With less than three months left in 2021, advisors know all too well that this year is a rough one in the bond market.

The confluence of low interest rates, inflation, volatility in 10-year Treasury yields and increasing speculation that the Federal Reserve will almost certainly raise interest rates in 2022 is making life hard on advisors when it comes to deal with clients' fixed income allocations.

Still, data confirm fixed income exchange traded funds are gathering assets at a blistering pace. One take away from the theme of bond ETFs adding assets at near record levels is that some bond funds are indeed working this year. That group includes the VanEck Fallen Angel High Yield Bond ETF (NYSEARCA:ANGL).

Advisors know and should impart upon clients that, with bond ETFs, getting caught up in year-to-date performances isn't worth it. However, it's hard to ignore the fact that ANGL is up 4.9% year-to-date, or more than double the returns of the widely followed Markit iBoxx USD Liquid High Yield Index while the Bloomberg US Aggregate Bond Index is lower by 2.1%.

Familiar Territory for Fallen Angels

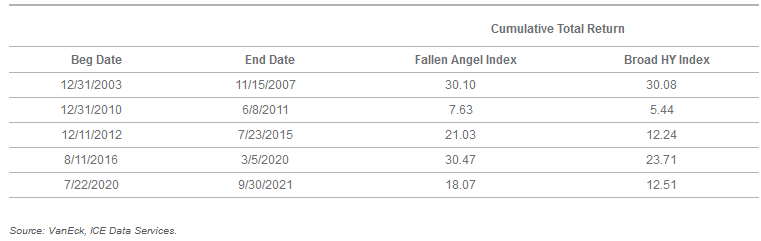

Fallen angels are corporate bonds born with investment-grade credit ratings that are later downgraded to high-yield status. Obviously, the investment-grade-to-junk move sounds ominous and bonds' price action during that time reflects as much, but fallen angels prove remarkably sturdy. In fact, historical data confirm this year's out-performance by ANGL is far from a one-off event.

“For example, out of the last 17 full calendar years, fallen angels bonds have outperformed in 13. This period encompasses many different market environments: rising and falling rates, recessions and expansions, and credit spreads at both extreme highs and lows and everything in between,” says Nicolas Fonseca, VanEck associate portfolio manager.

One of the primary reasons fallen angels historically top traditional junk bonds is the former are more likely to regain investment-grade status and upgrades are significant drivers of corporate bonds' returns over time.

“Predicting the timing of rating agency actions is difficult. Historically they have tended to lag the market, but there have been instances where they surprised the market and acted quickly, such as in 2020,” adds Fonseca. “With that said, we believe more upgrades are coming, though there are still risks to this outlook, including COVID, which is still here despite all efforts. However, in our minds the current trend is clearly positive and fallen angel bonds stand to benefit as rising stars could emerge again.”

Today's credit cycle could be a harbinger of more fallen angel upgrades and, potentially, more upside for ANGL. Expansion phases of credit cycles, which typically prove conducive to fallen angel upgrades, are marked by economic recovery, low default rates, low interest rates and declining credit spreads, among other factors. Sound familiar? It should because that's where we're at today.

Speaking of fallen angels in tight credit spread environments, advisors should note the hand chart below and use it to articulate to clients why ANGL is a credible consideration today.

Courtesy: VanEck

Rising Rates Don't Damage Fallen Angels

As advisors are aware of, 10-year Treasury yields are again trending higher. Under any circumstances, that scenario can't be ignored, but given the magnitude of the May through August decline by 10-year yields, history indicates those yields will almost certainly be higher well into the first if not second quarter of 2022.

That's likely to renew talk about what fixed income assets prove durable when rates rise. Fallen angels check that box.

“Rates are rising again, but this is similar to what occurred back in Q1, when the 10Y rose 0.81% from 0.93% to 1.74%, which is the highest reported figure this year. During that period, fallen angels outperformed broad high yield by 1.41% (8.55% vs 7.14%). Rising yields impact long dated bonds to a greater extent, and fallen angels do have an average duration that is longer than the broad high yield market. But the different sources of returns keep paying off,” concludes Fonseca.