Much like “Humpty Dumpty,” despite the Fed’s best efforts, you can’t create permanent inflation from artificial growth.

Currently, depending on whether you are “bullish” or “bearish,” there is much angst over the prospect of higher inflation. If you are bullish, higher inflation is a reflection of surging economic growth. If you are bearish, higher inflation leads to rising costs and higher rates. However, we need a better definition of what inflation is.

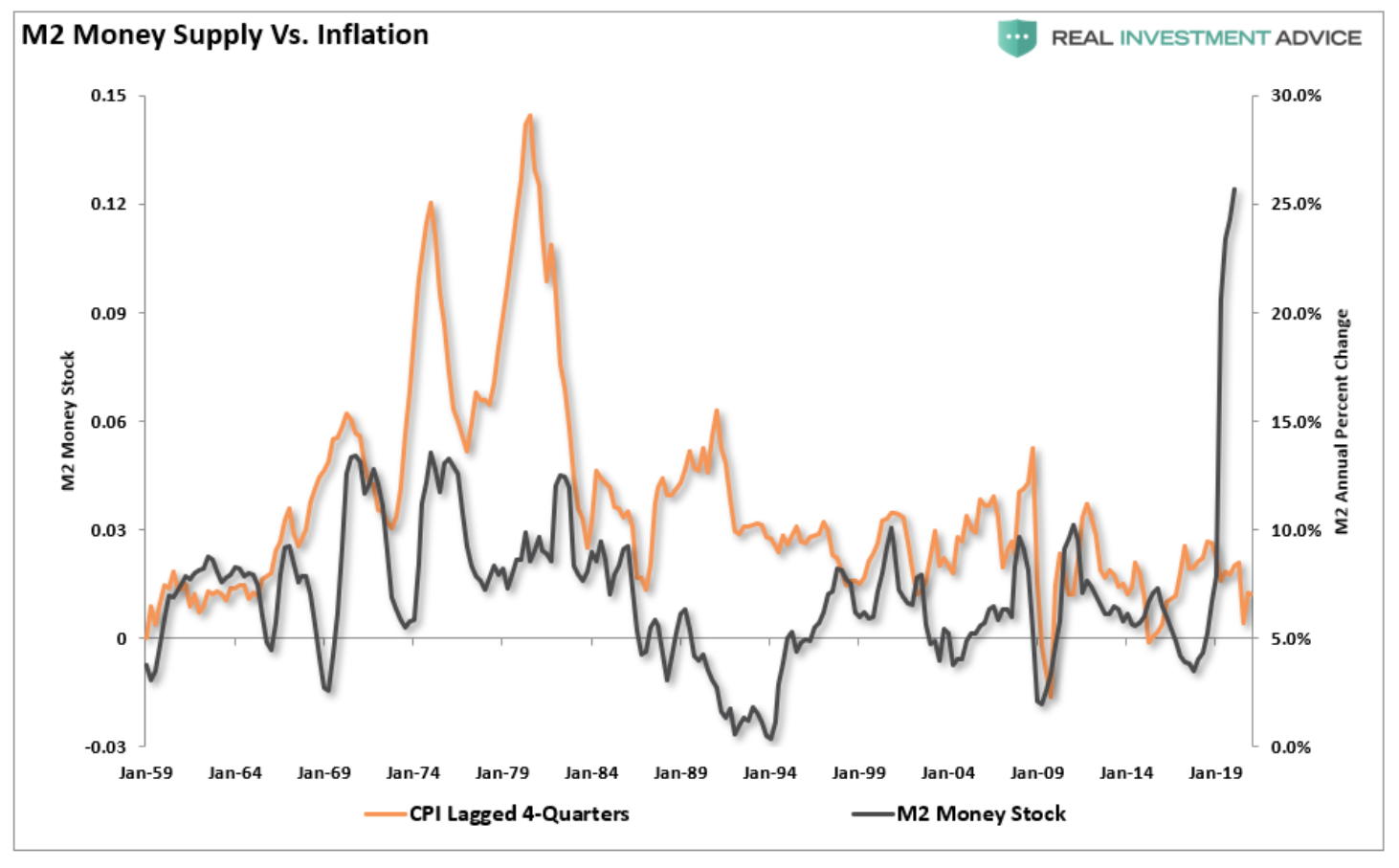

“In order to understand the effects of inflation it is helpful to understand that inflation is not a general rise in prices as such, but an increase in the supply of money which then sets in motion a general increase in the prices of goods and services in terms of money.” – The Mises Institute

The chart below shows the annual percentage change of M2 money supply and CPI. As Mises sets out, the surge in M2 should lead to a rise in “prices” over the next year.

There is little argument that we see a rise in prices in everything from food to housing and automobiles. The question we must answer is whether it is “sustainable” or “transitory” inflation?

