As advisors know, dividend investing can and should be separated into two camps: high dividends or yield and payout growth. It’s easy to understand why clients are often seduced by the former.

Through years of low interest rates, dividend yields of 3% to 4% were enticing, particularly when measured against the S&P 500 and cash instruments. On the other hand, chasing juicy payouts is one investing’s notable trade-offs because it often requires making bets on defensive and/or value sectors, which is to say high dividend stocks and the related exchange traded funds lagged the broader market when growth stocks were leading.

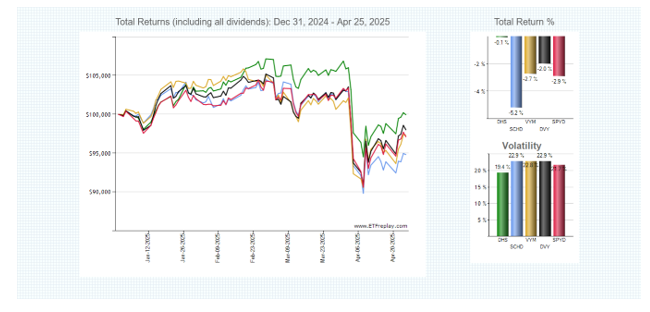

That scenario has changed this year, revitalizing ETFs such as the WisdomTree U.S. High Dividend Fund (DHS) along the way. DHS isn’t just beating the S&P 500 since the start of the year, as highlighted in the charts below, the ETF (green line) is outpacing rivals funds and doing so with less volatility.

(Data/image courtesy: ETF Replay)

DHS Details Matter

The $1.18 billion DHS turns 19 years old in eight weeks, which is to say it’s battle-tested across an array of market environments. For the bulk of its roughly two decades on the market, the ETF has performed as it expected, which is to say it trailed the broader when growth stocks were shining while performing less poorly and reducing volatility against more calamitous backdrops.

“In our opinion, the point isn't that dividends always win,” notes Christopher Gannatti, global head of research at WisdomTree. “It's that they show up when you need them most—and they do so without requiring you to bet the farm on what's next in AI, semiconductors or space colonization.”

Consider DHS’s knack for weathering storms. As Gannatti points out, the S&P 500 had two negative annual showings over the past decade – 2018 and 2022. During the latter, DHS gained almost 8% while the S&P 500 slumped 18.2%. That’s a testament to DHS not relying on rate-sensitive sectors such as real estate and utilities. Often lynchpins of other high dividend funds, utilities and real estate stocks combine for less than 15% of the DHS portfolio.

Even with those relatively tame weights to real estate and utilities stocks, DHS still sported a dividend yield of 4.11% as of April 25. That’s more than triple the rate of the S&P 500 and double the yield on the Russell 1000 Value Index.

DHS Perfect Mag 7 Offset?

As is the case with so many ETFs in the high dividend category, DHS isn’t heavily exposed to technology stocks. Its weight to that sector is just 3.10%, or barely more than S&P 500’s exposure to the same sector.

In fact, DHS has no magnificent seven exposure at all, implying the ETF could be paired with those stocks or tech-heavy funds to boost client income streams while potentially damping volatility. Additionally, DHS is home to plenty of familiar companies with the capability to, at the very least, maintain current dividend obligations for years to come.

“These are not distressed businesses with unsustainable payout ratios. DHS is built from the ground up and seeks to mitigate the risk of exposure to value traps and companies paying unsustainable dividends,” concludes Gannatti. “The highest weight is not in companies with the highest yields but rather in those companies that are distributing the most cash in aggregate to their shareholders.”