There are myriad reasons why S&P 500 index funds, including exchange traded funds, are favored tools of so many advisors.

These products are easy to explain to and approachable for nearly every client. Not only that, but S&P 500 ETFs are cheap and clients love that. Advisors should, too. Lower fees mean lower hurdles in terms of generating long-term performance. There are three S&P 500 ETFs on the market today with an annual fee of 0.03%, or $3 on a $10,000 investment.

One of the other reasons advisors and clients have for so long leaned on the S&P 500 is that the index is diverse. Supposedly. When a benchmark has 505 components (allotting for some dual share classes) as the S&P 500 does, it should be diverse and single stock risk shouldn't be a concern.

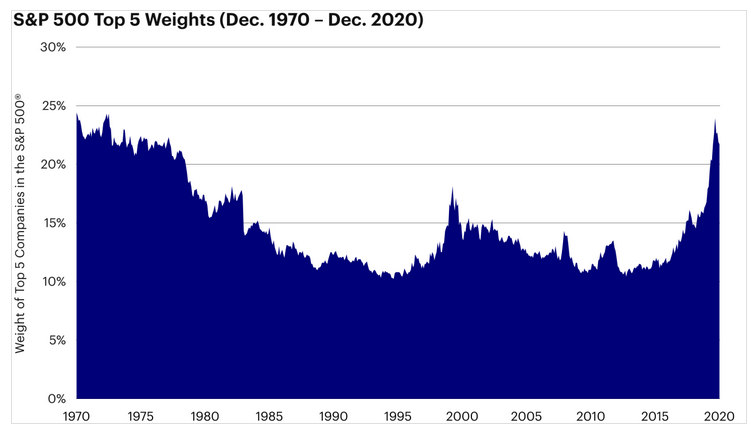

What should happen and reality are often two different things. These days, that sentiment is relevant as it pertains to the S&P 500 because a smaller number of stocks are taking on larger weights in the index.

How the S&P 500 Got Here

As advisors well know, the S&P 500 is weighted by market capitalization, meaning that as a component's market value rises, its weight within the index increases. Historically, cap weighting hasn't hindered the index's diversification, but there are times when it happens. We're experiencing one today.

“As a market capitalization-weighted index, the S&P 500 typically has a heavy concentration in a few names, and as its top five holdings as of Dec. 14, 2020 — Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG/GOOGL), and Facebook (FB) —have zoomed ever higher in 2020, they have come to dominate the Index’s performance,” according to Invesco research. “While the S&P 500 ostensibly measures 500 companies, the five largest companies have grown to account for nearly 22.0% of its weighting, a significant rise from 16.8% at the end of 2019.”

Courtesy: Invesco

The above factoid pertains to the combined weight of the those five stocks in the S&P 500 as of the end of 2020. As of Feb. 18, the percentage was steady at 22% – hardly a qualifier for diversity and towards the higher end of historical averages.

Equal-Weight: The Solution to Concentration Conundrum

An interesting fact about prior bouts of elevated S&P 500 concentration, namely the early 1970s and 2000 before the tech bubble burst, is that none of those companies are even top 10 members of the index today.

This time around could be different because companies like Apple, Microsoft and Amazon hold dominant positions in their respective markets, are constantly innovating and, at least in the case of the first two, remarkable generators of cash flow.

Good news: Advisors can help clients beat S&P 500 concentration with equal weighting, one of the oldest alternatives to cap weighting.

“An equal weight approach can provide diversification benefits and reduce concentration risk by weighting each constituent company equally, so that a small group of companies does not have an outsized impact on the index,” according to Invesco.

For those that aren't familiar, this is a strategy that's been deployed in real time for years. The Invesco S&P 500® Equal Weight ETF, which tracks the S&P 500 Equal Weight Index, is almost 18 years old and has $20.48 billion in assets under management.

Obviously, equal weighting leads to lower average market values. For example, the average market cap of RSP's component is $68.16 billion compared to a weighted average market cap of $507.86 billion in the cap-weighted S&P 500.

Many clients still aren't familiar with equal-weight funds, but advisors can educate skittish investors, particularly those with long-term time horizons.

“On a year-to-year basis, the performance of RSP relative to the S&P 500 is not much better than a coin flip; however the win rate improves over longer periods of time, rising to 71% over a five-year period and 87% over a 10-year period,” notes Invesco.

Bottom line: The equal-weight methodology is a straight forward concept advisors can easily articulate to clients and it possesses long-term advantages – two traits clients are sure to like.

Related: Generating Income Is a Problem. Fortunately, There Are Solutions