Sustainable Inflation Requires Organic Growth

Sustainable, demand-driven inflation, requires sustainable wages to support higher prices. Due to the artificial stimulus, retails sales are 20% higher than pre-pandemic norms while employment is 10-million jobs lower.

As discussed previously, there is a high correlation between inflation and economic growth, wages, and rates.

Unless jobs come roaring back with a subsequent surge in wages, the artificially driven “demand” feeding into inflation will reverse.

Bonds Are Right

As discussed in “Why Bonds Are Right,” there is an even higher correlation between interest rates and the economic composite of inflation, wages, and economic growth. To wit:

“As shown, the correlation between rates and the economic composite suggests that current expectations of sustained economic expansion and rising inflation are overly optimistic. At current rates, economic growth will likely very quickly return to sub-2% growth by 2022.”

The reason that rates are discounting the current “economic growth” story is that artificial stimulus does not create sustainable organic economic activity.

“This is because bubble activities cannot stand on their own feet; they require support from increases in money supply that divert to them real savings from wealth generators. Also, note again that a major cause behind the possible decline in the pool of real savings is unprecedented increases in money supply and massive government spending. While the pool of real savings is still growing, the massive money supply increase is likely to be followed by an upward trend in the growth rate of the prices of goods and services. This could start early next year. Once the pool of real savings starts to decline, however—because of massive monetary pumping and reckless fiscal policies—various bubble activities are will plunge. This, in turn, is likely to result in a large decline in economic activity and in the money supply.” – Mises Institute

As stimulus fades from the system, that decline in money supply is only one of several reasons that “deflation” will resurface.

Monetary & Fiscal Policy Is Deflationary

The Federal Reserve and the Government have failed to grasp that monetary and fiscal policy is “deflationary” when “debt” is required to fund it.

