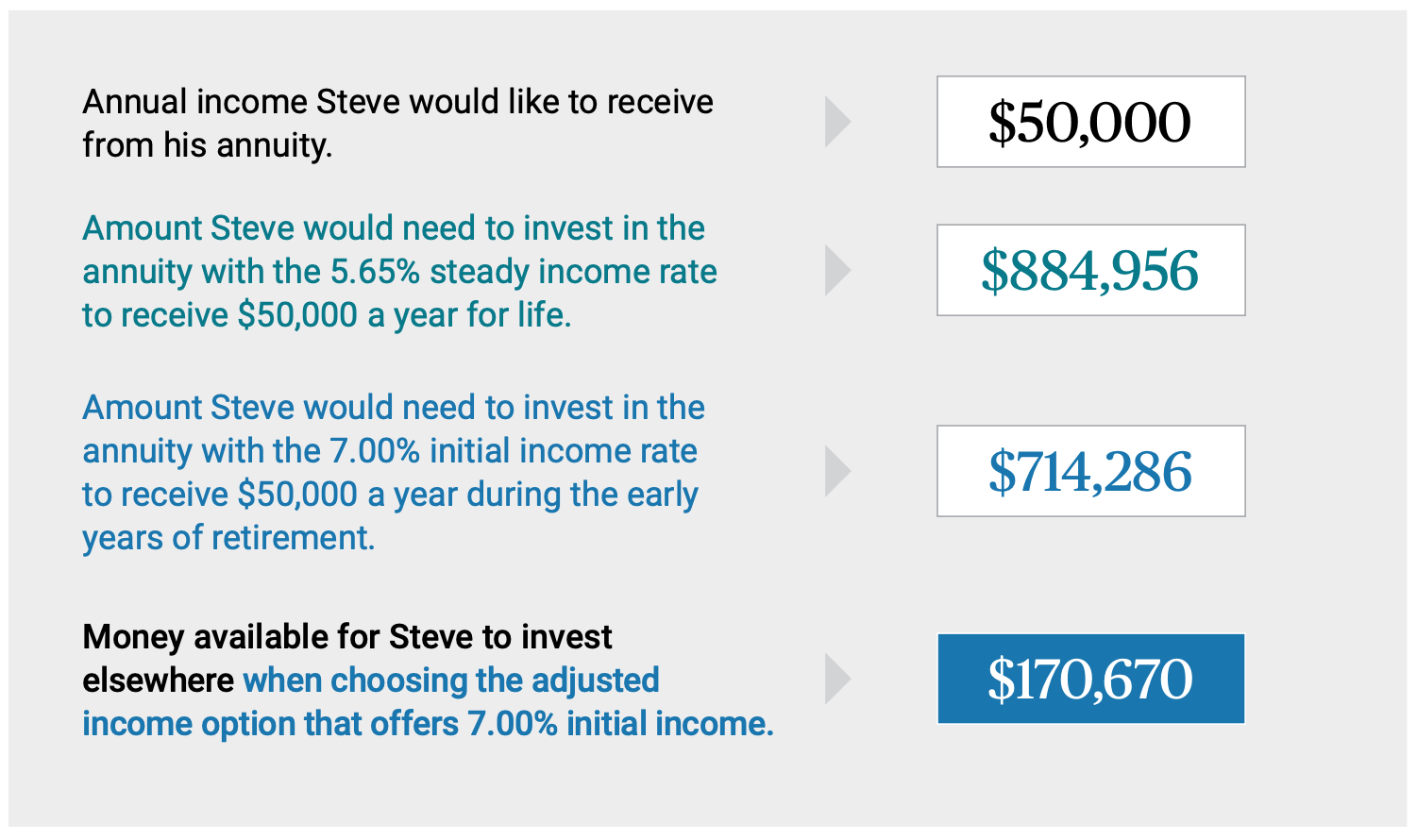

Choosing one of the Lincoln ProtectedPaySM lifetime income options that offers more upfront income in the earlier years may give you more flexibility with your money. With a higher initial annual income rate, you can invest a smaller amount to achieve your annual income goal.

In the example below, Steve’s annual income goal is $50,000. He can invest less to get that $50,000 a year by choosing the option with more initial income. Then, he may invest the difference elsewhere or spend the remainder some other way.

Examples are for illustrative purposes only. They do not reflect a specific investment.

The Protected Annual Income rate is based on the age at the time of the first withdrawal. Thereafter, the PAI rate will only change after reaching a higher age band and after an account value lock in. With tiered income options, your protected income payout will decrease if your account value falls to zero.

Your next steps

Work with your financial professional to determine how Lincoln ProtectedPay lifetime income can help support your lifestyle in retirement. Visit LincolnFinancial.com/ProtectedPay to learn more.

1 Lincoln ProtectedPaySM lifetime income suite is available for an additional annual charge of 1.50% above standard contract expenses, or 1.60% for joint life (maximum annual charge is 2.75%). Investment requirements apply.

2 The 6% simple annual growth will continue for the earlier of 10 years or through age 85 (based on the oldest life for joint). The 6% enhancement is not available in any year a withdrawal is taken. See the prospectus for complete details.