Over the past several years, covered call and other buy (or sell) write exchange traded funds have become increasingly prominent parts of the income-generating conversation.

The Federal Reserve’s rate-tightening campaign of 2022-23 played a role in that increased popularity as does the tempting yields on many of these ETFs. For example, the JPMorgan NASDAQ Equity Premium Income ETF (JEPQ) and the Global X Nasdaq 100 Covered Call ETF (QYLD), which are the two largest ETFs in the category, yield 11.60% and 13.78%, respectively.

More recently, the universe of options-selling ETFs expanded to include funds based on individual stocks known for commanding elevated options premiums – think the magnificent seven and other “sexy” growth stocks. There’s no denying those products have gained significant traction among income-hungry investors because four such ETFs are found among the 10 largest in this category.

One of the similarities between products such as JEPQ and QYLD and single-stock options selling ETFs is that most are based on monthly options contracts. However, the options market has evolved to include weekly contracts and zero-days-till-expiration (0DTE) contracts. Trading options that expire in a day is best left for computers and professionals, but a new breed of ETFs are harnessing the income-generating prospects of 0DTE and making it accessible to the masses. No, these aren’t your grandfather’s or father’s covered call ETFs.

Evolution Comes to Covered Call ETFs

For investors kicking the tires on 0DTE ETFs, it should be noted that are significant differences between these products and their monthly counterparts. For example, the Roundhill Innovation-100 0DTE Covered Call Strategy ETF (QDTE) may appear similar to a product like QYLD, but there are stark differences that must be acknowledged.

Obviously, 0DTE contracts price each morning whereas the monthly options held by JEPQ and friends expire over the course of a month. For long traders, having more time for contracts to come into the money is preferable, but when it comes to garnering income, 0DTE has plenty of perks.

“These contracts reset strikes every morning and expire on the close, allowing traders to profit from intraday price swings without carrying overnight risk,” according to Roundhill research. “That’s a significant shift from Gen 1 strategies, where holding positions overnight meant exposure to Fed speeches, earnings releases, and geopolitical events. By selling options in the morning, when volatility tends to trade higher and closing out positions before the days ends, traders seek to monetize the market’s short-term convulsions.”

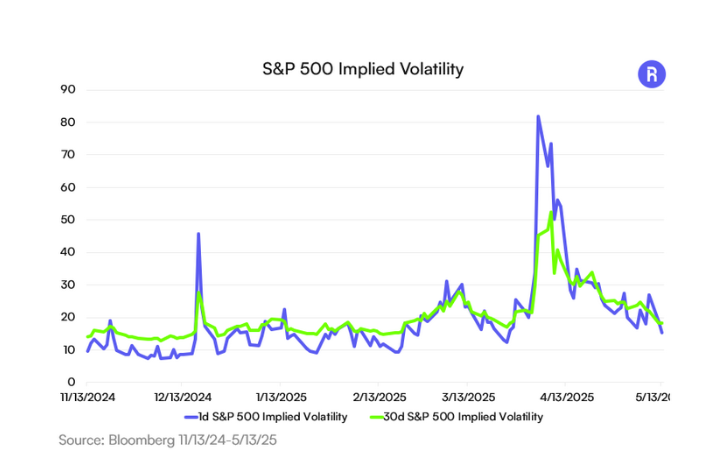

As noted in the chart below, 0DTE contracts, not surprisingly, are more volatile than monthly counterparts and that’s important because in the options market, volatility usually stokes higher premiums. That can lead to more income for investors engaged with an ETF like QDTE than a monthly options equivalent.

(Chart Courtesy: Roundhill Investments)

More 0DTE Perks

As noted above, traders that are long monthly options contracts are making tradeoffs. In exchange for the potential time benefit associated with longer expiry terms, holders of these contracts are subjected to headline risk such as earnings reports, jobs data and Fed decisions.

Those risks are significantly lowered with 0DTE options, which are reset every morning. That’s when ETFs like QDTE acquire holdings. It speeds up the already high-octane world of options trading while enhancing the income streams associated with options-selling ETFs.

“0DTEs represent a new evolution in covered call ETFs. Traditional covered calls models were built for a market that no longer exists: one where volatility was a rare event and market-moving news trickled in slowly,” concludes Roundhill. “Today, investors want strategies that can adapt quickly, and 0DTE options have been designed to take advantage of today’s fast-paced market.”

Related: Positioning Gen Z Clients for Short - And Long-Term Success