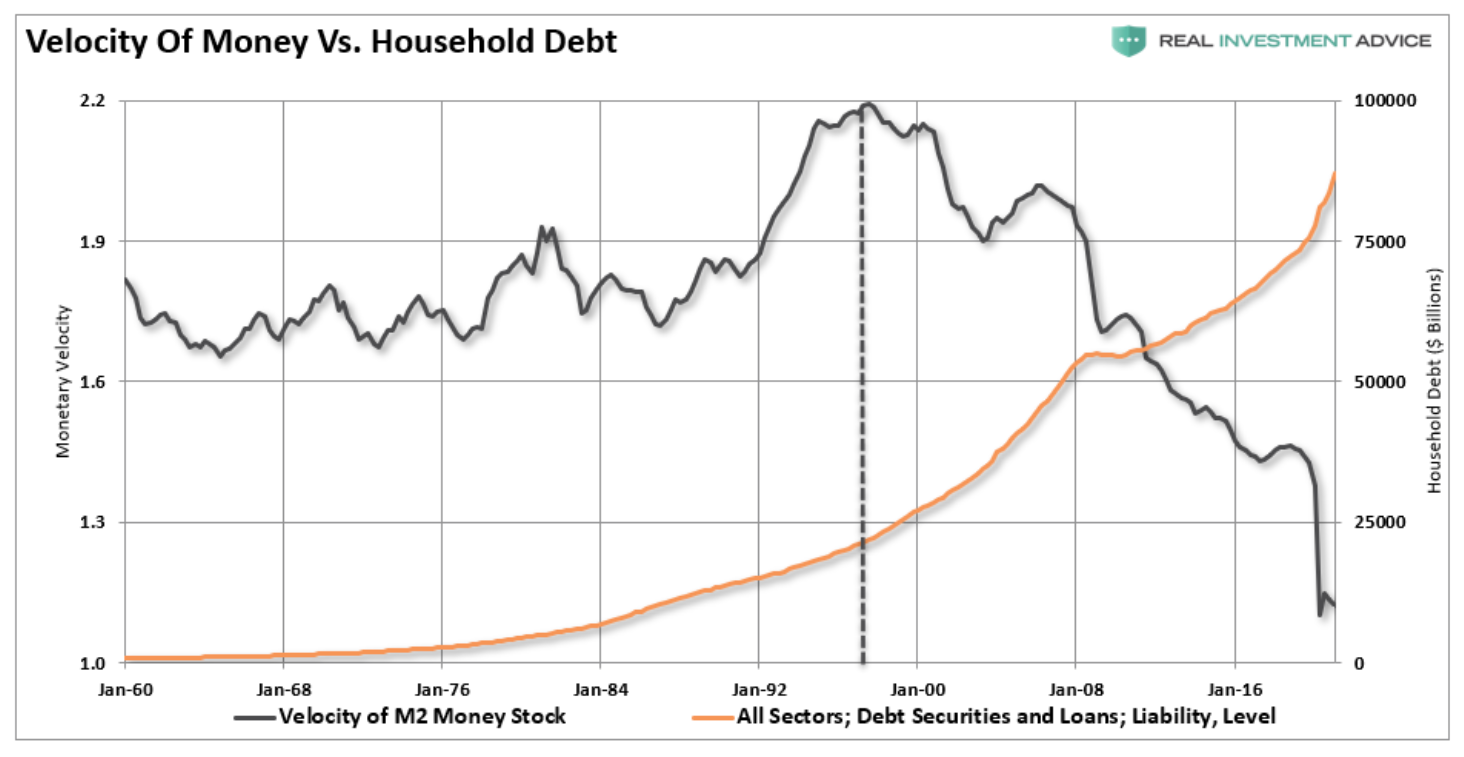

How do we know this? Monetary velocity tells the story.

What is “monetary velocity?”

“The velocity of money is important for measuring the rate at which money in circulation is used for purchasing goods and services. Velocity is useful in gauging the health and vitality of the economy. High money velocity is usually associated with a healthy, expanding economy. Low money velocity is usually associated with recessions and contractions.” – Investopedia

With each monetary policy intervention, the velocity of money has slowed along with the breadth and strength of economic activity.

While in theory, “printing money” should lead to increased economic activity and inflation, such has not been the case.

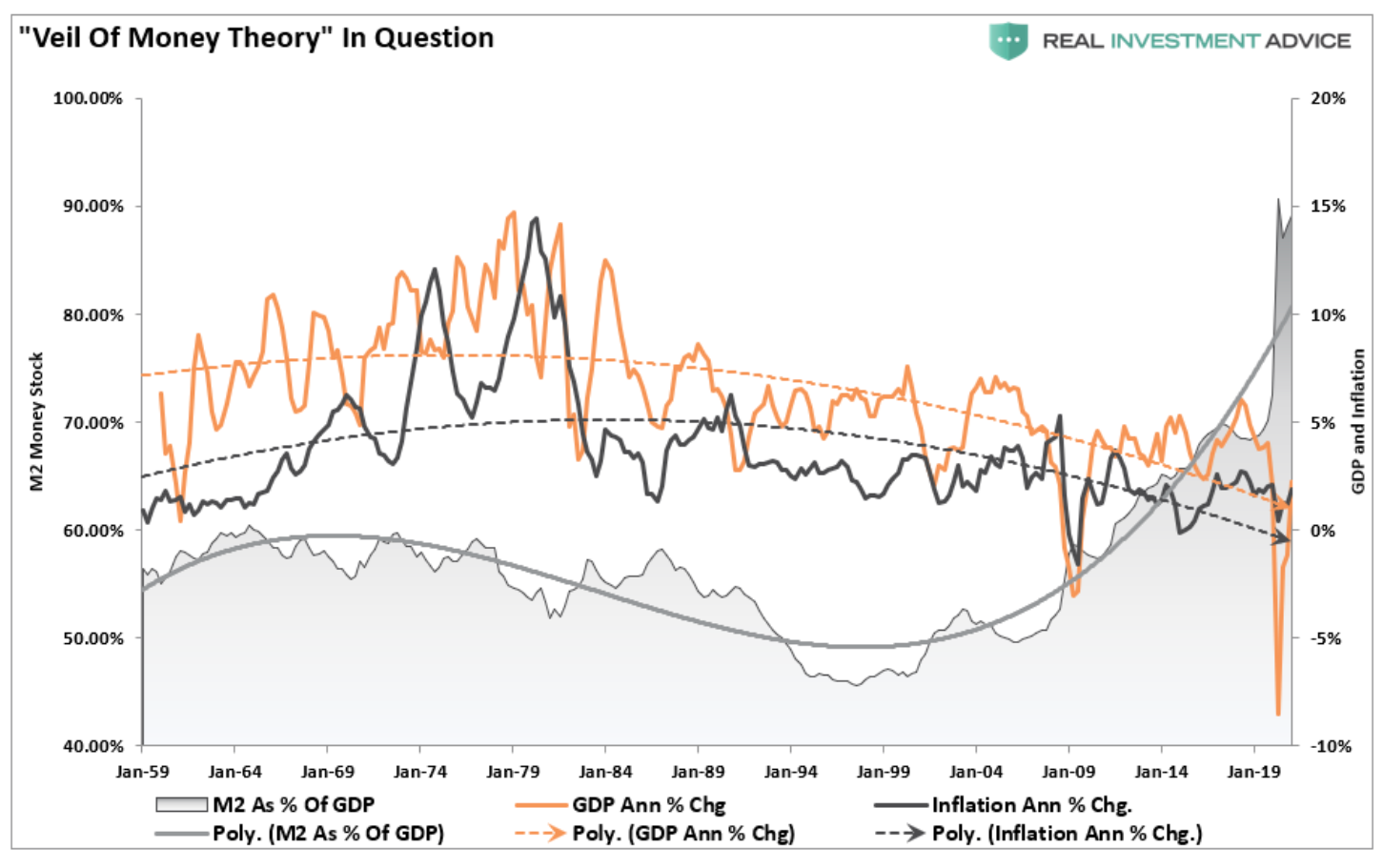

A better way to look at this is through the “veil of money” theory.

