As is being widely noted, environmental, social and governance (ESG) strategies delivered for clients in 2021 with many of the funds addressing domestic large-cap stocks in this category outperforming the broader market.

For many clients, that's a relief and a selling point because they want to be engaged with ESG strategies, but they've long been concerned about values-based investing leading to returns being left on the table. Of course, past performance isn't a guarantee of future returns, but is encouraging to see ESG fund allaying clients' performance concerns.

The 2021 showings by these products is all the more impressive when considering energy – a group ESG funds typically underweight or outright avoid – was the best-performing sector in the S&P 500. On that note, it's arguably remarkable that funds focusing on sustainability also delivered the goods last year. In investing parlance, “sustainability” often refers to robust levels of corporate environmental stewardship, though it can encompass social and governance factors.

Notable to advisors is the fact that there are indeed links between strong sustainability traits and equity performance. Importantly, 2021 wasn't a one-off in that department as we'll get into later in this piece.

Sustainability Rewards

Data confirm emphasizing sustainability paid off for market participants in 2021.

“The Morningstar U.S. Sustainability Leaders Index--representing the 50 U.S. companies with the best ESG scores as measured by Sustainalytics (a division of Morningstar)--returned 33.3% for the year, beating the broader U.S. market by more than 8%,” says Morningstar analyst Lauren Solberg. “It wasn’t just companies ranked the very highest in ESG scoring that outperformed. Morningstar’s broadest basket of sustainable companies, measured by the 373-stock Morningstar U.S. Sustainability Index, returned 29.1% in 2021, 3 percentage points better than the overall U.S. stock market.”

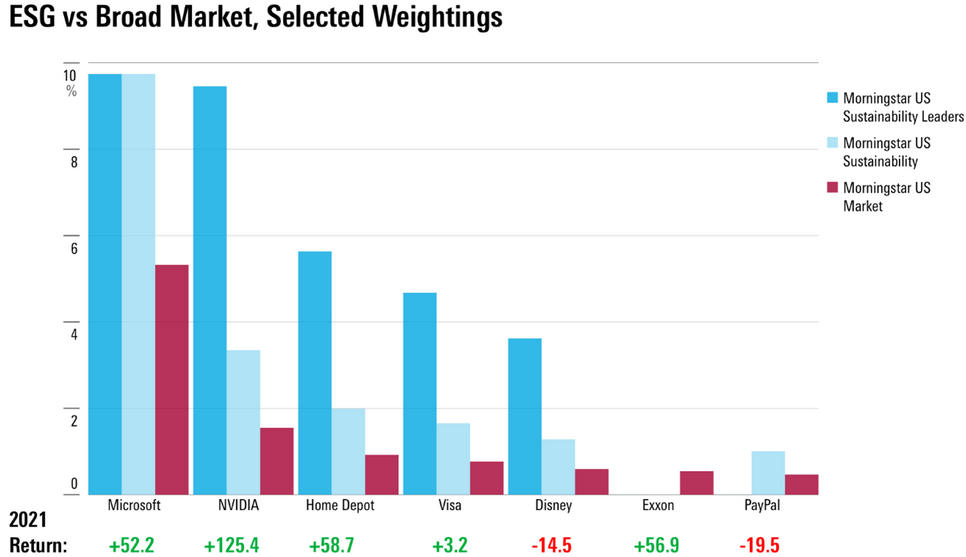

What want surprise advisors – and it's something they need to make clients aware of – is that much of the out-performance accrued by sustainability funds is attributable to large- and mega-cap growth stocks, as the chart below indicates.

Courtesy: Morningstar

Sustainability funds' often overweight positions in the technology sector underscore the points mentioned earlier about past performance not guaranteeing future returns and there being no promises that these strategies will outperform every year. With the Nasdaq-100 Index (NDX) down 8% to start 2022, this could be the year in which sustainable investing disappoints. However, the long-term track record is impressive.

“With the numbers posted in 2021, sustainable investing strategies continue their run of beating conventional market benchmarks over longer periods,” adds Solberg. “Six out of the 10 U.S. sustainability indexes beat their benchmarks over the trailing three-year performance period, as did seven over the five-year period.”

Understanding Sustainability Plumbing

While it remains to be seen if sustainability funds will outpace the broader market again this year, what is likely to be repetitive over clients' holding periods with these products is that technology and consumer discretionary stocks will be the main drivers of returns (or losses).

Conversely, these products are usually lightly allocated to cyclical (aside from consumer discretionary) and defensive sectors, meaning they could be laggards during a prolonged run of out-performance by value stocks.

“The tech and consumer cyclical sectors had a more notable impact on sustainability portfolios. Over the past five years, the Morningstar U.S. Technology Index has grown more than 30% and the Morningstar U.S. Consumer Cyclical Index is up 24%, ahead of all other U.S. sector indexes--and both the Morningstar U.S. Sustainability Leaders and Morningstar U.S. Sustainability indexes carry extra concentrations in those two areas,” concludes Solberg.

Related: ESG Funds Delivered in 2021