Written by: Nate Tonsager

I received a great follow-up question to my piece last week about not stressing over paper losses on your individual bond positions: What about investors who have bond ETFs? How should they approach their paper losses?

I felt the answer deserved to be shared because many people use ETFs for their bond exposure. In short, my advice of “stick to the plan” still holds for bond ETF owners, but with a caveat. It depends on why you want to own them. Is it for income generation or for portfolio diversification?

Income Generation

If you’ve been using bond ETFs to produce income, now is a good time to consider moving to a bond ladder comprised of individual bonds. Yields have risen and we are now seeing opportunities to lock in a 5%-6% annual rate using individual corporate and/or municipal bonds with a 5 to 6-year average portfolio duration.

Bond ETFs of all issuer types (government, municipal, corporate, etc.) have shown material price volatility over the past couple of years, so moving into a hold-to-maturity, individual bond ladder will lock in yields and would also help reduce the impact from price swings caused by interest rate movements. This is just like what I discussed in last week’s article.

Portfolio Diversification

If you’ve been holding bond ETFs as a portfolio diversifier, I would recommend staying the course for now just like the owners of individual bonds. Bond ETFs and individual bonds behave similarly, and right now both may be underwater from a price standpoint, but they are paying investors elevated yields.

The key difference between them is that bond ETFs rarely have a singular, set maturity date meaning there are no repayment guarantees ETF investors have by holding-to-maturity. With less guarantees, bond ETFs should have higher volatility than individual bonds, but also the potential for higher total returns over time.

Price Volatility In the U.S. Bond Market

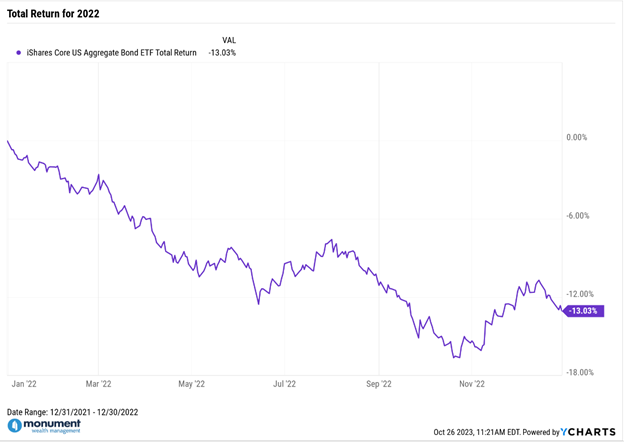

To illustrate what’s been going on with bond ETFs, let’s look at one of the biggest, the iShares Core U.S. Aggregate Bond ETF, ticker: $AGG. It now has a 30-day SEC yield around 4.84% annualized, which is pretty competitive given the current rate backdrop. However, that increase in yield also caused a -13.03% total return in calendar year 2022.

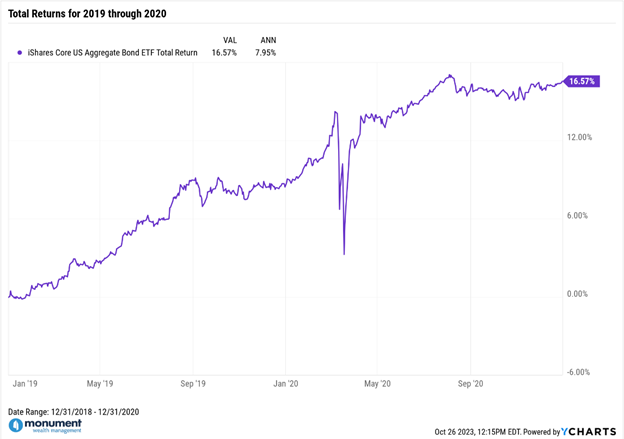

But if you look back a little farther into recent history, $AGG has also seen some stretches of impressive performance like 2019 through 2020, which saw a cumulative total return of +16.57%, or +7.95% annualized, over those two years.

These are fitting examples of the volatility, both positive and negative, bond ETF owners have experienced recently and should expect in rapidly changing interest rate environments.

So far in 2023, $AGG is down about -3%, but in the future, if interest rates move significantly lower during a flight to safety caused by the next crisis, whatever that may be, we likely will see noticeable price appreciation in bond ETFs like $AGG.

Why You Own Them Dictates Your Response

To summarize, with individual bonds you’re waiting for their set maturity date and the principal repayment. With bond ETFs you’re hoping for lower rates leading to their price recovery. However, no one can predict the next move in rates. It could be up or down, so with bond ETFs it’s impossible to know how long you’ll be waiting for or your final payout.

That’s the crux of this discussion. If your financial plan, time horizon and risk tolerance can support some volatility, bond ETFs continue to be appropriate for your fixed income exposure. If not, ladders of individual bonds are starting to appear well suited for investors who want to reduce some fixed income risk while locking in a known income stream.

Every investor is different, so there is no “right” answer to this question. But whether you own individual bonds or bond ETFs, they should be part of a long-term financial plan and should be offering some form of diversification or safety within your portfolio.