If money is a commodity, more of it should lead to less purchasing power, resulting in inflation. However, this theory began to fail as Governments attempted to adjust interest rates rather than maintain a gold standard.

Crossing The Rubicon

As shown, beginning in 2000, the “money supply” as a percentage of GDP has exploded higher. The “surge” in economic activity is due to “reopening” from an artificial “shutdown.” Therefore, the growth is only returning to the long-term downtrend. As shown by the attendant trendlines, increasing the money supply has not led to either more sustainable economic growth rates or inflation. It has been quite the opposite.

However, it isn’t just the expansion of the Fed’s balance sheet that undermines the strength of the economy. For instance, it is also the ongoing suppression of interest rates to try and stimulate economic activity. In 2000, the Fed “crossed the Rubicon,” whereby lowering interest rates did not stimulate economic activity. Therefore, the continued increase in the “debt burden” detracted from it.

Similarly, we can illustrate the last point by comparing monetary velocity to the deficit.

As a result, monetary velocity increases when the deficit reverses to a surplus. Such allows revenues to move into productive investments rather than debt service.

The problem for the Fed is the misunderstanding of the derivation of organic economic inflation

6-More Reasons Deflation Is A Bigger Threat

Previously, Mish Shedlock discussed Dr. Lacy Hunt’s views on inflation, or rather why deflation remains a more significant threat.

- Inflation is a lagging indicator. Low inflation occurred after each of the past four recessions. The average lag was almost fifteen quarters from the end of each. (See Table Below)

- Productivity rebounds in recoveries and vigorously so in the aftermath of deep recessions. The pattern in productivity is quite apparent after the deep recessions ending in 1949, 1958, and 1982 (Table 2 Below). Productivity rebounded by an average of 4.8% in the year after each of these recessions. Unit labor costs remained unchanged as the rise in productivity held them down.

- Restoration of supply chains will be disinflationary. Low-cost producers in Asia and elsewhere could not deliver as much product into the United States and other relatively higher-cost countries. Such allowed U.S. producers to gain market share. As immunizations increase, supply chains will gradually get restored, removing that benefit.

- Accelerated technological advancement will lower costs. Another restraint on inflation is that the pandemic significantly accelerated the implementation of technology. The sharp shift will serve as a restraint on inflation. Much of the technology substitutes machines for people.

- Eye-popping economic growth numbers vastly overstate the presumed significance of their result. Many businesses failed in the recession of 2020, much more so than usual. Furthermore, survivors and new firms will take over that market share, which gets reflected in GDP. However, the costs of the failures won’t be.

- The two main structural impediments to traditional U.S. and global economic growth are massive debt overhang and deteriorating demographics, both having worsened as a consequence of 2020.

To summarize, the long-term risk to current outlooks remains the “3-Ds:”

- Deflationary Trends

- Demographics; and,

- Debt

Conclusion

With this in mind, the debt problem remains a massive risk. If rates rise, the negative impact on an indebted economy quickly depresses activity. More importantly, the decline in monetary velocity shows deflation is a persistent threat.

Treasury&Risk clearly explained the reasoning:

“It is hard to overstate the degree to which psychology drives an economy’s shift to deflation. When the prevailing economic mood in a nation changes from optimism to pessimism, participants change. Creditors, debtors, investors, producers, and consumers all change their primary orientation from expansion to conservation.

- Creditors become more conservative, and slow their lending.

- Potential debtors become more conservative, and borrow less or not at all.

- Investors become more conservative, they commit less money to debt investments.

- Producers become more conservative and reduce expansion plans.

- Consumers become more conservative, and save more and spend less.

These behaviors reduce the velocity of money, which puts downward pressure on prices. Money velocity has already been slowing for years, a classic warning sign that deflation is impending. Now, thanks to the virus-related lockdowns, money velocity has begun to collapse. As widespread pessimism takes hold, expect it to fall even further.”

There are no real options for the Federal Reserve unless they are willing to allow the system to reset painfully.

Unfortunately, we now have a decade of experience of watching monetary experiments only succeed in creating a massive “wealth gap.”

Most telling is the current economists’ inability to realize the problem is trying to “cure a debt problem with more debt.”

In conclusion, the Keynesian view that “more money in people’s pockets” will drive up consumer spending, with a boost to GDP being the result, has been wrong. It hasn’t happened in 40 years.

Unfortunately, deflation remains the most significant threat as permanent growth doesn’t come from an artificial stimulus.